PHOTO

Fitch Ratings-London: Consolidation among GCC banks may gain momentum if lower oil prices add to competitive pressure in the region, Fitch Ratings says. Sustained lower oil prices and weaker global demand may put pressure on GCC bank operating environments, leading to weaker profitability and acting as a catalyst for M&A as banks seek to diversify their revenues and increase scale. Smaller banks may become targets due to their weaker franchises, and often higher funding costs and thinner capital buffers.

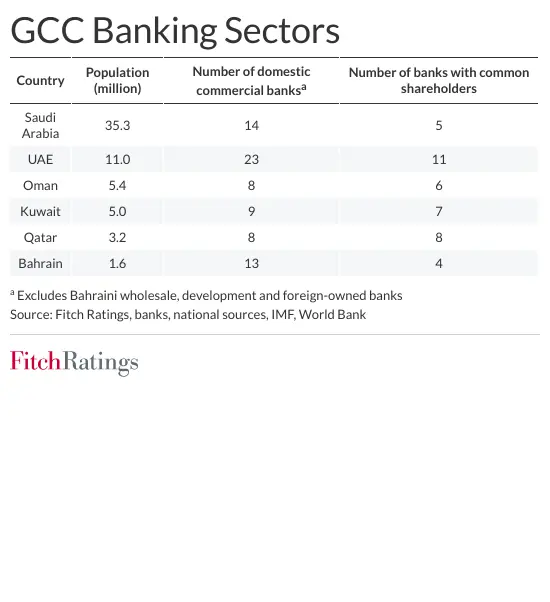

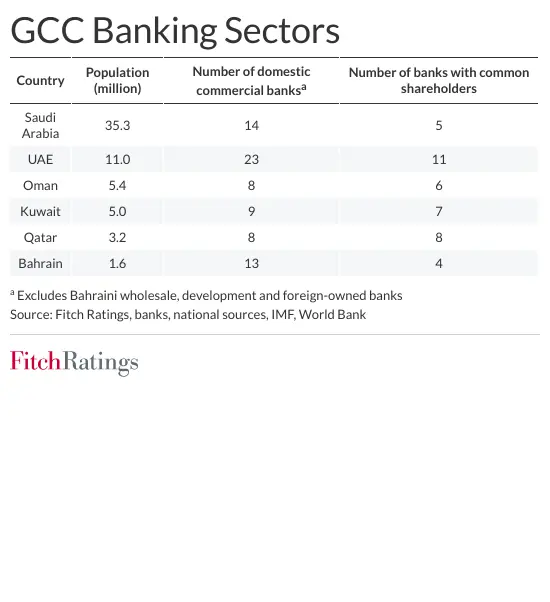

Most GCC banking sectors are ‘overbanked’: characterised by a large number of banks relative to population size, with over 150 banks operating across the region, including 75 domestic commercial banks. Many GCC banks have shareholders in common, which could help to bring about M&A in some cases. However, many of the common shareholders are not sufficiently large to wield significant influence.

Bahrain appears the most likely market for consolidation as it is highly overbanked, with generally weaker banking sector profitability and growth prospects. The Bahraini authorities seem supportive of consolidation, but relatively few banks have common shareholders, which could hinder deals.

Oman and Kuwait are also overbanked with modest banking sector profitability. However, consolidation pressures in Kuwait may ease if economic reforms lead to stronger growth and better profitability prospects, and Oman’s banking sector could expand given its relatively low banking sector assets/GDP ratio.

In the UAE, some smaller banks with weaker franchises and revenue generation may need strategic mergers to sustain their operations, especially if profitability comes under pressure for a sustained period. Again, strong growth prospects may limit this need in the short term.

Consolidation is likely to be less widespread in Qatar and Saudi Arabia. Qatar has many banks for its small population, but profitability is strong, so there is less pressure for M&A to diversify revenues. Saudi Arabia stands out as the one GCC market that does not appear overbanked given its much larger population, lower banking system assets/GDP ratio and strong growth prospects.

Bank sector M&A in the GCC has been focused on enhancing shareholder value through strengthened market positions and economies of scale. This has led to the creation of dominant entities, such as First Abu Dhabi Bank and Saudi National Bank. The recent merger between Kuwait Finance House and Bahrain’s Ahli United Bank, creating a regional Islamic banking powerhouse, exemplifies the trend. Nevertheless, smaller banks with weaker franchises, pricing power and capital buffers are increasingly likely to feature in M&A.

We expect digital banking and new digital entrants to be an increasingly significant driver of consolidation in the region, with banks seeking technological partnerships to improve competitiveness. The expansion of open banking is also likely to influence M&A strategies, fostering joint ventures between tech companies, telecom firms and banks.

Islamic banks have increasingly been involved in M&A to consolidate their franchises, as with Dubai Islamic Bank’s acquisition of Noor. The UAE’s ambitious domestic Islamic finance strategy may lead to further M&A involving Islamic banks. Emirates NBD and Abu Dhabi Commercial Bank have acquired domestic Islamic subsidiaries, which should support financing and deposit growth. In Oman, banks such as Oman Arab Bank and Sohar International Bank have completed or are pursuing Islamic bank acquisitions to cement their positions in the market.

Most GCC bank M&A has been domestic, but we expect a gradual shift towards regional transactions, such as Kuwait Finance House’s takeover of Ahli United Bank. A few GCC banks have also shown a strong appetite to expand beyond the region, although this brings additional risks, especially for acquisitions in more macroeconomically volatile markets, such as Turkiye and Egypt.

Matt Pearson

Associate Director, Corporate Communications

Fitch Group, 30 North Colonnade, London, E14 5GN

E: matthew.pearson@thefitchgroup.com