PHOTO

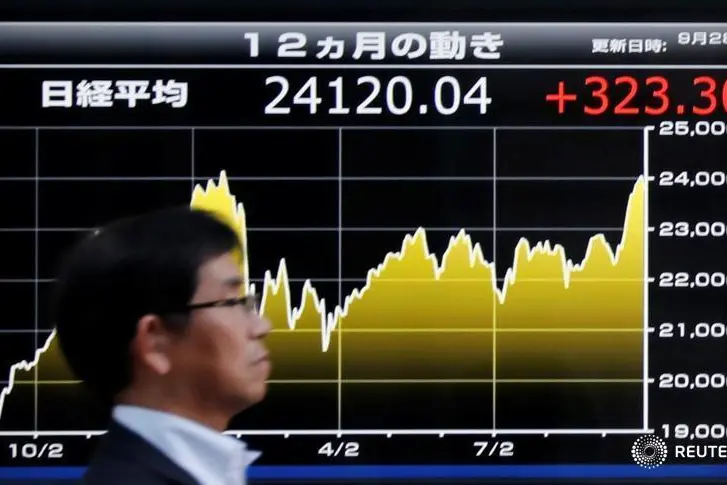

Japanese shares rose on Friday, led by the gains in chip-related and other heavyweight stocks, with sentiment lifted by hopes that China's easing of its COVID-19 curbs will boost the economy.

By 0204 GMT, the Nikkei share average rose 1.2% to 27,908.17 and was set to gain 0.47% for the week. The broader Topix was up 1.05% to 1,961.89 and is on course to post a 0.4% weekly gain.

Wall Street's main indexes advanced overnight, with the S&P 500 snapping a five-session losing streak, as investors interpreted data showing a rise in weekly jobless claims as a sign the pace of the Federal Reserve's interest rate hikes could soon slow.

Chip-related Advantest jumped 4.39% and Tokyo Electron rose 2.5%. Technology investor SoftBank Group rose 1.6% and electronic component maker TDK climbed 3.43%.

"The Nasdaq's gain raised sentiment and Japanese shares tracked U.S. technology stocks," said Yugo Tsuboi, senior strategist at Daiwa Securities.

"Also, caution for China has changed to hopes as the country has eased its pandemic restrictions."

China on Wednesday announced the most sweeping changes to its resolute anti-COVID regime since the pandemic began three years ago, loosening rules that curbed the spread of the virus but sparked protests and hobbled the world's second-largest economy.

Cosmetic maker Shiseido, one of the stocks that benefit from China's consumer spending, gained 2.05% and is set to jump more than 5% for the week.

Toshiba rose 3.94% after Reuters reported Japan Industrial Partners, the preferred bidder to buy out the company, has moved closer to securing financing from banks.

The utility sector rose 2.38% to be the best performer among the Tokyo Stock Exchange's 33 industry sub-indexes.

Kansai Electric Power rose 3.39% and Tokyo Electric Power Company Holdings advanced 5.93%. (Reporting by Junko Fujita; Editing by Rashmi Aich)