PHOTO

Bahrain's pipeline of projects focuses on manufacturing, construction and tourism.

Bahrain is pushing ahead with new projects, several bankrolled by richer Gulf Arab allies, as it seeks to stimulate growth amid declining revenues from the energy sector.

Fitch Ratings expects Bahrain to continue to benefit from savings through the implementation of development projects financed by fellow Gulf Cooperation Council (GCC) countries Saudi Arabia, the United Arab Emirates and Kuwait.

"Lower oil prices are not assumed to impact the flow of funds from these countries," Fitch analyst Christopher Findlay said.

Fitch, which recently revised Bahrain's outlook to negative, estimates growth rates of 3.3% in 2015 and 3% in 2016 and 2017 for the country, much lower than the 4.5% in 2014 as crude oil production remained flat in 2015.

"Projects have been ramped up significantly this year (2015) and will continue to be so over the forecast horizon," Fitch said. "Growth will be supported by the non-hydrocarbon sector expanding by 4.4% in 2015, and remaining around 3.5% in 2016 and 2017, underpinned by manufacturing, construction, tourism and social and personal services."

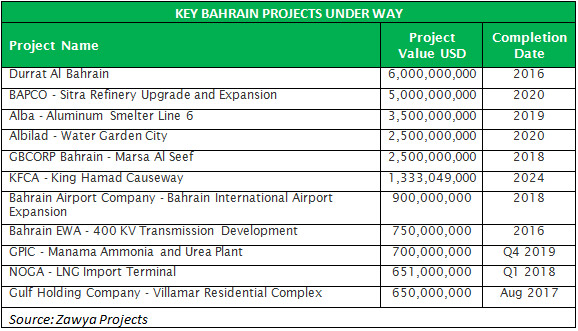

The kingdom's overall pipeline of projects stood at USD 72.3 billion by mid-December 2015, up 17.2% from a year earlier, according to the latest quarterly report from the Bahrain Economic Development Board (EDB).

It said the pipeline of "strategically significant" infrastructure projects undertaken by the GCC Development Fund, government holding firms, and the private sector is estimated at around USD 32 billion.

CONSTRUCTION OUTLOOK GOOD

The EDB said that despite a slight slowdown in the construction and real estate sectors in the third quarter of 2015, a large pipeline of projects "provides a robust underpinning for near-to-medium term growth" in the kingdom.

It said around USD 6 billion of the GCC Development Fund has already been allocated to date and some USD 3.7-billion worth has been tendered. The housing sector secured 35% of the funds while other major beneficiaries included electricity and water projects (22%), airport expansion (14%) and roads (12%).

The report said that work has started on USD 1.3 billion worth of projects.

"The significant difference between tendered and commenced projects suggest that GCC Fund spending is likely to have a substantial impact on the construction sector in 2016 and beyond," EDB said.

A number of retail developments are also under way or just launched, such as the December opening of Dragon City Mall, developed by Diyar AL Muharraq and Chinamex Middle East Investment & Trade Company.

First Bahrain has started building Al Mercado mall in Janabiya, while Dadabhai Group's MD Holding Company is set to launch Galleria mall this year.

Private sector real estate projects include a joint venture between Diyar al Muharraq and Abu Dhabi's Eagle Hills to build Marassi al Bahrain in the north of the island, and

real estate firm Naseej's planned Canal View project.

Housing bank Eskan Bank plans to release design tenders for the Bander Al Seef residential project in early 2016 with construction tenders set for a September release. The project will feature 2,600 affordable residential units.

ENERGY INVESTMENTS

Tiny oil producer Bahrain has diversified its economy in recent years and the oil sector represents only about a fifth of Bahrain's gross domestic product, according to the EDB.

The kingdom's aluminium industry, for example, contributes around 10% of GDP. State-owned Aluminium Bahrain (Alba) is expanding its industrial base by 50% by 2019 and sovereign wealth fund Mumtalakat has bought a 49% stake in Spanish aluminium products group Aleastur to deepen expertise in the sector.

But while the non-oil sector remains a key focus, Bahrain is also investing in the energy sector. Oilfield services provider Petrofac was awarded a contract in September for a new 500 million cubic feet per day gas dehydration facility.

"We expect Bahrain to invite bids for further offshore oil and gas exploration, while

there are plans for an expansion of gas-processing facilities at the Bahrain National Gas Company (Banagas) that would increase capacity by 350 million cubic feet per day," according to the Economist Intelligence Unit (EIU).

In December, the government awarded a contract to newly formed joint venture Bahrain LNG to build a floating liquefied natural gas (LNG) terminal.

The Bahraini government has a 30% stake in the public-private partnership of Bahrain LNG through Nogaholding, which manages government investment in the oil and gas sector. The remaining 70% will be owned by a consortium comprising Bermuda's Teekay LNG Partners (30%), South Korea's Samsung (20%) and Kuwait's Gulf Investment Corporation (20%).

The terminal, to be owned and operated under a 20-year agreement starting July 2018, would meet Bahrain's rising demand for gas, which grew on average by more than 2.5% a year from 2011 to 2014, according to the EIU. It said the project would support large-scale infrastructure development worth USD 22 billion over the next five years.

Meanwhile, Bahrain Petroleum Company's Sitra crude is eyeing an oil refinery valued at as much as USD 5 billion. Saudi Aramco and Bahrain Petroleum Company (Bapco) are building a USD 300-million pipeline with a capacity of 350,000 barrels per day (bpd), which would replace an older onshore conduit which currently carries 230,000 bpd.

The article is produced by frontiernations.com exclusively for Zawya.com

Zawya 2016