PHOTO

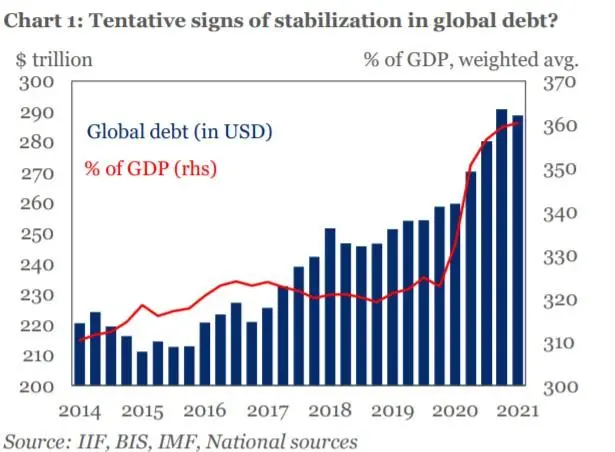

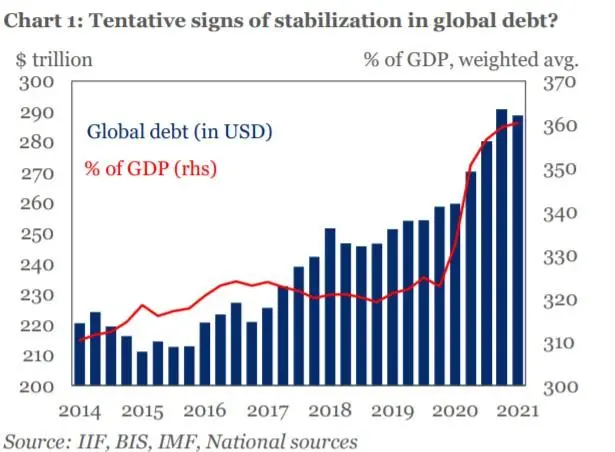

Global debt declined by $1.7 trillion to some $289 trillion in Q1 2021 driven by mature market economies, where total debt dropped $2.3 trillion to below $203 trillion, the Institute of International Finance (IIF) said in a recent report.

The drop in global debt levels is seen as the first decline in 10 quarters. However, debt in emerging markets rose slightly in Q1 (+$0.6 trillion) to a fresh record high of over $86 trillion.

And despite the Q1 dip, total global debt is still up $30 trillion (12 percent) since end-2019, now standing at over $288 trillion, the report said.

"Despite the slight drop in total debt, debt ratios continued to increase in Q1 as economic activity remained below pre-pandemic levels in many countries. However, the pace has slowed dramatically: after a jump of over 36 percentage points in 2020, global debt/GDP rose only one percentage point in Q1 2021, to just over 360 percent of GDP," Emre Tiftik, Director of Sustainability Research at IIF said.

"With global bond issuance now back below pre-COVID-19 levels, debt ratios should dip slightly this year given the projected recovery in global economic activity," he added.

Rising debt

The financial sector accounted for nearly half of the decline in debt levels in Q1 2021 in the mature markets. Household and non-financial corporate debt also declined slightly.

In contrast, mature market government debt continued to increase, but at its slowest pace since Q4 2018.

Across emerging markets, the increase in debt was driven by private sector, IIF noted. “With EM government debt broadly stable, the non-financial corporate and financial sectors have been the main drivers of the debt buildup,” Tiftik said.

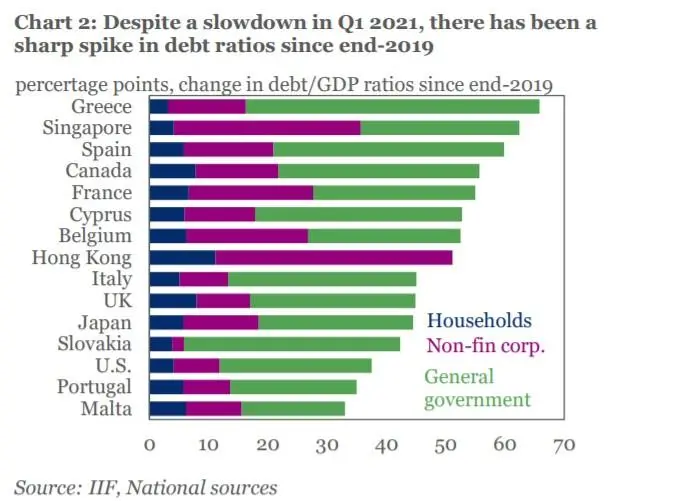

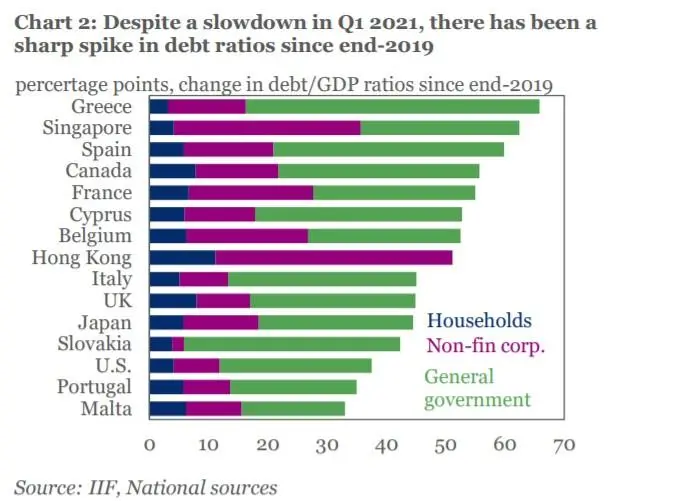

Greece, Singapore, and Spain have seen the sharpest increases in debt-to-GDP ratios (ex-financial sector) since the onset of the pandemic, though the pace slowed in Q1 2021, the report said.

Denmark, Slovenia, Estonia, Finland, Lithuania, and the U.S. were the only mature market economies recording a decline in debt ratios (ex-financials) in Q1.

Government spending was the main driver of the overall rise in mature market debt ratios in Q1, increasing the most in Slovakia, Greece, Cyprus, Italy, and Spain.

While near-term sovereign debt vulnerabilities in major EM economies have eased back to prepandemic levels, government revenues remain under pressure due to continued lockdowns, the report said, adding, with vaccination still relatively slow in many emerging markets, sovereigns with high borrowing needs risk having persistently high interest expenses relative to revenues and GDP.

IIF highlights the importance of accelerating the transition to a low carbon economy.

Failure to reduce reliance on carbon-intensive activities could add to upward pressure on EM government borrowing costs by reducing investor appetite for EM assets, Tiftik said.

(Reporting by Seban Scaria; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021