PHOTO

India-based climate and sustainable advisory firm EnKing International has charted an aggressive expansion plan for the global carbon offsets market and expects the Middle East to account for 10-15 percent of the company’s forecasted 30 billion Indian rupees ($401 million) revenue next year, the company’s top official told Zawya Projects.

The Bombay Stock Exchange-listed company’s stock has zoomed 100 times since its Initial Public Offering (IPO) last year.

Founder and CEO Manish Dabkara said prospects for the carbon business are bright as global demand for carbon credits have soared as post-COP26, a growing number of countries and corporations commit to carbon neutrality by mid-century.

Founder and CEO Manish Dabkara, EnKing International

“Nations worldwide are in different stages of implementing emission trading schemes. Over the next three years, we will see domestic, national, and international carbon markets and carbon trading mechanisms develop,” he said.

“One carbon credit is one tonne of carbon dioxide removed from the atmosphere or avoided, and these certificates are traded in Voluntary and Compliance carbon markets like any other commodity. Entities or individuals aiming for carbon neutrality can buy carbon credits to make up for their unavoidable emissions,” Dabkara explained.

Compliance markets are government-mandated, whereas Voluntary markets cater to companies and individuals voluntarily seeking to reduce emissions without any legal compulsion.

The Taskforce on Scaling Voluntary Carbon Markets, in association with the Institute of International Finance and McKinsey, has estimated that demand for carbon credits could increase 15 times or more by 2030 and by up to 100 times by 2050. The global market for carbon credits could be worth upward of $50 billion in 2030.

Dabkara said developed nations account for a whopping 98 percent of carbon credit demand while developing nations account for a minuscule 2 percent. “Currently, 95 percent of the credits originating from developing countries are traded in Voluntary carbon markets as it is hard to sell them in Compliance markets,” he said.

MENA and beyond

Dabkara, a first-generation entrepreneur, has charted out an aggressive plan for global expansion, including the Middle East, starting with the Dubai office established in December 2021.

“We have a team of 200 people in 18 nations, and we are targeting to expand additionally in 50-100 nations,” he disclosed.

The company’s “global market share is around 26 percent of the $1 billion voluntary carbon market this year and has a 90% industry share in India,” he said.

He added that the company also accounts for over 50 percent of the carbon offset projects registered with the Qatar-based Global Carbon Council, the only Voluntary trading market in the Middle East.

“During this financial year, we would be able to mobilise around 100 million credits (up from 40 million-plus credits in 2020), and our target for the next year is 150 million credits,” he said.

“Our revenue target for the next year is 30 billion Indian rupees ($401 million), and we are aiming for 10-15 percent contribution from the Middle East excluding Turkey.” The company’s revenue for 2021 was just 1.91 billion rupees ($26 million).

Dabkara said EnKing has around 50 projects, mainly in renewable energy, accounting for 20 million credits in its Turkey portfolio.

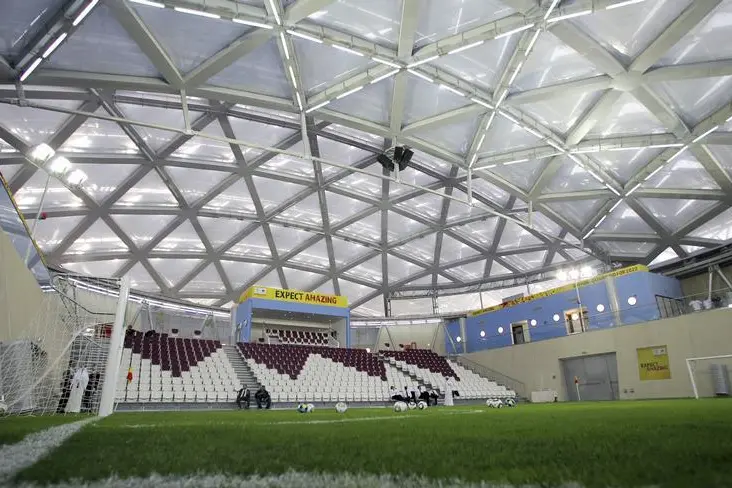

In the Gulf region, he said, the company is close to inking a deal with Qatar to supply 2 million credits to make the 2022 FIFA World Cup carbon neutral and will soon begin the registration process for ACME’s $3.5 billion green ammonia project in Oman.

Dabkara explained that typically “renewable projects supplying power to the grid would be able to secure 10-20 percent additional revenues by generating carbon credits, but this percentage is going to increase as carbon prices rise.”

He pointed out that the MENA region has scope for buyers and sellers of carbon credits, but the “credits originating from the Middle East are costlier. Hence, buyers are keener on purchasing carbon credits originating from developing nations like India or China. The number of projects originating from the region will also be less comparatively, he noted.

Business verticals

The company offers carbon sustainability advisory services to a wide range of projects like bio-methanation, renewable power, waste management, energy efficiency, and water purification. It also provides end-to-end services for the validation, registration, monitoring, verification, issuance, and supply of eligible carbon credits and matches buyers and sellers of credits across the globe.

The EnKing founder said demand for credits is from the sports events, logistics, and from oil and gas, aviation, and marine industries, where it is hard to reduce emissions.

Enking’s international clients include the World Bank, the IMF, and the United Nations. The firm has also formed a joint venture with Royal Dutch Shell for developing nature-based solutions as part of its backward integration plan.

“We are aggressively looking forward to developing nature-based solutions like forestry, amending agricultural practises, and mangroves,” he said.

“Mangrove projects generate around 60 carbon credits per hectare, the highest among any nature-based solutions while agricultural practises create 10-15 carbon credits per hectare and forestry around 20 to 30”, he said.

Developing mangroves form a significant part of the Middle Eastern’ countries carbon reduction plans. Both UAE and Saudi have plans to plant 100 million mangroves each by 2030.

(Reporting by Sowmya Sundar; Editing by Anoop Menon)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2022