PHOTO

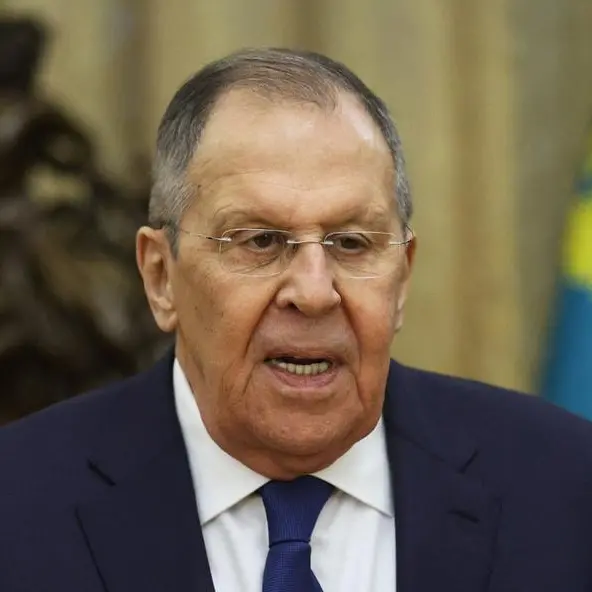

SINGAPORE - An imminent price cap on Russian oil by G7 countries is likely to divert trade to smaller companies, the chief executive of Dutch energy and commodity trader Vitol, Russell Hardy, said on Wednesday.

Larger corporates such as Western banks and insurance companies will not participate in the trades unless there is absolute clarity that the price of the contract is below the price cap, Hardy said at the FT Commodities Asia Summit in Singapore.

So the challenge of redirecting leftover Russian oil that typically goes into Europe will be in the hands of smaller companies that do not operate in G7 nations, he said.

The European Union expects to have regulations ready in time for the planned introduction of the cap on Dec. 5.

Since regulations for the price cap will apply to the provision of financial services for the trade, Hardy expects one alternative trading location to be Dubai, where companies can operate without being subject to the price cap.

The price cap will probably be segmented into three portions, including low-value Russian products, high-value Russian producs, and crude oil, he added.

The G7 groups Britain, Canada, France, Germany, Italy, Japan and the United States plus the European Union.

(Reporting by Jeslyn Lerh and Trixie Yap; Editing Ana Nicolaci da Costa and Bradley Perrett)