PHOTO

COVID-19 has hit economies in the Middle East and North Africa (MENA) hard over the past few months, and although lockdowns are being scaled back now, economic recovery is likely to be sluggish.

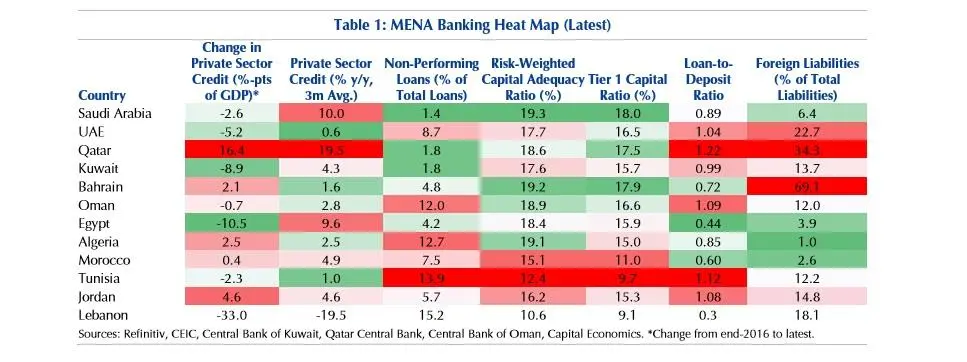

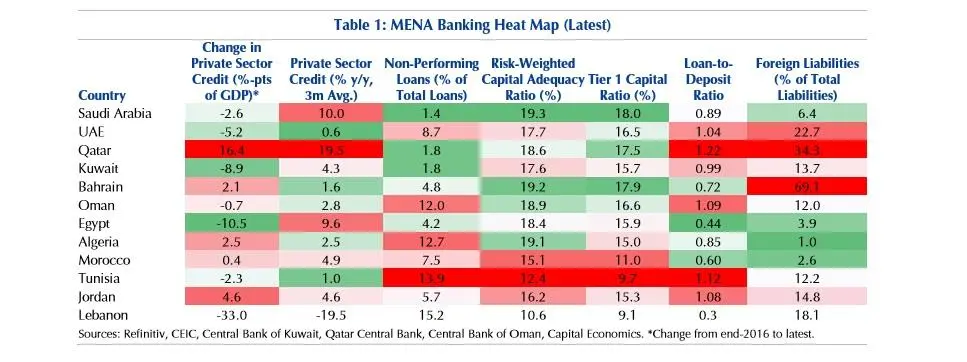

The main obstacle to the region’s banks is the rise in non-performing loans (NPLs), according to London-based economic research consultancy Capital Economics.

"Measures to contain the virus have led to large swathes of economies being shut down, leading to job losses, falls in income, and a greater incidence of business failures. Indeed, a recent survey by the Dubai Chamber of Commerce found that a majority of businesses expect to close within the next year, with those in the travel and tourism sector expecting more acute pain in the coming months," Capital Economics' James Swanston wrote in a note.

Authorities across the region have taken steps in recent months to mitigate the risk that the current economic downturn triggers balance sheet strains. Central banks in the Gulf and Jordan have lowered interest rates in line with the Fed, while in Egypt, Morocco, and Tunisia have cut rates too. Most governments have directed local banks to give debt payment holidays to customers.

"In the Gulf countries at least, NPL ratios are generally low and banking sectors are well positioned to withstand a jump in bad loans. In Saudi Arabia and Kuwait, for instance, we estimate that NPL ratios would have to increase from just under 2% at present to 13-18% before tier 1 capital ratios fell below Basel III minimums," he said.

"Vulnerabilities in the UAE’s banking sector don’t appear to be as large as they were prior to the 2009 global financial crisis. But a period of weak economic growth has led to a steady rise in the NPL ratio in the past couple of years," Swanston added.

(Writing by Seban Scaria, editing by Daniel Luiz)

#NPL #MENA #FINANCIALSERVICES #BANKING

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020