PHOTO

Sarkhou: This collaboration reflects our ongoing commitment to enhancing and expanding our investment offerings through strategic partnerships

Abdulmalek: This partnership brings together PGIM’s global investment expertise and Kamco Invest’s regional reach to deliver differentiated solutions for clients

Kuwait City: Kamco Invest, a regional non-banking financial powerhouse with one of the largest assets under management in the Middle East, and PGIM, a leading global investment manager, signed a memorandum of understanding to pursue a strategic partnership that leverages their complementary capabilities and expertise across wealth and asset management.

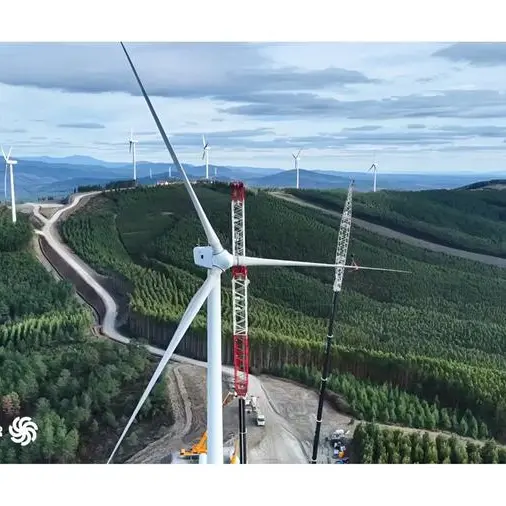

Through this partnership, Kamco Invest and PGIM, the global asset management business of Prudential Financial Inc, will explore opportunities for joint product development and co-branded investment solutions across public and private markets. Potential areas of collaboration include public market strategies such as equities, fixed income and sukuk, as well as private market opportunities spanning private credit, real estate, infrastructure, secondaries and other alternative asset classes.

Furthermore, the partnership aims to combine PGIM’s global investment management capabilities with Kamco Invest’s regional client access, market connectivity and distribution reach. The parties may also evaluate opportunities to jointly pursue regional and global mandates from institutional, sovereign, pension and insurance clients, where their combined capabilities enhance the overall value proposition.

In parallel, PGIM and Kamco Invest intend to explore knowledge sharing and capability development domains, including the exchange of market insights, research and best practices, as well as engagement through training initiatives, conferences and professional exchanges.

Commenting on the partnership, Faisal M. Sarkhou, Chief Executive Officer of Kamco Invest, said, “We are excited to partner with PGIM, a global leader in investment management. This collaboration reflects our ongoing commitment to enhancing and expanding our investment offerings through strategic partnerships that bring world-class expertise, diversified capabilities, and disciplined investment practices to our clients in Kuwait and across the wider GCC.”

Sarkhou added, “We believe this partnership will enable us to strengthen our wealth management offerings and deliver more innovative and tailored solutions that address the evolving needs of our institutional and high-net-worth clients, while supporting the growth of the region’s capital markets.”

PGIM is a leading global investment manager with approximately US$1.5 trillion in assets under management, offering a broad range of investment solutions across public and private markets. With a strong global footprint and a disciplined, long-term investment approach, PGIM serves a diverse base of institutional and wealth clients worldwide, including sovereign wealth funds, pension funds and insurance companies.

Headquartered in the United States, with a presence across key global financial markets, PGIM combines local expertise and market-specific insights to deliver investment solutions to clients worldwide. It provides deep expertise in equities, public and private fixed income, real estate, infrastructure and other alternative asset classes, as well as multi-asset and outcome-oriented strategies.

Mohammed Abdulmalek, Head of the Middle East for PGIM adds; “Our partnership with Kamco Invest brings together PGIM’s global investment expertise and Kamco Invest’s regional reach to deliver differentiated solutions for clients across Kuwait and the wider GCC. By combining complementary strengths, we aim to co‑develop strategies— leveraging expertise across PGIM’s US$1trn public and private credit platform, world-leading real estate business, and other equity and alternative asset classes — aligned to the long‑term objectives of regional institutional and wealth clients. This partnership further strengthens our commitment to delivering bespoke, outcomes‑focused solutions for our clients in Kuwait and the Middle East.”

Sarkhou concluded, “This partnership will create value not only for Kamco Invest’s clients, but also for the wealth management and private banking clients of Burgan Bank. As a subsidiary of Burgan Bank, Kamco Invest and the bank have successfully combined their banking and investment expertise to create, grow, and preserve wealth for their clients. This strategic collaboration will further strengthen their joint wealth management capabilities and broaden the range of investment solutions available, reinforcing their shared commitment to delivering best-in-class service and expertise.”

The signing of the MOU reflects the expansion of Kamco Invest’s offering through strategic partnerships with leading global investment managers. By deepening its capabilities across asset classes, Kamco Invest aims to reinforce its position as a regional leader in delivering diversified, innovative, and institutionally structured investment solutions to its clients.

About Kamco Invest

Kamco Investment Company K.S.C (Public) “Kamco Invest” is a regional non-banking financial powerhouse headquartered in Kuwait with offices in key regional financial markets, established in 1998 and listed on Boursa Kuwait in 2003. It is an Independently managed subsidiary of Burgan Bank, a member of KIPCO Group, adopting highest standards of corporate governance and regulated by the Capital Markets Authority and Central Bank of Kuwait. The Company offers a comprehensive range of investment solutions covering asset management, investment banking and brokerage.

Kamco Invest has AUM of over US$16.4bn as of 30 September 2025 allocated to various asset classes and jurisdictions, making it one of the largest asset managers in the MENA region. It has acted as investment banker to deals exceeding US$45.3bn from its inception to 30 September 2025 in equity capital markets, debt capital markets and mergers & acquisitions.

About PGIM

PGIM, the global asset management business of Prudential Financial, Inc. (NYSE: PRU) is built on a 150-year legacy of strength, stability, and disciplined risk management through more than 30 market cycles. Managing US$1.5 trillion in assets1, PGIM offers clients deep expertise across public and private asset classes, delivering a diverse range of investment strategies and tailored solutions—including fixed income, equities, real estate and other retail investment vehicles. With 1,400+ investment professionals across 41 offices in 20 countries, we serve retail and institutional clients worldwide. For more information, visit pgim.com.

Prudential Financial, Inc. (PFI) of the United States is not affiliated in any manner with Prudential plc, incorporated in the United Kingdom or with Prudential Assurance Company, a subsidiary of M&G plc, incorporated in the United Kingdom. For more information please visit news.prudential.com.

1As of 30 September 2025