PHOTO

Chinese companies are likely to aggressively look out for acquisitions or investing in strategic technologies/assets, and promising sectors in foreign locations as many companies globally are witnessing a fall in valuation amidst COVID-19 pandemic.

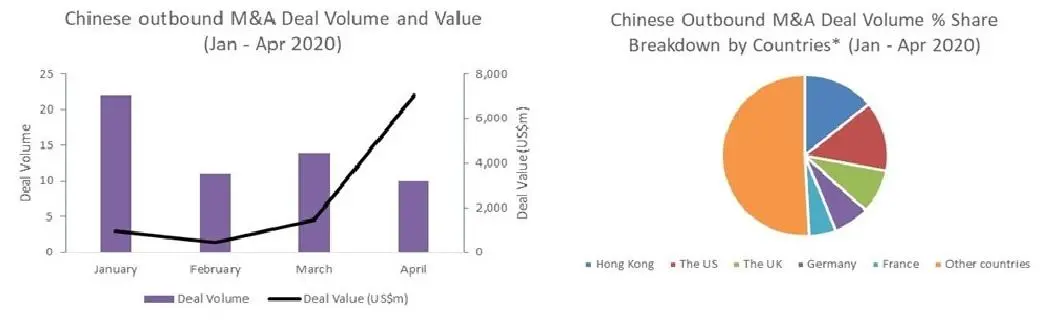

As many as 57 Chinese outbound merger and acquisition (M&A) deals worth $9.9 billion were announced during January to April 2020, while 145 Chinese outbound investments reached $4.5 billion, according to according to London-based data services firm GlobalData.

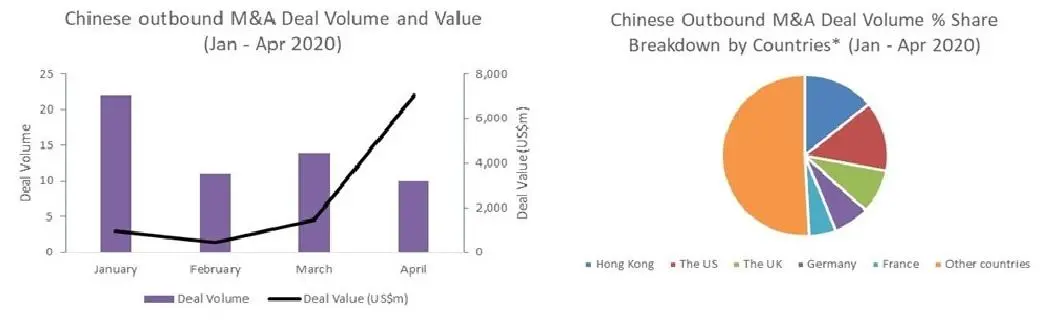

Source: GlobalData’s Financial Deals Database

"Government policies in China have been favorable and encourage domestic companies to invest in strategic technologies/sectors/assets in foreign locations. The slowdown in the domestic economy has also fueled the appetite for cross-border M&A," said Aurojyoti Bose, Lead Analyst at GlobalData.

The key M&A target destinations for Chinese firms included Hong Kong, the US, the UK, Germany, France, Canada, India, among others. On the other hand, the prime investment destinations included the US, India, the UK, Hong Kong, Japan, France, Germany, South Korea and Australia, GlobalData said.

In its latest 'China Outbound Investment in Q1 2020' report, global consultancy firm EY revealed that overall outward direct investment (ODI) dipped 2.8 percent year-on-year (YoY) to $25.7 billion, while non-financial ODI fell 3.9 percent YoY to $24.2 billion. However, the Belt and Road non-financial ODI grew 11.7 percent, and mainly invested in countries and regions such as ASEAN, Kazakhstan and the UAE.

In addition, EY said that the announced value of China overseas M&As reached $3.5 billion, down 78 percent YoY, the lowest value in a single quarter over the past 10 years.

However, Chinese companies' acquisition of distressed foreign assets at a much lower price during COVID-19 pandemic has seen governments across several countries tightening their foreign direct investment (FDI) policies, according to GlobalData.

"With the majority of the big companies in China being state-owned, governments worldwide are seeing these investments as a potential threat," Bose said, indicating the outbound acquisitions/investments by China may gain pace once these countries recover from COVID-19.

(Writing by Syed Ameen Kader; Editing by Anoop Menon)

(anoop.menon@refinitiv.com)

#CHINA #MERGERS #ACQUISITIONS $FDI #BRI #COVID19

© ZAWYA 2020