PHOTO

While Saudi Arabia’s non-oil economy continued to expand in November on the back of strong demand and slight price pressures, a softening in new business growth meant it was the least marked expansion since August, the latest survey of purchasing managers showed on Sunday.

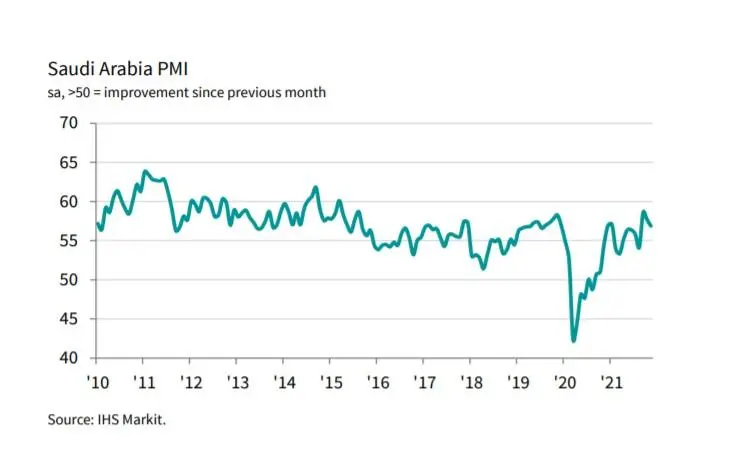

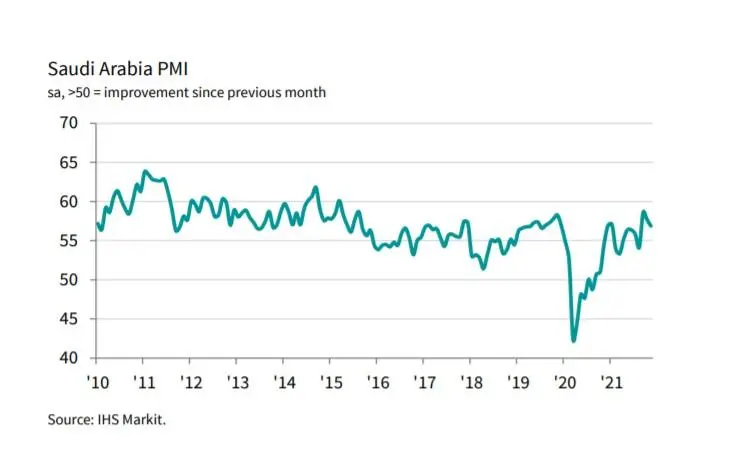

The headline seasonally adjusted IHS Markit Saudi Arabia Purchasing Managers’ Index (PMI) fell to 56.9 in November from 57.7 in October, down to a three-month low. However, the index was in line with the average recorded over the 12-year series.

The New Orders Index, the largest component of the headline PMI, fell for the second month in a row from September's seven-year high. “Despite this, the index continued to indicate a robust upturn in new business volumes that was stronger than most of the recovery period since the initial COVID-19 lockdown,” the report said.

Survey panellists attributed the higher sales to a continued return to normal economic conditions and a boost to tourism from relaxed travel measures.

New export orders rose in November at their fastest pace since May, due to higher demand from abroad as mobility restrictions eased.

"The Saudi Arabia PMI continued to signal a strong end to the year for the non-oil economy. Despite slipping to a three-month low, new business growth was rapid overall, whilst activity expanded at one of the quickest rates since the start of the pandemic,” said David Owen, economist at IHS Markit.

The higher output reduced the backlogs of work. But the rate of depletion was the slowest recorded since the start of the pandemic, as firms signalled that demand pressures had begun to squeeze overall capacity.

"Another key indicator - backlogs of work - signalled that the capacity gap registered since February 2020 had narrowed to its smallest so far, suggesting that higher demand levels are starting to put pressure on businesses,” Owen said.

There was a marginal improvement in job creation in November, but firms remained cautious about future sales forecasts.

"Nevertheless, jobs growth remained disappointingly mild, with many firms choosing not to expand their workforces amid a weak level of optimism for future activity. The threat of future COVID-19 waves continued to promote a cautious outlook, leading to a decline in the number of firms expecting output to expand over the next year," according to Owen.

The outlook for the coming year weakened to a three-month low in November. “The degree of optimism was also far lower than pre-COVID trends, as many companies remained cautious about the strength of the economic recovery and possible future waves of the virus,” the report noted.

(Reporting by Brinda Darasha; editing by Seban Scaria)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021