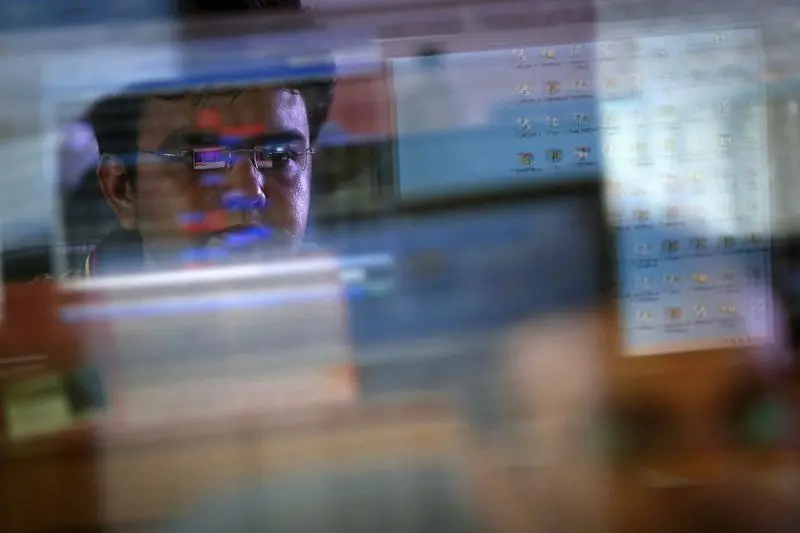

PHOTO

Indian shares opened slightly higher on Tuesday, as data showing annual retail inflation eased to a three-month low in October strengthened bets of smaller interest rate hikes from the country's central bank.

The NSE Nifty 50 index was up 0.14% at 18,354.85 as of 0346 GMT, while the S&P BSE Sensex rose 0.16% to 61,722.74.

India's annual retail inflation eased to 6.77% last month, helped by a slower rise in food prices, data showed on Monday. Although, that was slightly higher than the 6.73% forecast by economists in a Reuters poll and the central bank's tolerance limit.

More than 1,000 corporations reported their quarterly results on Monday as the country's month-long earnings season drew to a close. A bulk of them defied a global slowdown to report profit growth and signal better times ahead.

In early trading, Nifty's bank and auto indexes were among the top-performing sectors, gaining 0.4% and 0.6%, respectively.

Tyre manufacturer Apollo Tyres rose over 5% on a rise in quarterly profit, while low-cost carrier SpiceJet fell nearly 2% after reporting a bigger quarterly loss on a surge in fuel costs and depreciating rupee.

Globally, investors will get another look at U.S. inflation when the producer price index data is released at 1330 GMT.

Foreign institutional investors bought net 10.89 billion rupees ($134.50 million) worth of equities on Monday, while domestic investors purchased 471.8 million rupees of shares, according to provisional data available with the National Stock Exchange. ($1 = 80.9650 Indian rupees) (Reporting by Praveen Paramasivam in Bengaluru; Editing by Subhranshu Sahu and Eileen Soreng)