Sharjah, UAE: Bank of Sharjah P.J.S.C today announced the results for the period ended 31 December 2018

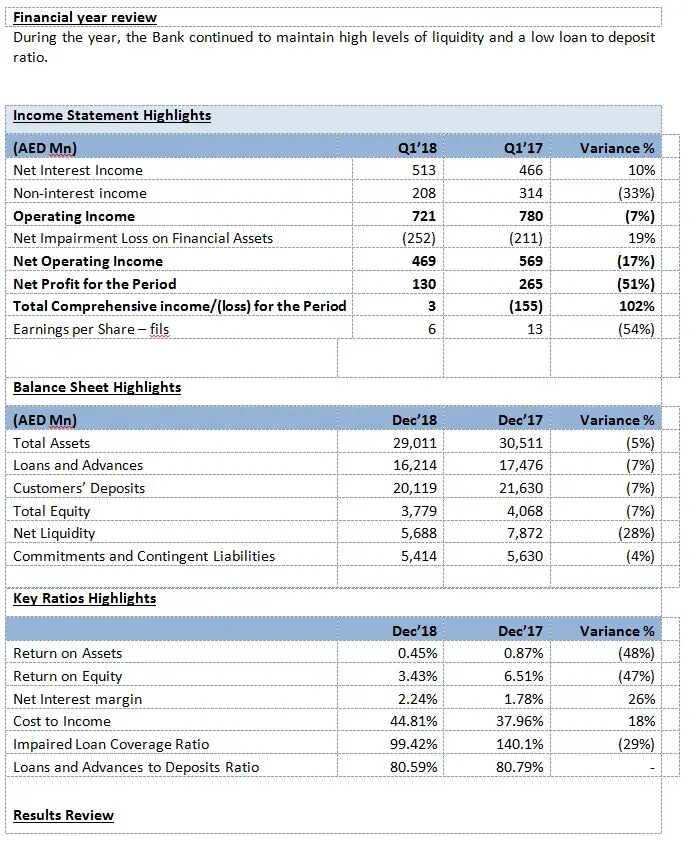

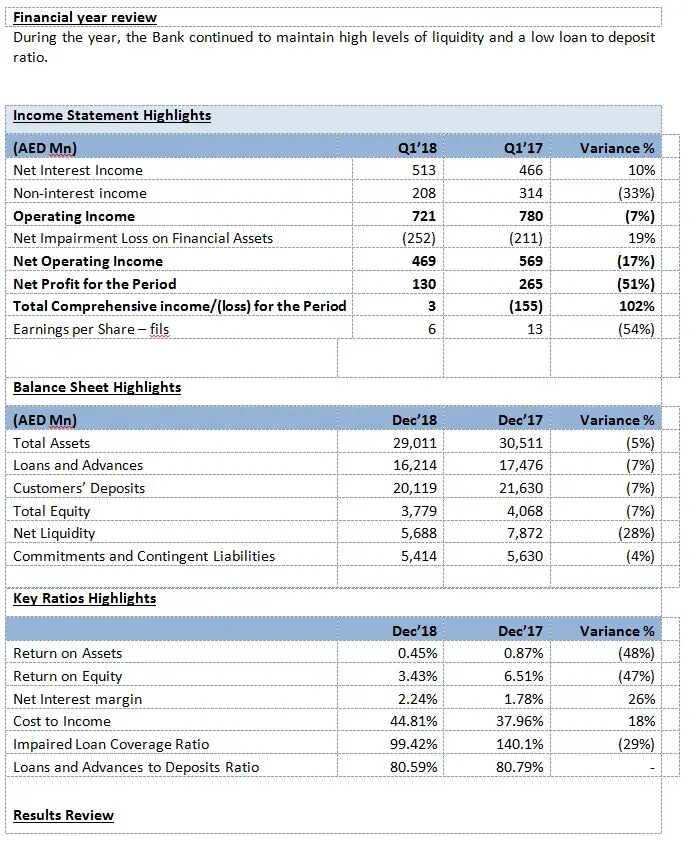

Financial Highlights

- Net Profit for the year of AED 130 million, down by 51% compared to 31 December 2017

- Total Comprehensive income of AED 3 million, up by 102% compared to 31 March 2017

- Total Operating Income of AED 721 million, down by 7% compared to 31 December 2017

- Net Operating Income of AED 469 million, down by 17% compared to 31 December 2017

- Total Assets at AED 29,011 million, down by 5% compared to 31 December 2017

- Net Loans and Advances at AED 16,214 million, down by 7% compared to 2017

- Total Customers’ Deposits at AED 20,119 million, down by 7% compared 2017

- Return on Assets at 0.45% and Return on Equity at 3.43%

- Basel III Common Equity Tier 1 ratio at 13.12% compared to a minimum required ratio of 8.5%

- Loans and Advances to Deposits Ratio at 80.59%

Income

Net Interest Income increased by 10% compared to the corresponding figure of the year 2017, Non-Interest Income decreased by 33% and operating income decreased by 7%. The net operating income reached AED 469 million for the year 2018 compared to AED 569 million for the year 2017, a decrease of 17%.

Net profit for the current year 2018 reached AED 130 million, against AED 265 million for 2017, down by 51%. Earnings per share for the year 2018 were down by 54% and reached 6 fils compared to 13 fils in 2017.

Total Comprehensive income for the year increased by 102% to AED 3 million versus a total comprehensive loss of AED 155 million for 2017. This was mainly due to a positive effect from change in fair value of issued bonds.

Assets Growth

Total Assets reached AED 29,011 million, a decrease of 5% over the corresponding 31 December 2017 figure of AED 30,511 million.

Loans and Advances

Loans and Advances reached AED 16,214 million, 7% below the corresponding figure of AED 17,476 million as at 31 December 2017.

Customer Deposits

Customers’ Deposits reached AED 20,119 million, 7% below the corresponding 31 December 2017 balance of AED 21,630 million.

Capital and Liquidity

Total Equity as at 31 December 2018 stood at AED 3,779 million, 7% below the corresponding 31 December 2017 balance of AED 4,068 million.

Net Liquidity reached AED 5,688 million as at 31 December 2018, a decrease of 28% compared to 2017 year figure of AED 7,872 million.

-Ends-

For further information, please contact:

Crista Pinto

Al Rahma Advertising

Tel: 971-4-351-2101/ 0558749158

Email: crista@rahmaad.com

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.