PHOTO

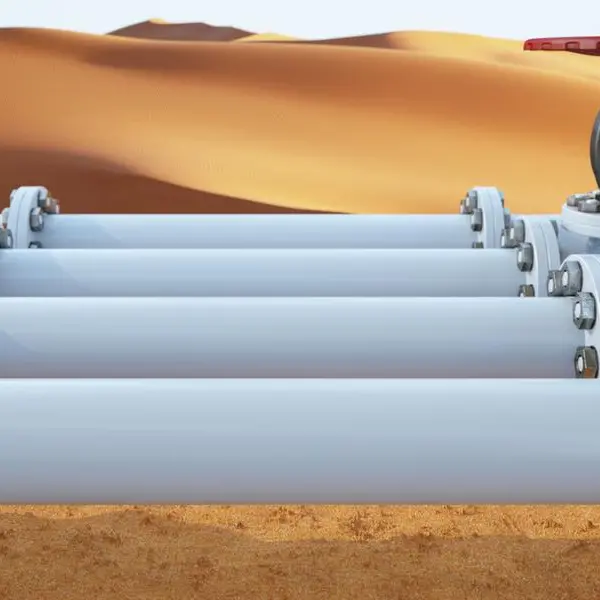

Aramco announced on Thursday that it has signed an $11 billion lease and leaseback agreement for its Jafurah gas processing facilities with a consortium of global investors led by funds managed by Global Infrastructure Partners (GIP), part of BlackRock.

Jafurah, the Kingdom’s largest non-associated gas development, is estimated to hold 229 trillion standard cubic feet of raw gas and 75 billion stock tank barrels of condensate. The field is central to Aramco’s goal of increasing gas production capacity by 60 percent between 2021 and 2030.

Under the deal, a newly formed subsidiary, Jafurah Midstream Gas Company (JMGC), will lease development and usage rights for the Jafurah Field Gas Plant and the Riyas NGL Fractionation Facility, then lease them back to Aramco for 20 years, according to a press statement by Aramco.

JMGC will receive a tariff from Aramco in exchange for exclusive rights to process raw gas from Jafurah.

Aramco will retain a 51 percent majority stake in JMGC, with the remaining 49 percent owned by investors led by GIP. The transaction is expected to close after meeting customary conditions.

Amin H. Nasser, Aramco President & CEO, said: “As Jafurah prepares to start phase one production this year, development of subsequent phases is well on track. We look forward to Jafurah playing a major role as a feedstock provider to the petrochemicals sector, and supplying energy required to power new growth sectors, such as AI data centres, in the Kingdom.”

Past precedents

The transaction underscores the trend of monetising oil and gas infrastructure via long term lease back models by the region’s national oil companies while retaining operational control.

In September 2024, Reuters reported that a BlackRock-managed fund acquired a minority stake in the Saudi–Bahrain Pipeline Company (SBPC) from Bapco Energies. The 112-km pipeline transports crude oil from Saudi Aramco to Bahrain’s national refinery

In December 2021, Aramco signed a $15.5 billion lease and leaseback deal involving its gas pipeline network with a consortium led by BlackRock and Hassana, the investment management arm of the General Organisation for Social Insurance (GOSI) in Saudi Arabia,

Aramco Gas Pipelines Company, 51 percent owned by Aramco and 49 percent owned by investors led by BlackRock and Hassana, has leased usage rights in Aramco’s gas pipelines network and leased them back to Aramco for a 20-year period.

In return, Aramco Gas Pipelines Company receives a tariff payable by Aramco for the gas products that will flow through the network, backed by minimum commitments on throughput.

The deal that started it all

In 2019, UAE's ADNOC inked a deal worth $4 billion with a consortium including GIC, BlackRock, KKR and Abu Dhabi Retirement Pensions and Benefits Fund, selling them a 49 percent stake in its subsidiary ADNOC Oil Pipelines (AOP).

The agreement involved AOP leasing ADNOC’s usage rights in 18 pipelines for transporting crude and condensates from the national oil company's onshore and offshore concessions, and leasing them back to ADNOC for a period of 23 years.

In July 2020, ADNOC had sold a 49 percent stake in ADNOC Gas Pipelines - which held 20-year lease rights for 38 gas pipelines spanning 982 km - to an international consortium including GIP, Brookfield, GIC, Ontario Teachers’, NH Investment & Securities, and Snam for $20.7 billion.

ADNOC, which owns 51 percent in ADNOC Gas Pipelines, pays the latter a volume-based tariff, subject to a floor and a cap, for the use of pipelines that transport sales gas and natural gas liquids (NGL) from ADNOC’s upstream assets to Abu Dhabi’s key outlets and terminals.

In April 2024, local alternative investment firm Lunate acquired a 40 percent stake in AOP from BlackRock and KKR, with a further 6 percent stake acquired from Snam in January 2025, thereby bringing infrastructure back under UAE-based ownership.

(Writing by SA Kader; Editing by Anoop Menon)

(anoop.menon@lseg.com)

Subscribe to our Projects' PULSE newsletter that brings you trustworthy news, updates and insights on project activities, developments, and partnerships across sectors in the Middle East and Africa.