PHOTO

In many ways, the story of the property sector in the United Arab Emirates for the first six months of 2018 is the same as it has been for perhaps the previous 18 months – both sale prices and rents for residential units across the emirates remain in decline, yet despite the weak market conditions new launches continue, with developers dangling ever-bigger carrots out to buyers in the form of easy payment plans.

According to property brokerage Asteco, prices for both apartments and villas in Dubai declined by an average 11 percent year-on-year in the second quarter of 2018, with the steepest declines being reported in Dubai Sports City for apartment sales (down 17 percent) and in Jumeirah Park for villas (23 percent). Overall rents across the city have also declined by an average of 11 percent, the firm said.

Dubai Land Department released figures for the first half of the year last month, which showed that the volume of transactions completed in the first half of 2018 dropped by 22 percent to 27,642, while the value of deals completed fell by 16 percent to 111 billion UAE dirhams ($30.2 billion).

According to Chestertons, 58 percent of transactions completed in the second quarter were off-plan sales – a marginal increase on the 56 percent of total sales in the first quarter.

“The post-completion payment plans are really what have been spurring the market and the sales for the past year,” John Stevens, the managing director of property brokerage Asteco, told Zawya in a telephone interview last week.

Craig Plumb, head of research at JLL Mena, agreed.

“Those people that are buying, are buying off-plan from developers,” Plumb said in a telephone interview on Sunday. “That’s largely because of the discounts that you can get for doing that.”

JLL’s latest Real Estate Market Overview for Dubai published last week stated that 7,000 residential units entered the market in the second quarter of the year, including 1,800 units at Dubai Properties’ Remraam development in Dubailand.

Stock rising

It said that a further 34,000 units are scheduled to complete during the second half of this year, with 50,000 units due next year and a further 36,000 scheduled for 2020, although it added that it was “unlikely that all these projects will complete on schedule”. If these were all completed, it would represent a 26 percent increase in Dubai’s housing stock over a three-year period, to 626,000 units.

The pipeline of Dubai residential projects and the number of units likely to enter the market has been a topic of debate between developers and consultants for several years. Although consultants say that their figures are based on estimates provided by developers, these are often overambitious and the realisation rate (the amount of properties actually delivered against the number predicted at the start of the year) has stood at around 30 percent in recent years.

Stevens argued that this rate could accelerate, given the greater use of more generous payment plans by developers. Investors may still need to pay a deposit of 10-15 percent, “but then your payment plan really commences on handover”.

“With developers on that structure, it is much more in their interest to make sure that it (a home) is handed over on time. So I think whatever is pushed out in 2018 is going to hand over in 2019,” he said.

“The old problem about projects being delayed 6, 12 or 18 months, I don’t think that’s necessarily going to be as prevalent as we might have seen from 2010 onwards.”

Ivana Gazivoda Vucinic, head of consulting and valuations at Chestertons MENA, told Zawya in an emailed response to questions that at the start of this year, 50,000 new Dubai homes were scheduled to complete.

“We’ve seen 11,000 units delivered so far this year and we expect an additional delivery of approximately 15,000 units by the end of the year. This is an increased realisation rate, as opposed to 30-35 percent, which was an average achieved in recent years,” she said.

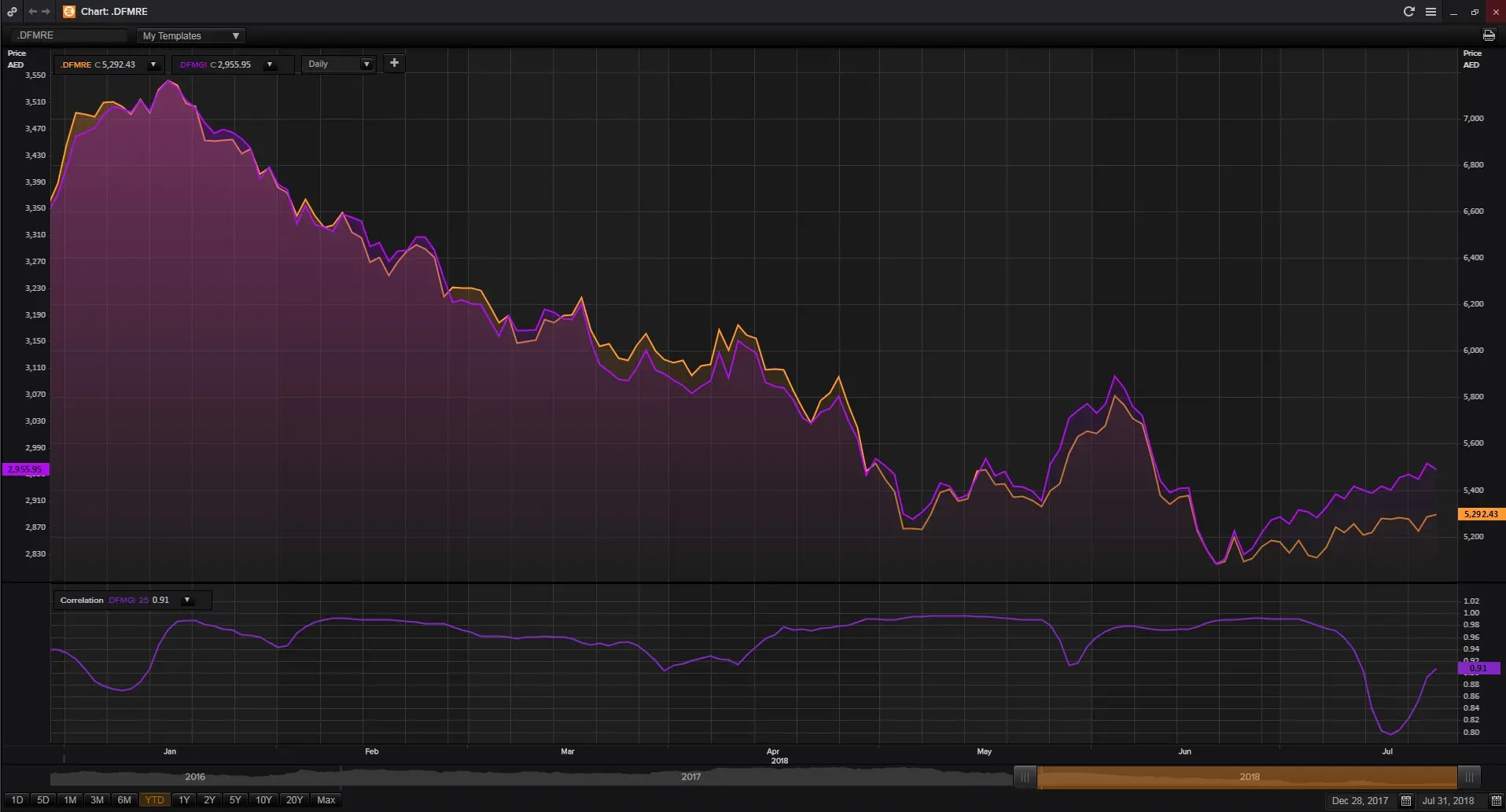

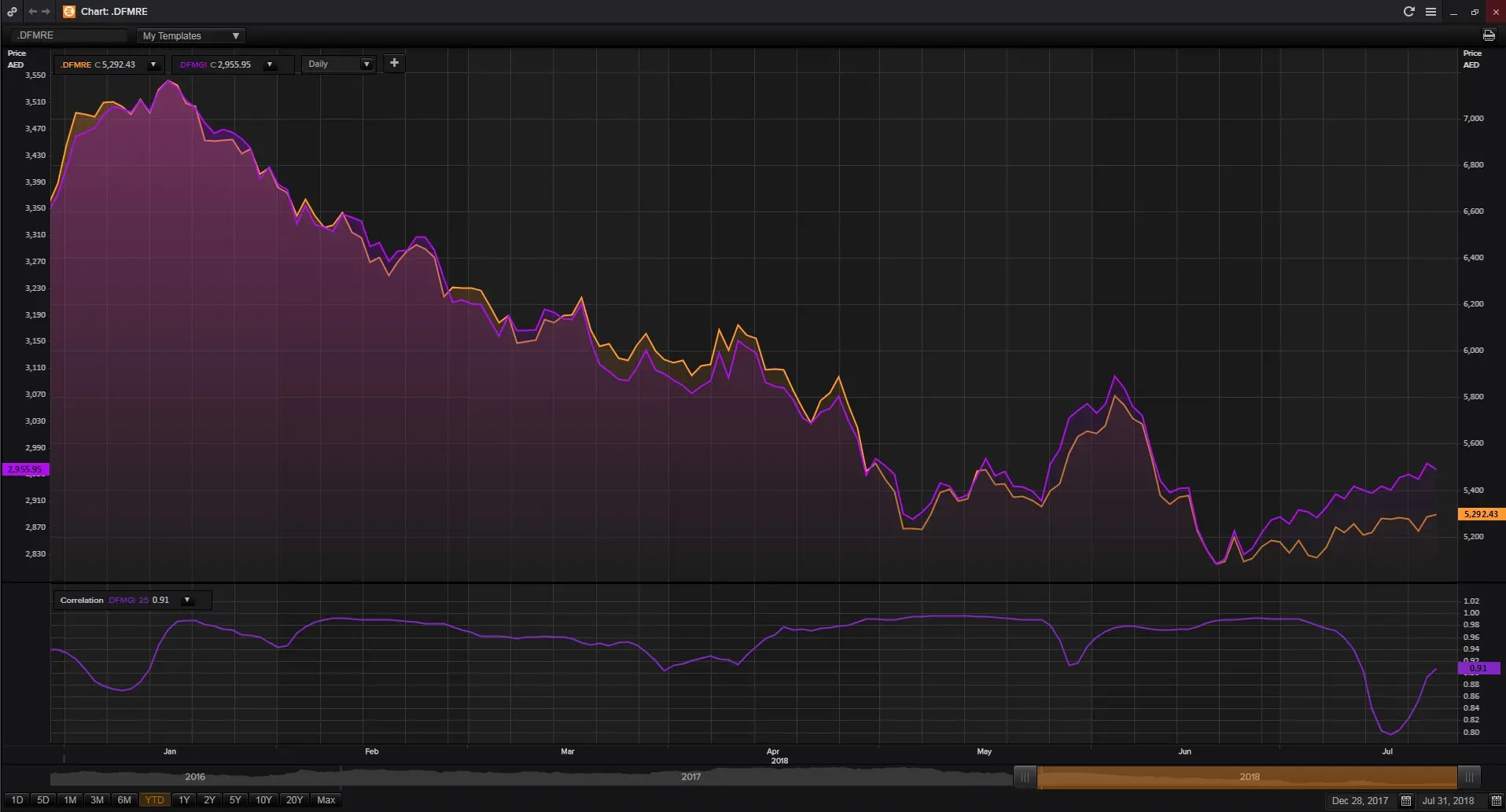

Concerns about the looming pipeline has also turned investor sentiment negative against many of Dubai’s real estate equities. Since the start of this year, the value of shares in many of the region’s developers have dropped lower, with Damac Properties down by 30 percent by close on Tuesday, 31 July, Union Properties down 27 percent and Emaar Properties down 20 percent. During the same period, the Dubai Financial Market dropped by 12 percent.

Graph showing the correlation between the performance of real estate and construction stocks in Dubai in the year to July 31 (orange line) and the performance of the Dubai Financial Market index (purple line). Source: Thomson Reuters Eikon.

The price is right

Plumb also said that there seemed to be “fewer marketing gimmicks” in recent years, as developers have focussed more on price rather than branding endorsements or ‘giveaways’, such as offering cars when buyers purchase units of a certain value.

“I guess they’re trying to be a bit more smart in terms of making it more financially attractive to buy,” he said.

Outside of Dubai, apartment rental rates in Sharjah and the other northern Emirates also witnessed an 11 percent decline, according to Asteco. Stevens said that falling rents in Sharjah could be attributed to two main factors. Firstly, new supply with better facilities has come onto the market, forcing owners of older buildings to reduce rents to entice tenants. Secondly, cheaper rents in Dubai typically mean some tenants will relocate to be closer to work.

“Dubai ends up sort-of being a sponge. When rents drop in Dubai, the vacancy levels increase outside – in Sharjah, the Northern Emirates and so on,” he said, although he added that access to bigger homes for reasonable rental rates meant the Northern Emirates continue to be popular.

“You can get yourself a 3-bedroom unit in Ajman for 40-50,000 (United Arab Emirates dirhams per year, or $10,892-$13,615), which is going to get you a one-bedroom in Dubai.”

In Abu Dhabi, both sale prices and rents remain under pressure in a market which has witnessed three years of decline following the fall in oil prices, which subsequently led to layoffs and consolidation among government firms, banks and energy companies.

According to JLL, sale prices of apartments in the capital fell by 9 percent year-on-year, while villa sale prices dropped by 19 percent. Despite the recent announcement of a 50 billion UAE dirham economic stimulus package by the emirate’s Crown Prince last month, the firm’s outlook for the next 12 months remains negative as the benefits from the stimulus and other recent government pledges around long-term visas and foreign currency ownership will take time to feed through.

“We expect this effect to be visible in the next 2- 5 years,” Chesterton’s Vucinic said. “For the remainder of this year we expect further corrections of both sales prices and rent rates in Abu Dhabi.”

Stevens argued that although demand has pushed down prices in Abu Dhabi, the overall volume of sales has held up.

“There are fewer developers (and) there aren’t so many developments being launched. If you’re looking to buy a property, rather than in Dubai where you might have 50-100 developments to choose from if you’re looking for off-plan, in Abu Dhabi you have very little choice.”

(Reporting by Michael Fahy; Editing by Shane McGinley)

For latest news on business and finance in the Middle East visit Thomson Reuters Zawya

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018