PHOTO

- Ajman shines with record growth in sales and rentals, whilst Sharjah and RAK emerge as hotspots for property purchases in the UAE

Dubai, UAE: dubizzle’s highly anticipated Annual Property Market Report for the Northern Emirates has revealed that the region’s real estate markets have witnessed significant growth in 2023, with Ajman, Sharjah, and Ras Al Khaimah (RAK) at the forefront, according to the UAE’s leading property platform. Based on primary data gathered from site visits and user behaviour throughout 2023, the reports released for each emirate have shown an impressive uptrend in both the sales and rental sectors, revealing a promising outlook for investors and homebuyers alike.

Commenting on the report’s findings, Haider Khan, CEO of dubizzle, said: “Our 2023 Annual Property Market Reports for Ajman, Sharjah, and Ras Al Khaimah showcase their emerging status as rising stars in the UAE property market. We’ve noticed consistent increases in nearly all villa and apartment categories, bolstered by the availability of modern amenities at competitive price points and timely completion of off-plan projects and other developments. Listings advertised in Sharjah and the Northern Emirates attracted over 25M page views in 2023, showing their appeal with property seekers in the UAE. With demand for housing and investment options rising across the UAE, these emirates have become prime opportunities for those wanting more competitive options with similar amenities and benefits.”

Ajman – ‘Surprise contender’ with soaring real estate numbers in 2023

The Ajman property market experienced a significant surge in 2023, according to dubizzle’s dedicated report, showcasing the “quiet emirate’s” increasing appeal as a prime real estate destination, driven by its ongoing infrastructural developments, urban planning, and a variety of properties with desirable amenities.

It saw some of the most notable surges in rents, per square foot prices, and ROI figures, due to increased interest from investors and homebuyers.

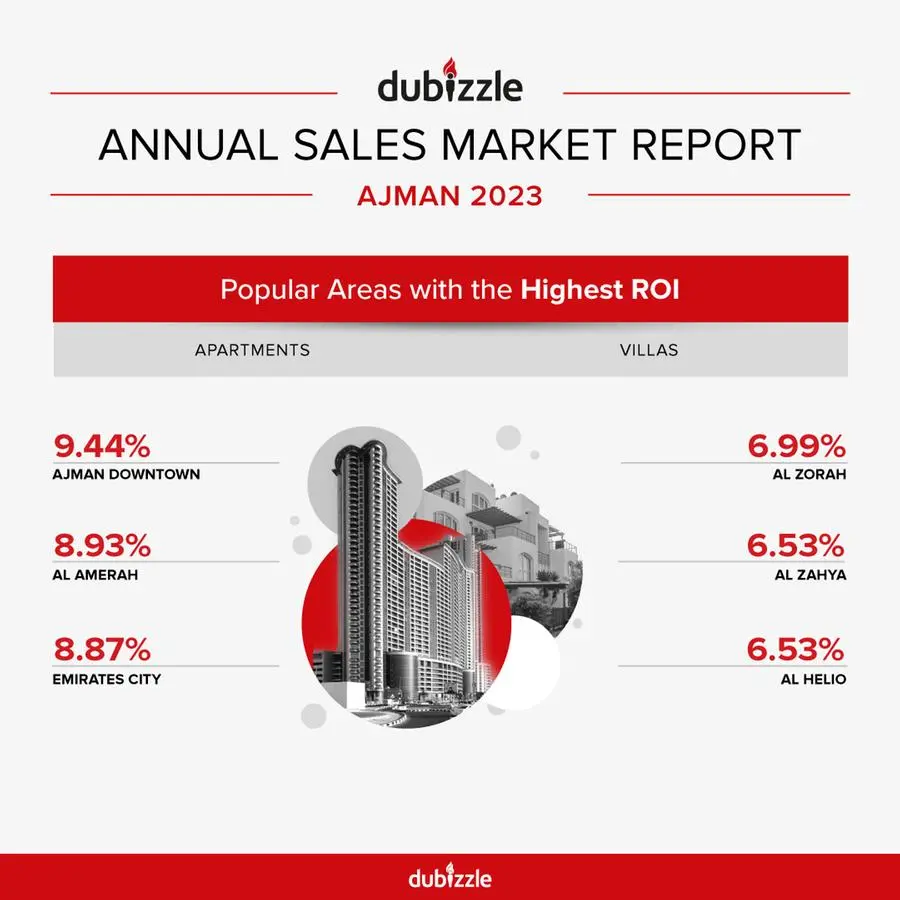

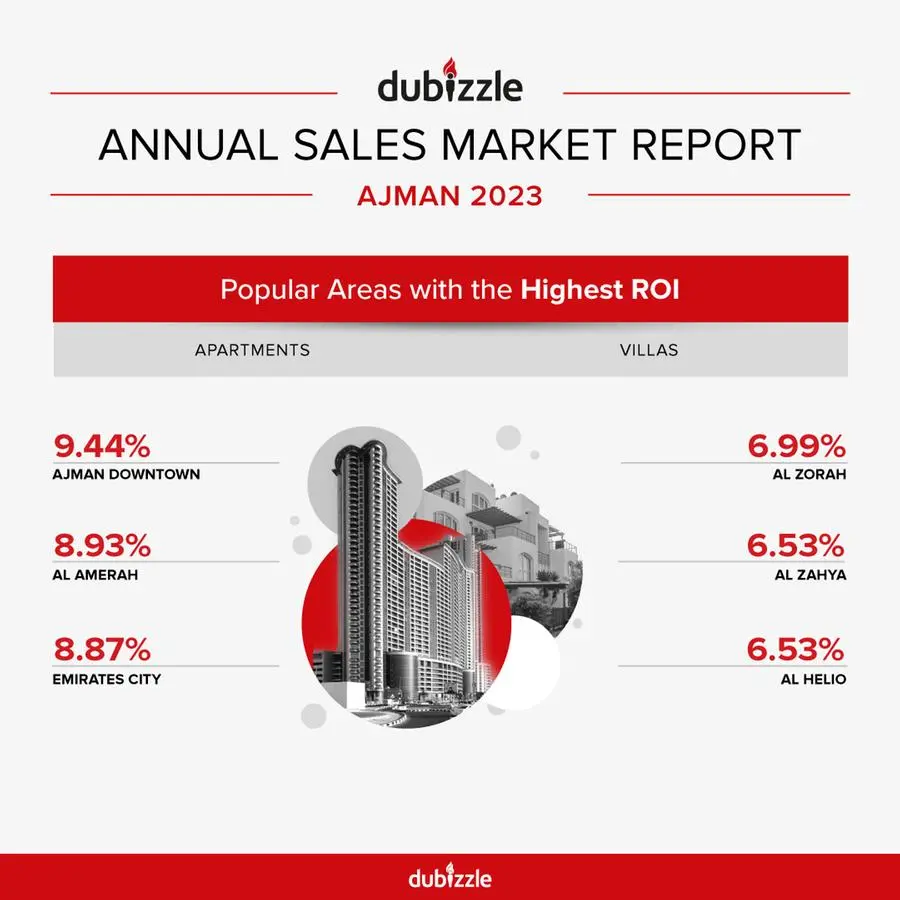

Ajman Downtown leads the way as a prime apartment buying destination with a remarkable Return on Investment (ROI) of 9.44%, a clear indicator of its growing popularity and value in the property market. Al Yasmeen emerges as the most sought-after area for villa purchases with 6.15%, with Al Zorah providing an impressive ROI of 6.99%.

The rental market has shown a healthy uptrend, with annual apartment rents ranging from AED 27,000 to AED 47,000. Al Nuaimiya leads in apartment rentals with an average annual rent of AED 27,000, and also ranks high for apartment purchases with an average sales price of AED 371,000.

Lucrative opportunities lay in the localities of Emirates City, Al Sawan and Al Amerah, which stand out as promising investment areas with ROIs of 8.87%, 8.29%, and 8.93% respectively.

Sales and rental dynamics

Villas in Al Yasmeen average an annual buying price of AED 1.32 million, with a solid ROI of 6.15%. A notable 10.40% increase in price per square foot for villas has been observed in 2023 in Al Yasmeen, while Al Rawda saw a staggering 27% increase in square foot price. Al Zahya and Al Rawda followed closely, offering competitive prices and ROIs for villas. Al Nuaimiya and Ajman Downtown have been recognised for their apartment sales, with Al Nuaimiya also leading in apartment rentals.

Villa rents increased in Al Mowaihat (a high 40.63% for 4bhk villas), and Al Zahra (almost 20%), and Al Yasmeen, whereas apartment rents in Al Nuaimiya (over 53% for studio flats), Al Rawda (15.38% hike for 2bhk), Al Rashidiya, and Al Jurf have seen a rise, reflecting a dynamic rental market.

Ajman’s property market is evolving rapidly, offering diverse and lucrative opportunities for investors and homebuyers. The year 2023 has been pivotal, with substantial growth in both the sales and rental sectors.

Sharjah maintains “reliable neighbour” status

Sharjah’s real estate market has shown remarkable growth in 2023, as detailed in dubizzle’s comprehensive annual property market report. Recognised as the cultural capital of the UAE and valued for its proximity to Dubai, the emirate has continued to attract a significant number of people, with an upward trajectory in both rental and sales prices for apartments and villas.

It also caters to a range of preferences and budgets, with certain areas emerging as particularly attractive for investment and residency. Preferred neighbourhoods are Al Khan, Muwaileh, Al Tai, Al Jazzat, Al Nahda, and Al Qasimia, which list among the most sought-after among prospective tenants and buyers.

Sales and rental uptick

There has been a general rise in prices across the board, with apartments averaging from AED 601,000 to AED 1.01 million in selling prices, and AED 21,000 to AED 45,000 in annual rents.

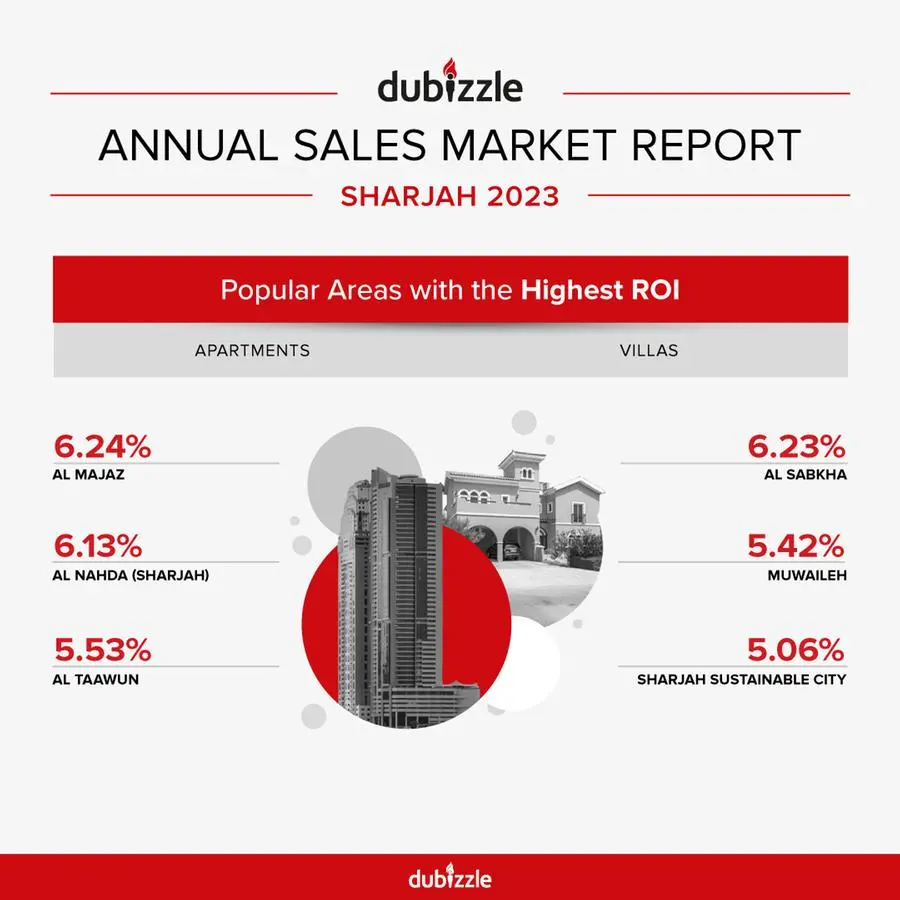

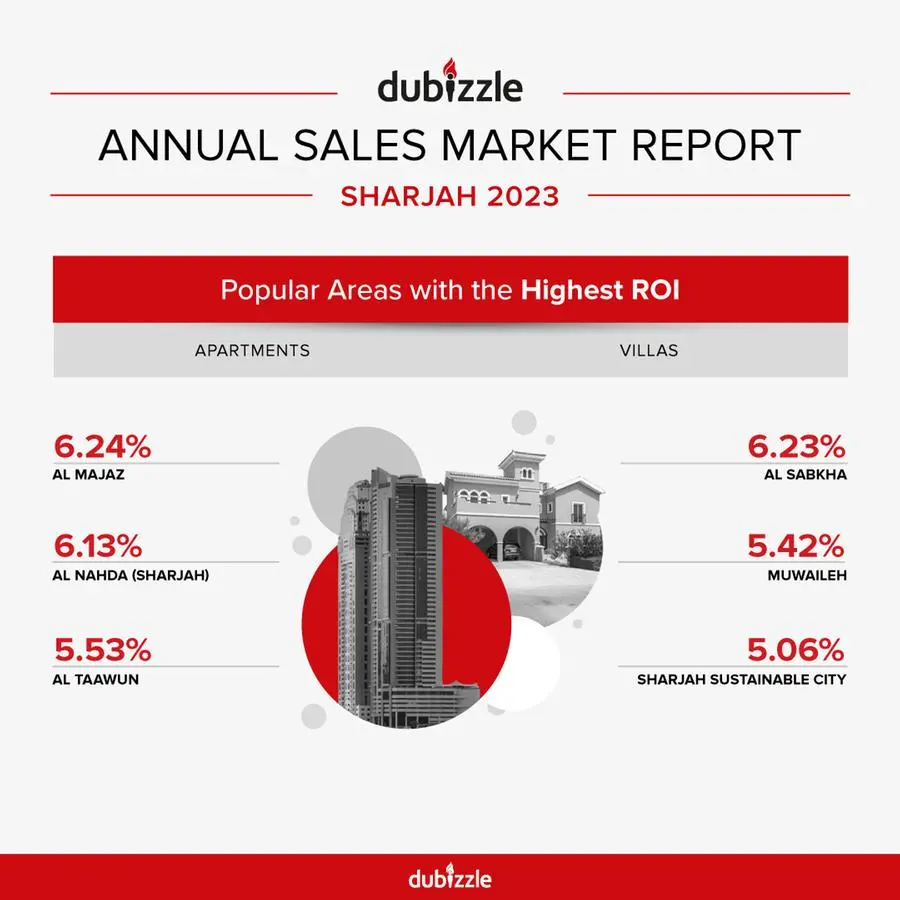

Al Khan leads as the most sought-after area for buying apartments, with an average asking price of AED 948,000 and an ROI of 3.51%. Muwaileh and Al Majaz also emerged as popular choices with attractive ROIs. Al Majaz recorded the highest ROI for apartments at 6.24%, while Al Sabkha topped the list for villas with a 6.23% ROI. Muwaileh’s 3bhk apartment prices, meanwhile, saw a staggering rise of 40.48%.

Top areas for apartment rentals were Al Nahda (which also had a 15.38% rent increase), Muwaileh, Al Qasimia, Al Majaz and Al Taawun, with Al Nahda leading due to its ideal location and reasonable rents.

Al Tai, Al Jazzat, Sharjah Sustainable City and Muwaileh are the most preferred neighbourhoods for villa rentals, with Al Tai offering an average annual rent of AED 111,000, and annual rents rising by 18.75% in Al Sabkha. Sharjah Sustainable City broke on to the scene in a big way, with an ROI of 5.06%, and offering spacious residences and modern amenities with a sustainable lifestyle.

Ras Al Khaimah shows complex market trends

The real estate market in Ras Al Khaimah (RAK) witnessed another year of impressive growth in 2023, while also displaying complex up-and-down trends. Completion of off-plan projects and developments, coupled with the availability of modern amenities, has sustained RAK’s appeal in the eyes of investors, buyers, and tenants. The preferred areas were Al Hamra Village, Mina Al Arab, and Al Marjan Island as the top choices for buying and renting properties.

Sales and rental trends

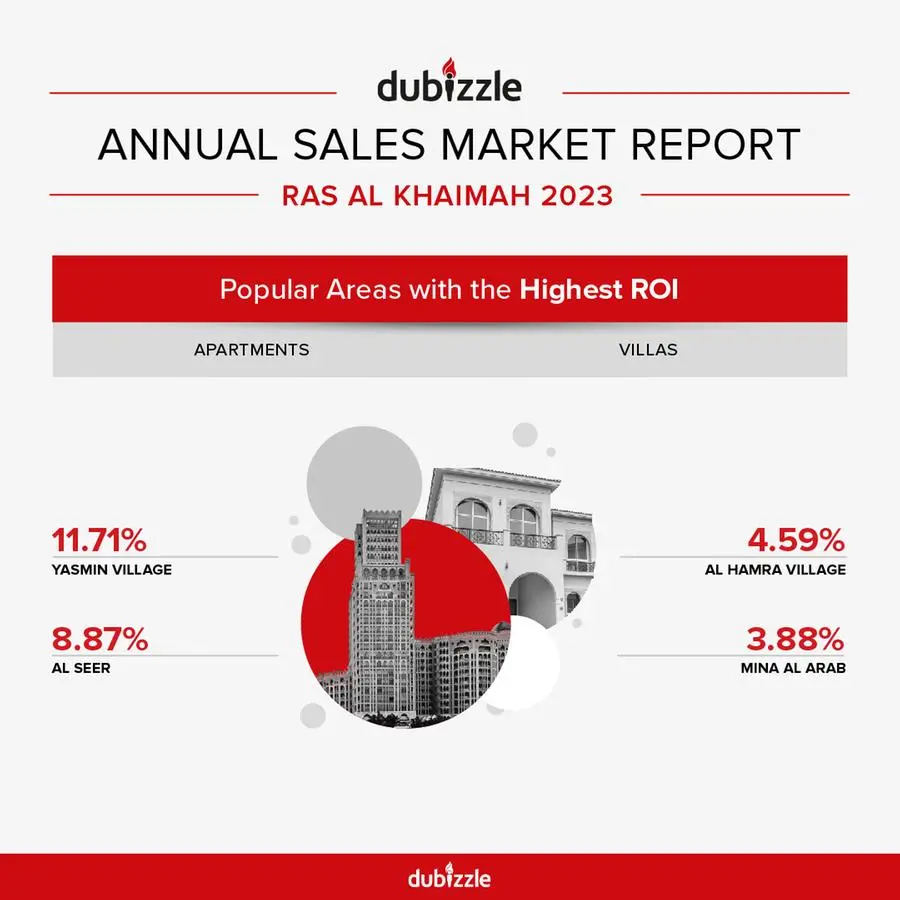

In apartments, the average annual rent ranged from AED 22,000 to AED 42,000. Al Marjan Island recorded the highest sales price for apartments at AED 1.57 million, while Yasmin Village offered the highest ROI of 11.71%.

Al Seer apartments had the highest rise in rentals overall, at 16%. Among villas, Al Hamra Village saw the highest shift in average annual rents for villas at 10.34%.

Al Hamra Village led as the most popular area for apartment purchases with an average sale price of AED 656,000 and an ROI of 7.33%. Al Marjan Island and Mina Al Arab also emerged as preferred choices for buyers, with the former recording average villa sales prices of AED 19 million and seeing a whopping 35.33% increase in its 3bhk prices.

Al Hamra Village also topped the rental market for both flats and villas, followed by Al Marjan Island and Al Dhait for apartments, and Mina Al Arab seeing interest for both flats and villas. Al Hamra Village stood out once again, this time in the villa sales market, with an average price of AED 3.68 million. Mina Al Arab and Al Marjan Island followed, showcasing the diversity and appeal of the villa market in RAK.

About dubizzle:

dubizzle, a distinguished unicorn company based in Dubai, is an integral part of Dubizzle Group Holdings Limited. As the UAE's largest classified site for cars and properties, dubizzle plays a pivotal role in facilitating transactions across diverse categories such as automobiles, jobs, properties and various goods.

The user-friendly platform, coupled with innovative features, has solidified dubizzle as the go-to destination for both buyers and sellers to effortlessly connect and transact. dubizzle takes pride in their unwavering commitment to the values of transparency, authenticity and consumer protection, positioning dubizzle as the UAE’s favourite platform for ethical online commerce in the UAE.

#NoHustleNoBustle #dubizzleit

Media Contact:

Gambit Communications

Nour Aboulaban

Senior Account Manager

Nour@gambit.ae