PHOTO

- Persists the upward trajectory of property prices in Dubai

- Sales prices for apartments and villas across prime registering surges between 4 &21% in 2023

Dubai, UAE – Bayut, the premier property portal in the UAE, has unveiled its 2023 Dubai Property Market Report, shedding light on the most coveted areas within the emirate's real estate sector. Through their latest property market reports, Bayut has provided the property seekers with a valuable repository of data, to help them enhance their decision-making, using comprehensive market intelligence.

The report shows that Dubai’s property sector closed 2023 brilliantly and with flying colours. Based on the search trends observed on Bayut, the upward trajectory of property prices in Dubai persists, establishing a favourable setting for sellers and landlords. This sustained uptrend aligns with the heightened demand fuelled by the influx of investors and residents, resulting in unprecedented growth in the real estate market.

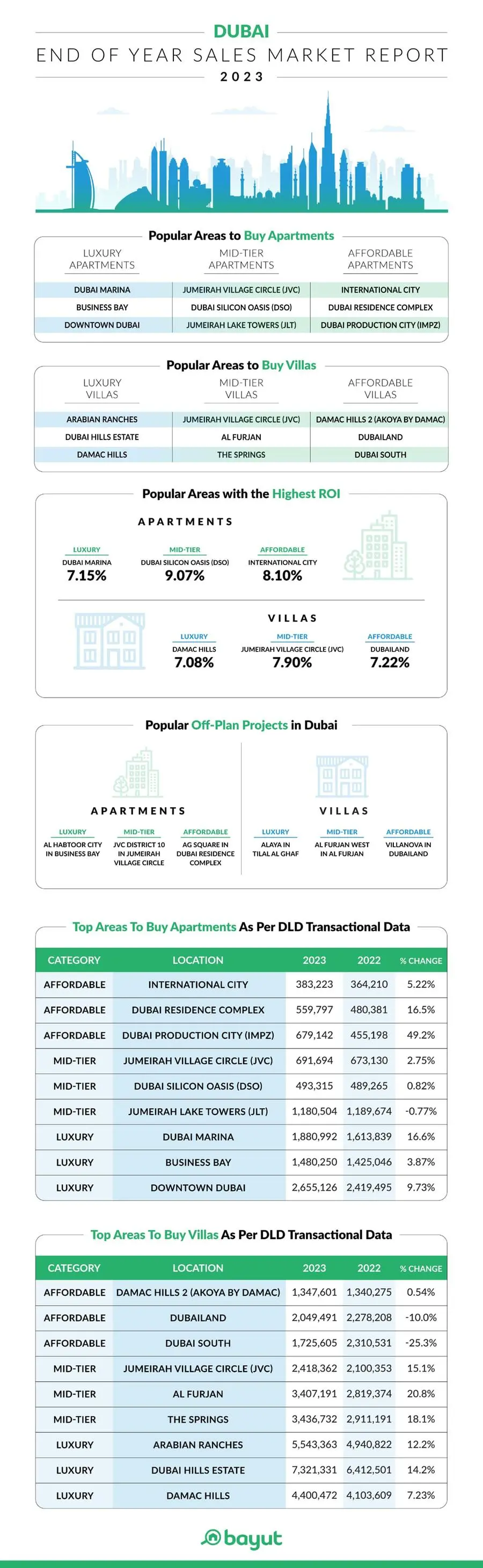

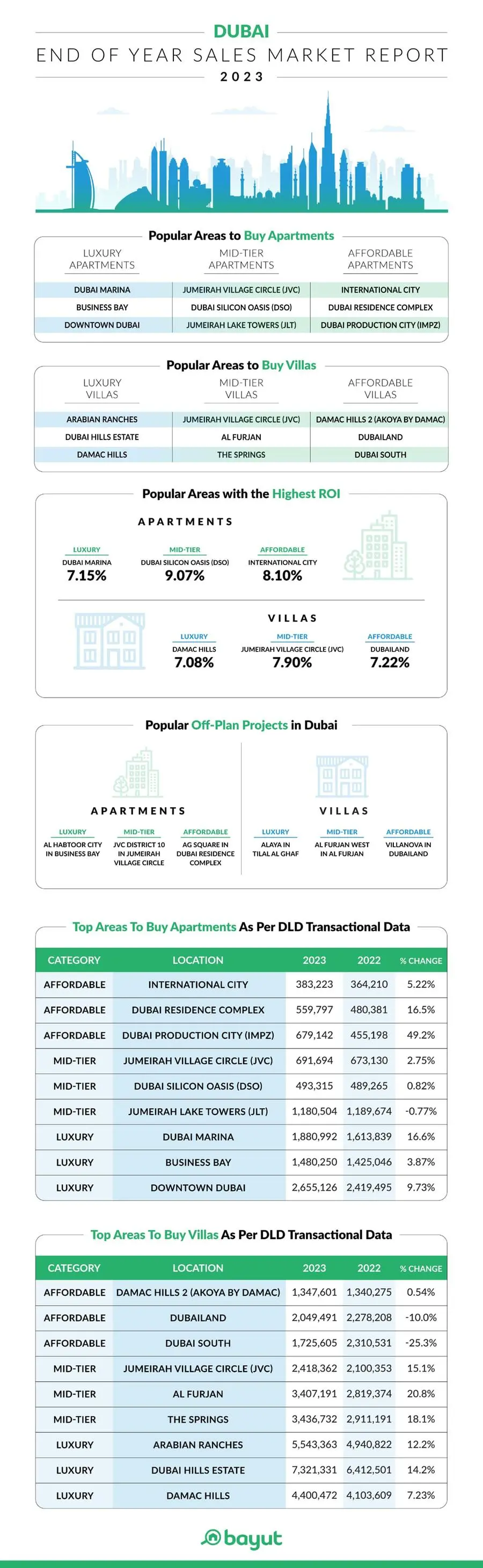

Trends for Buying Properties in Dubai

- Bayut's data indicates a notable uptick in sales prices for apartments and villas across prime neighbourhoods in Dubai, registering surges of between 4 and 21% in 2023.

- In the affordable property segment, potential investors and home buyers have shown heightened interest in International City, Dubai Residence Complex, DAMAC Hills 2 and Dubailand. Property buyers with a mid-range budget have gravitated towards areas like Jumeirah Village Circle, Dubai Silicon Oasis, Al Furjan and The Springs. Conversely, luxury property investors have demonstrated a preference for Dubai Marina, Business Bay, Arabian Ranches and Dubai Hills Estate during 2023.

- For budget-friendly apartments, transactional sales prices in sought-after areas have witnessed increments ranging from 5 - 50%. The average transaction prices for affordable villas have generally decreased by 10% to 26%, with the exception of DAMAC Hills 2, which recorded a minor increase of 0.54%.

- In the mid-tier property segment, the average sales transaction prices for apartments have generally increased by up to 3%. Jumeirah Lake Towers has been an outlier, where the transactional sale price has decreased by 0.77%. Sought-after areas with mid-tier villas have reported 15 - 21% increase in average transaction sales price.

- In the luxury property sector, most areas have seen a consistent appreciation in transactional prices of between 3% and 17%.

- According to the Dubai Transactions on Bayut, the company’s proprietary insights system with detailed processed data based on DLD information, 2023 saw a total of 132,628 property sale transactions, amounting to a total value of AED 409.8 billion, including both residential and commercial purchases.

- On examining the Return on Investment (ROI) based on projected rental yields for apartments, specific areas like DIP, Liwan and Discovery Gardens have emerged as the healthiest options for potential investors, offering yields of up to 11%. When it comes to apartments in the mid-tier segment, Dubai Silicon Oasis, Dubai Sports City and Motor City have been the most compelling options, offering rental yields of up to 9%. In the luxury apartment segment, areas like Al Sufouh, Green Community and Jumeirah Golf Estates delivered impressive returns of up to 10%.

- Bayut's ROI trends for villa communities also portray a positive outlook. Buy-to-let villas and townhouses in Al Rashidiya boast an average ROI exceeding 9%, making it an enticing prospect for potential investors. Similarly, areas such as International City and Jebel Ali are offering ROI percentages exceeding 8%. The mid-tier villas in JVC, Town Square and Reem have recorded projected ROIs of between 6% and 8%. In the luxury villa category, Al Barari stands out with an ROI surpassing 8%.

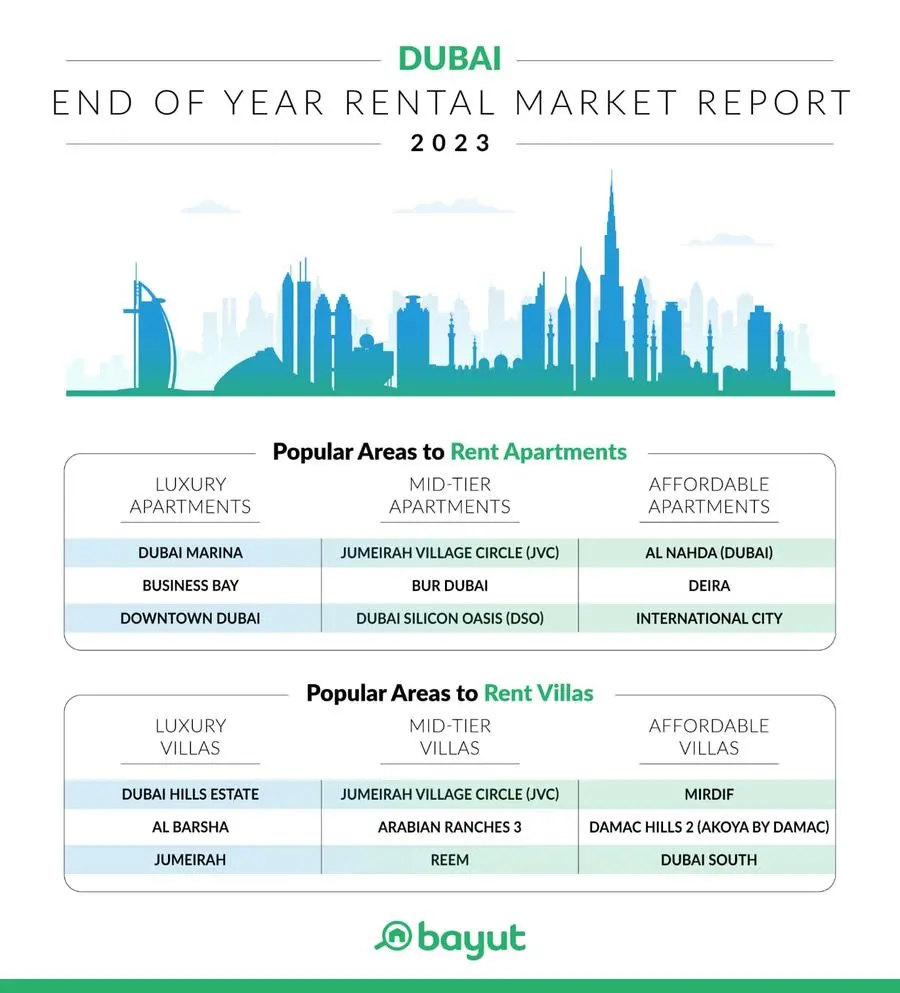

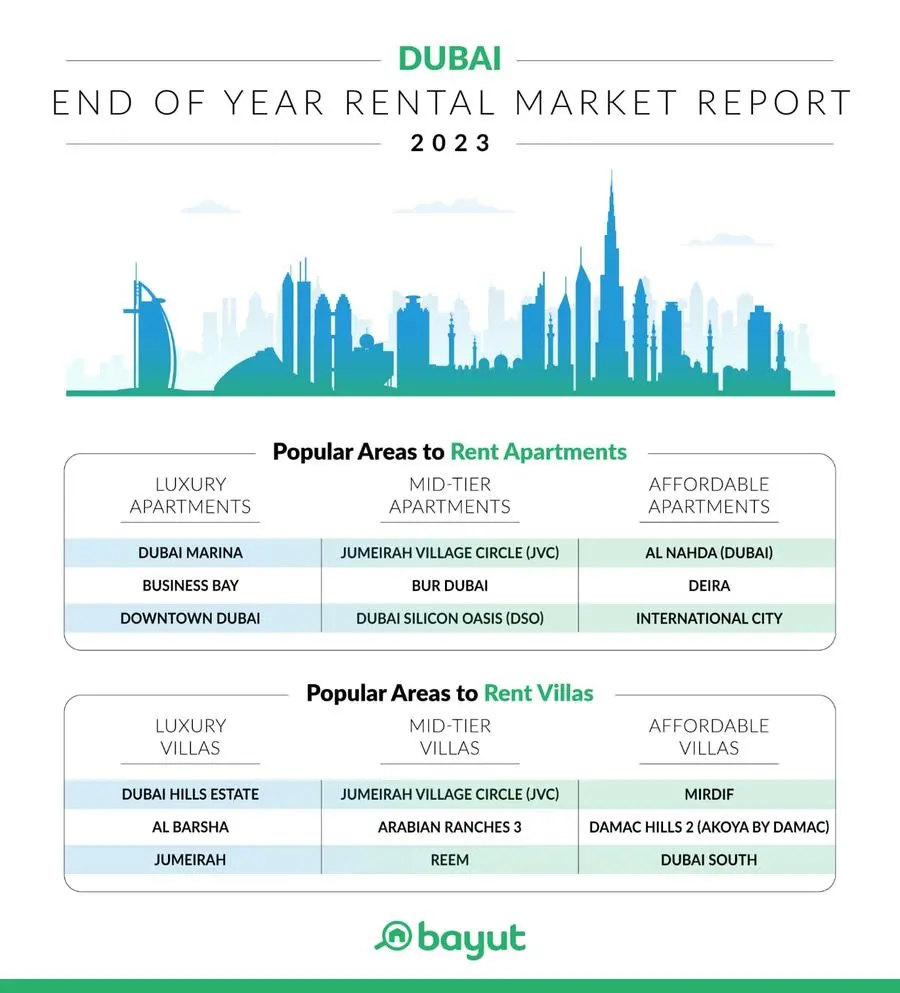

Trends for Renting Properties in Dubai

Upticks in all segments:

- Bayut's data showed that the advertised rental prices have surged by between 4 and 17% for affordable apartment rentals in sought-after areas. Asking rents for apartments in the mid-tier segment have recorded double digit increases of up to 23%. Asking prices for luxury apartment rentals have also witnessed an upward trajectory, with prices increasing by between 4 and 21%.

- Reasonably-priced villas have generally experienced price upticks ranging between 10% and 33%, with rental houses in Dubai South becoming cheaper by up to 6%. Rental costs for mid-tier villas have experienced upticks of 1 - 21%. Luxury villa rentals in Dubai have surged by 38%.

- Regarding the affordable accommodations, Al Nahda and Deira have garnered the most attention for apartments, while Mirdif and DAMAC Hills 2 were the preferred choices for villa-seekers. In the mid-tier segment Jumeirah Village Circle (JVC) and Bur Dubai were the most popular choices among tenants, whereas those in search of villas were mostly inclined towards properties in JVC and Arabian Ranches 3. In the luxury category, Dubai Marina and Business Bay have maintained their popularity for apartment rentals, while Dubai Hills Estate and Al Barsha have been coveted for high-end villa rentals.

- Analysing transactional rental prices, the majority of increases in affordable neighbourhoods for both villas and apartments have varied within the 5 - 11% range. An exception is observed in Dubai South for villas, where average transaction prices have decreased by up to 4%. Transactional prices for apartment and villa rentals in the mid-tier segment have reported increases of up to 17%. In the luxury apartment segment, transaction prices for rentals have risen by 11 - 15%. Meanwhile, luxury villa rentals have experienced a notable increase of 26.4% in Dubai Hills Estate.

Phenomenal year:

2023 has been a phenomenal year for the Dubai real estate market. With the number of transactions in the third quarter alone nearing an unprecedented AED 100 billion, it would be safe to anticipate that this property boom is here to stay for 2024.

Furthermore, the supply-demand dynamics in the UAE property market play a crucial role in price movements. With limited new supply entering the market, especially in sought-after locations, the scarcity of available properties are expected to drive prices upward due to increased competition amongst buyers.

Commenting on the findings, Haider Ali Khan, CEO of Bayut and Head of Dubizzle Group MENA said: “The Dubai property sector has maintained its commendable growth trajectory, concluding 2023 on a high note. Our data reveals sustained progress in property prices, driven by heightened demand from investors and residents wanting to own property in this promising market. There are notable upticks in sales prices across various segments, reflecting the appeal of Dubai's real estate landscape”.

“The impressive total of property sale transactions in 2023, amounting to close to AED 410 billion, solidifies the robustness of the market. As we prepare ourselves for 2024, the heightened demand for properties is expected to increase, owing to the launch of various new primary projects attracting a lot of investors from across the globe”, Khan concluded.

About “Dubizzle Group”:

Dubizzle Group (Emerging Markets Property Group - formerly EMPG), owns and operates online real estate listing and classifieds platforms in emerging markets locally and globally.

The group's key projects include Dubizzle and Bayut in the UAE, Zameen in Pakistan, OLX in the Middle East, North Africa and Pakistan, and La Modi in Indonesia and the Philippines.

Following the recent merger with OLX Group in 2020 and a successful investment profile, EMPG is now valued at more than $1 billion, making it one of the few unicorns in the region.

The group invests heavily in technology, research and development, in cooperation with dedicated technical support centers. They also serve more than 50 cities within these regions, and have more than 5,500 employees in 10 countries.

For more details, please visit: www.dubizzlegroup.com

About "Bayut":

Bayut is the most trusted specialized platform in the UAE for buying, selling and renting real estate. The site provides detailed insights, comprehensive content resources, and updated statistics that allow users who are renters or investors in the real estate sector to make the best decision when searching for properties in the various emirates.

Since 2008, Bayut has witnessed rapid growth, not only in terms of the increase in real estate partners, but also in terms of site traffic growth over the past few years. Haider Ali Khan, CEO since 2014, has continued the growth process over the past five years, including completing multiple rounds of financing from major financial companies, including Naspers, KCK, and "Exor" and other well-known names. In 2019, Bayut announced the launch of the Bayut.sa website from Riyadh.

About "Dubizzle":

Dubizzle is a leading online platform for classifieds in the UAE. Since 2005, Dubizzle has become the premier portal for users to buy, sell or find anything in their community. Dubizzle's vision is to form a society based on the redistribution of things and goods among its members, so that they play a useful role among people who actually need them. The Dubizzle platform contributes to building an environment that is not only related to the product, but also gives the public new methods that enable them to exchange space, efficiency, and material value by dealing face-to-face, without the need for a commercial intermediary.

For media inquiries or more information, please contact:

Nour Nabulsi

Director of Marketing, Corporate Communications and Strategic Partnerships

Email: noor.nabulsi@bayut.com