PHOTO

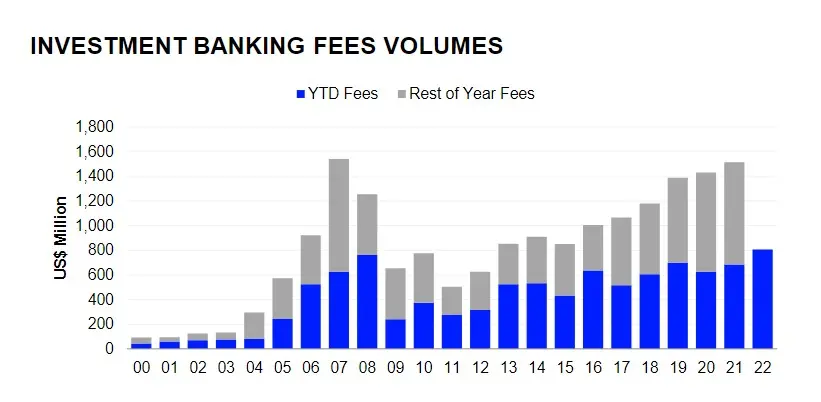

Investment banking fees in the Middle East & North Africa (MENA) totaled $806 million during the first half of 2022, up 18% from last year and the strongest first-half total since records began in 2000, according to global data provider Refinitiv.

Fees from equity capital markets compelled this new high rising 332% to $229 million, the highest year-to-date total on record.

Completed mergers & acquisition fees increased by 26% to $246 million, the third-highest first-half total on record and accounting for 31% of the overall fee pool, Refinitiv said in a report.

Saudi Arabia was the highest fee-earning nation with 36% of total fees, followed by the UAE with 34%.

JP Morgan took the top spot in the MENA investment banking fee league table, earning $54.4 million or a 6.7% share of the market. Goldman Sachs and HSBC Holdings took second and third place with 6% and 5.9% market share, respectively.

Bond underwriting fees declined by 81% to $41 million, the lowest year-to-date total since 2009. MENA Bond fees made up the smallest proportion of the overall fee pool with just 5%, the lowest proportion since 2009.

Syndicated loans increased 31% year-on-year to $289 million and accounted for 36% of the total investment banking fee pool.

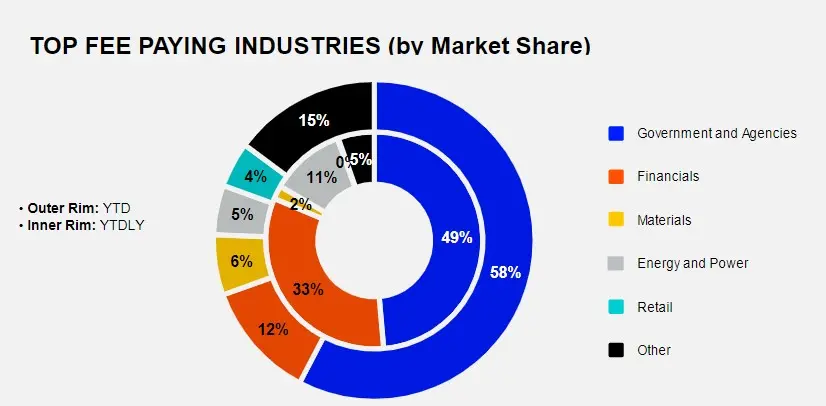

Governments and agencies made up 58% of the fee pool and were the highest-earning industry so far in 2022.

(Reporting by Seban Scaria; editing by Daniel Luiz)