PHOTO

Saudi Aramco is actively developing additional investment opportunities with its Chinese partners to help build a world-leading chemicals sector, said President and CEO Amin Nasser.

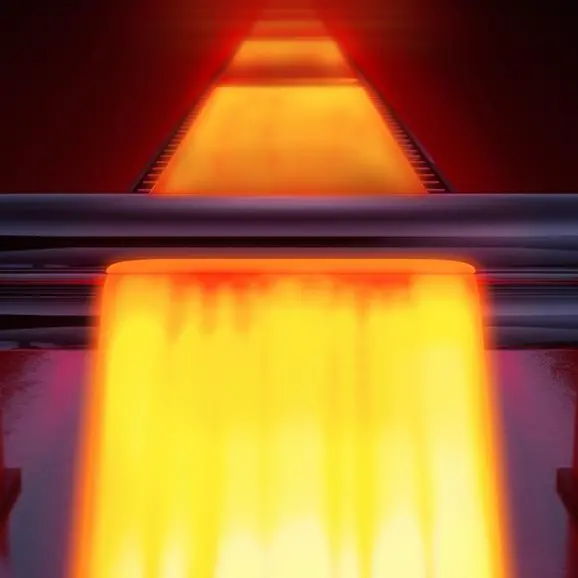

“Aramco has developed a formidable position as well, with our majority ownership in SABIC. This is crucial to our plans to increase liquids-to-chemicals throughput to four million barrels per day by 2030,” he said at the China Development Forum 2024.

SABIC’s partnership in Fujian is on track to commence construction of a major chemicals facility at an estimated cost of $6.4 billion, the CEO added.

Moreover, demand for lower greenhouse gas (GHG) emissions materials – especially advanced composites and non-metallics in general – is growing rapidly.

“There are wide-ranging opportunities to jointly develop advanced GHG emission reduction technologies. In turn, this would help to protect the environment and create new industrial value chains with global impact,” he stated.

According to Nasser, the company has more than doubled the funding for its venture capital arm to $7.5 billion, focusing on industrial innovation, disruptive technologies, and sustainability.

“So, there are attractive opportunities for China and Aramco to join hands in all these areas,” the CEO said.

China has a vitally important place in Aramco’s global investment strategy, Nasser said, adding Aramco was among the leading direct investors in China last year.

“But we are not mere investors, and China is not just a market to us. We want to be a partner of first resort in China’s economic development journey, as new opportunities clearly come into focus,” he stated.

(Editing by Anoop Menon)