PHOTO

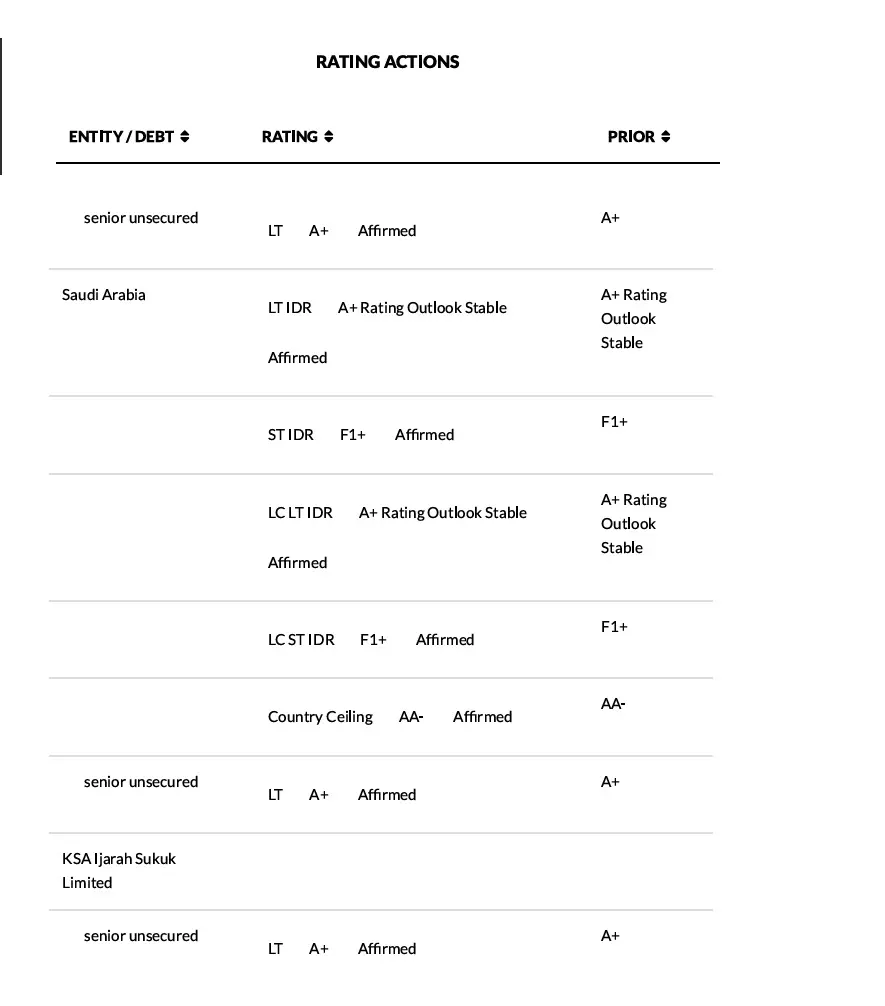

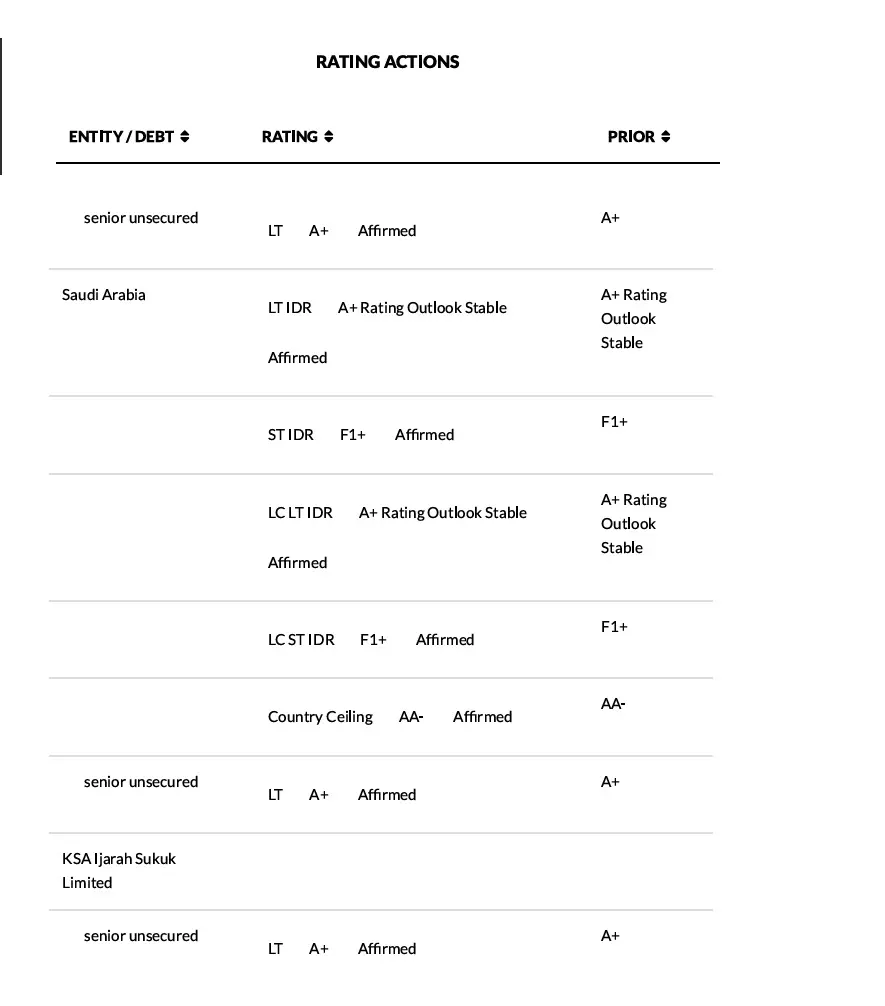

Fitch Ratings - London - Fitch Ratings has affirmed Saudi Arabia's Long-Term Foreign-Currency Issuer Default Rating (IDR) at 'A+' with a Stable Outlook. A full list of rating actions is at the end of this rating action commentary.

The affirmation ratings reflect its strong fiscal and external balance sheets, with government debt/GDP and sovereign net foreign assets (SNFA) considerably stronger than both the 'A' and 'AA' medians, and significant fiscal buffers in the form of deposits and other public sector assets. Oil dependence, World Bank Governance Indicators (WBGI) and vulnerability to geopolitical shocks have improved but remain weaknesses. Deep and broad social and economic reforms implemented under Vision 2030 are diversifying economic activity, albeit at a meaningful cost to the balance sheets.

Key Rating Drivers

Strong External Balance Sheet: Reserves are projected at 11.6 months of current external payments in 2026, well above the peer median of 1.9 months. SNFA will decline due to higher borrowing, but will remain a clear credit strength, at 41.2% of GDP at end-2026 against a peer median of 3.6%. However, large external borrowing across the economy will move the economy to a small net external debtor position in 2027, in line with the peer median (Saudi Arabia had a net external creditor position of 81.6% at end 2016).

Financial Inflows Offset CADs: We forecast a widening of the current account deficit (CAD) to 4.3% of GDP in 2026 from an estimated 3% in 2025 due to the cost of imported inputs associated with high domestic spending and a small increase in oil export receipts (Fitch forecasts Brent to average USD63/b in 2026 and 2027). The deficit should narrow slightly in 2027 as revenues benefit from higher oil export volumes, new export facilities coming on stream and higher tourism inflows, supported by slower import growth from lower project spending. External borrowing and a further reorientation of public assets to domestic from foreign investments should keep reserves stable.

Large Fiscal Deficit to Narrow: Fitch projects the fiscal deficit will narrow and reach 3.6% of GDP by 2027 after lower oil revenues and overspending pushed it to an estimated 5% in 2025 ('A' median 2.9%). Oil revenues will be up from 2025 as higher production will offset the impact of lower prices. Non-oil revenues will continue to benefit from buoyant economic activity and improved collection techniques. Fitch assumes spending growth will be low, as capex has likely peaked and measures are in place to contain current spending.

Rising Government Debt: Fitch's fiscal projections are consistent with a further increase in debt/GDP, which is projected at 36% at end 2026 (well below the projected 2026 peer median of 56%) based on the authorities' goal of maintaining deposits around current levels in nominal terms. An ongoing project recalibration exercise at the sovereign and government-related entity (GRE) level provides an important tool in the event of a shortfall in revenues. GRE borrowing should also slow: while it has grown rapidly recently, this was from a very low base and leverage ratios are low.

Solid Growth: Economic growth is projected at 4.8% in 2026, following an estimated 4.6% in 2025. This will be driven by higher oil production, reflecting the Opec+-related output increases over 2025.Growth will ease in 2027, in line with slower growth in oil production. Prospects for the non-oil sector remain healthy, underpinned by reform, high levels of government and GRE spending, new projects coming on stream and buoyant consumer spending. However, Fitch anticipates that ongoing project recalibration, lower government capex and tighter liquidity will pose challenges to non-oil growth.

Reform Momentum: Reform momentum remains strong with recent steps including a new investment law and a greater opening of the real estate and stock markets to foreign investors. A removal of fees on some expat workers in the industrial sector highlights an understanding of the need to ease near-term bottlenecks. Nonetheless, the resilience of non-oil growth to a period of lower government and GRE spending remains to be tested.

Strong Banks: Core metrics of the banking sector are healthy. Over the first three quarters of 2025 capital adequacy edged up to 20% and non-performing loans fell to an all-time low of 1.1%. Credit growth and high net interest margins have supported profitability. Credit growth is slowing owing to macroprudential measures, but should remain just above nominal non-oil GDP growth. Lending growth has continued to outpace deposit growth, resulting in a further deterioration in the sectors' net foreign asset position. However, this remains relatively small compared to total assets of the banking sector and is in stable forms.

ESG - Governance: Saudi Arabia has an ESG Relevance Score of '5' for Political Stability and Rights and '5[+]' for the Rule of Law, Institutional and Regulatory Quality and Control of Corruption. These scores reflect the high weight that the WBGI have in our proprietary Sovereign Rating Model (SRM). Saudi Arabia has a medium WBGI ranking in the 54th percentile, with low scores for Voice and Accountability, and Political Stability and Absence of Violence constraining the average.

.

RATING SENSITIVITIES

Factors that Could, Individually or Collectively, Lead to Negative Rating Action/Downgrade

-Public Finances: Deterioration in the overall public finance position, reflected in government debt/GDP trending firmly above our forecasts or marked drawdowns of government assets, including government deposits at the central bank.

-Public Finances: Significant increases in contingent liabilities that undermine the strength of the public-sector balance sheet and offsetting improvements in narrower government measures, for example, due to a sustained rise in GRE debt.

-Structural Features: A major escalation of geopolitical tensions that affects key economic infrastructure and activities over an extended period.

Factors that Could, Individually or Collectively, Lead to Positive Rating Action/Upgrade

-Public Finances: Fiscal reforms that increase the budget's resilience to oil price volatility, for example, greater non-oil revenue generation or rationalision of expenditure, while also maintaining the strength of the wider public-sector balance sheet.

-Structural Features: A continuation of economic reform that supports strong growth of the non-oil economy or underpins resilience to lower public spending.

-Public/External Finances: A sustained period of oil prices markedly above our current forecasts that would allow an improvement in the sovereign and external balance sheets.

Sovereign Rating Model (SRM) and Qualitative Overlay (QO)

Fitch's proprietary SRM assigns Saudi Arabia a score equivalent to a rating of 'A' on the Long-Term Foreign-Currency (LT FC) IDR scale.

Fitch's sovereign rating committee adjusted the output from the SRM to arrive at the final LT FC IDR by applying its QO, relative to SRM data and output, as follows:

-Public Finances: +1 notch, to reflect large public sector assets, including government deposits held with the central bank and state pension funds, that could be mobilised to support government funding).

Fitch's SRM is the agency's proprietary multiple regression rating model that employs 18 variables based on three-year centred averages, including one year of forecasts, to produce a score equivalent to a LT FC IDR. Fitch's QO is a forward-looking qualitative framework designed to allow for adjustment to the SRM output to assign the final rating, reflecting factors within our criteria that are not fully quantifiable and/or not fully reflected in the SRM.

Debt Instruments: Key Rating Drivers

Senior Unsecured Debt Equalised: The senior unsecured long-term debt ratings are equalised with the applicable Long-Term IDR, as Fitch assumes recoveries will be 'average' when the sovereign's Long-Term IDR is 'BB-' and above. No Recovery Ratings are assigned at this rating level.

Country Ceiling

The Country Ceiling for Saudi Arabia is 'AA-', one notch above the LTFC IDR. This reflects moderate constraints and incentives, relative to the IDR, against capital or exchange controls being imposed that would prevent or significantly impede the private sector from converting local currency into foreign currencies and transferring the proceeds to non-resident creditors to service debt payments.

Fitch's Country Ceiling Model produced a starting point uplift of +1 notch above the IDR. Fitch's rating committee did not apply a qualitative adjustment to the model result.

REFERENCES FOR SUBSTANTIALLY MATERIAL SOURCE CITED AS KEY DRIVER OF RATING

The principal sources of information used in the analysis are described in the Applicable Criteria.

Climate Vulnerability Signals

The results of our Climate.VS screener did not indicate an elevated risk for Saudi Arabia.

ESG Considerations

Saudi Arabia has an ESG Relevance Score of '5' for Political Stability and Rights as WBGI have the highest weight in Fitch's SRM and are therefore highly relevant to the rating and a key rating driver with a high weight. As Saudi Arabia has a percentile rank below 50 for the respective Governance Indicator, this has a negative impact on the credit profile.

Saudi Arabia has an ESG Relevance Score of '5[+]' for Rule of Law, Institutional & Regulatory Quality and Control of Corruption as WBGI have the highest weight in Fitch's SRM and are therefore highly relevant to the rating and are a key rating driver with a high weight. As Saudi Arabia has a percentile rank above 50 for the respective Governance Indicators, this has a positive impact on the credit profile.

Saudi Arabia has an ESG Relevance Score of '4' for Human Rights and Political Freedoms as the Voice and Accountability pillar of the WBGI is relevant to the rating and a rating driver. As Saudi Arabia has a percentile rank below 50 for the respective Governance Indicator, this has a negative impact on the credit profile.

Saudi Arabia has an ESG Relevance Score of '4[+]' for Creditor Rights as willingness to service and repay debt is relevant to the rating and is a rating driver for Saudi Arabia, as for all sovereigns. As Saudi Arabia has a record of 20+ years without a restructuring of public debt, which is captured in our SRM variable, this has a positive impact on the credit profile.

The highest level of ESG credit relevance is a score of '3', unless otherwise disclosed in this section. A score of '3' means ESG issues are credit-neutral or have only a minimal credit impact on the entity, either due to their nature or the way in which they are being managed by the entity. Fitch's ESG Relevance Scores are not inputs in the rating process; they are an observation on the relevance and materiality of ESG factors in the rating decision. For more information on Fitch's ESG Relevance Scores, visit www.fitchratings.com/topics/esg/products#esg-relevance-scores.