PHOTO

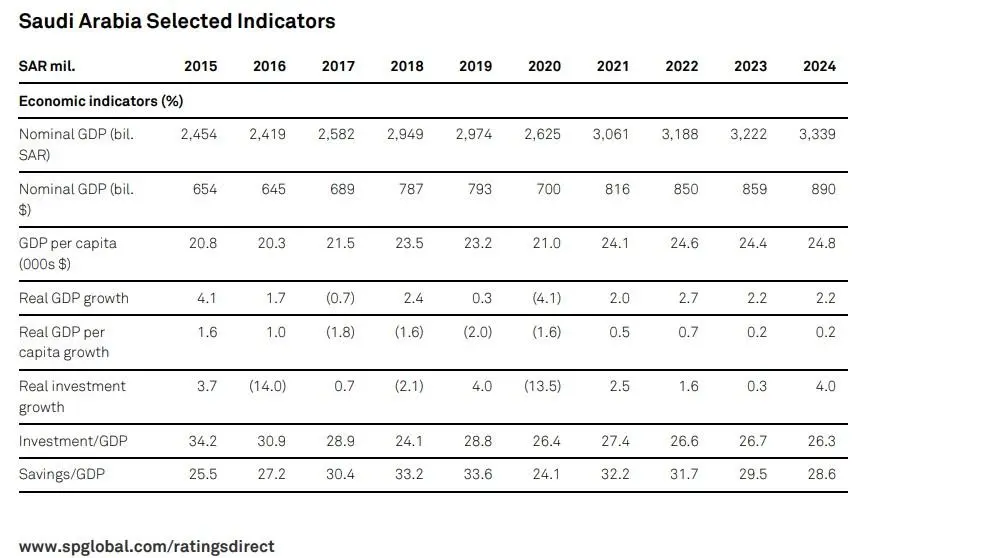

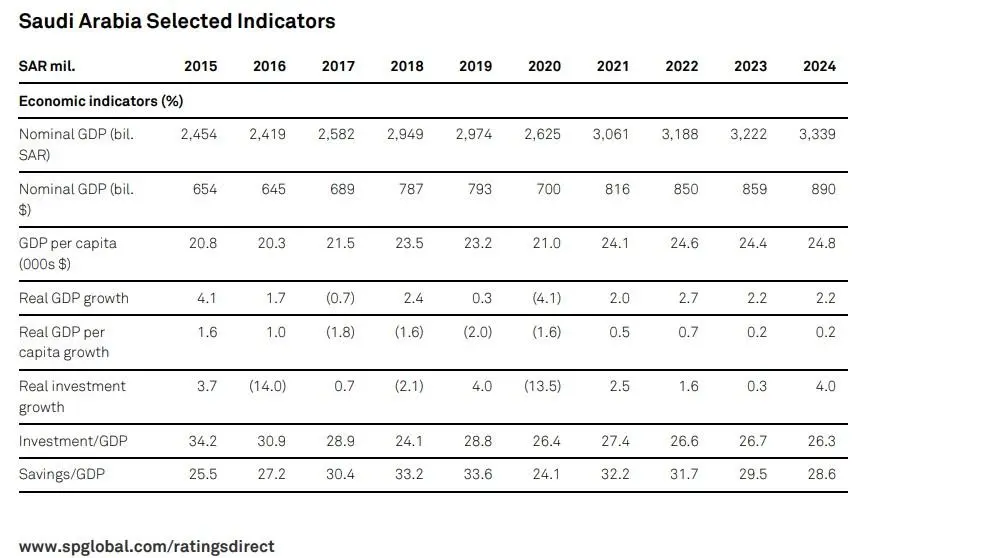

After contracting sharply in 2020, the Saudi economy is forecast to return to positive growth in 2021, global ratings agency S&P said in its latest report.

S&P expects the kingdom’s current account to return to surplus and the fiscal deficit to narrow, based on improving global macroeconomic conditions and oil prices as the world begins to emerge from the pandemic.

"We are affirming our 'A-/A-2' long- and short-term sovereign credit ratings on Saudi Arabia. The outlook is stable," the ratings agency said.

The kingdom's government and external net asset positions over the next two years will remain sufficiently strong to support the ratings, it said.

"We could raise the ratings if Saudi Arabia's economic growth prospects improve significantly or the government's net asset position reverses its ongoing decline. This could follow sustained stronger-than-expected GDP growth or fiscal performance," Ravi Bhatia, Primary Credit Analyst at S&P said.

According to S&P, higher oil prices and widespread rollout of vaccines will lead to a rebound to positive economic growth in 2021-2024.

"In 2021, higher oil prices will be partially counterbalanced by lower Saudi oil production volumes. The authorities will continue to grapple with a trade-off between the need to provide support to the economy and population, and containing the fiscal deficit," the report said.

The pandemic weighed on both the Saudi oil and non-oil sectors in 2020, and delayed investment projects. "However, the government will revert to its ambitious investment and economic diversification strategy from 2021 onward," the report said.

Saudi's sovereign fund, PIF, is widely seen as the engine powering the kingdom's economic diversification strategy.

PIF is pursuing a two-pronged strategy: Building an international portfolio of investments while investing locally in projects that will help reduce the kingdom's reliance on oil.

In January, PIF approved its five-year strategy of investment and job creation as part of its economic transformation.

The fund will invest $266bln in the local economy in the next five years through 13 strategic sectors. It will also double its asset volume by more than 4 trillion riyals by 2025 to reach 7.5 trillion riyals by 2030.

Last week, PIF signed $15 billion worth of syndicated multi-currency revolving credit facilities with 17 banks. The new credit facility gives the fund access to extra capital that can be deployed quickly when needed.

(Reporting by Seban Scaria; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021