PHOTO

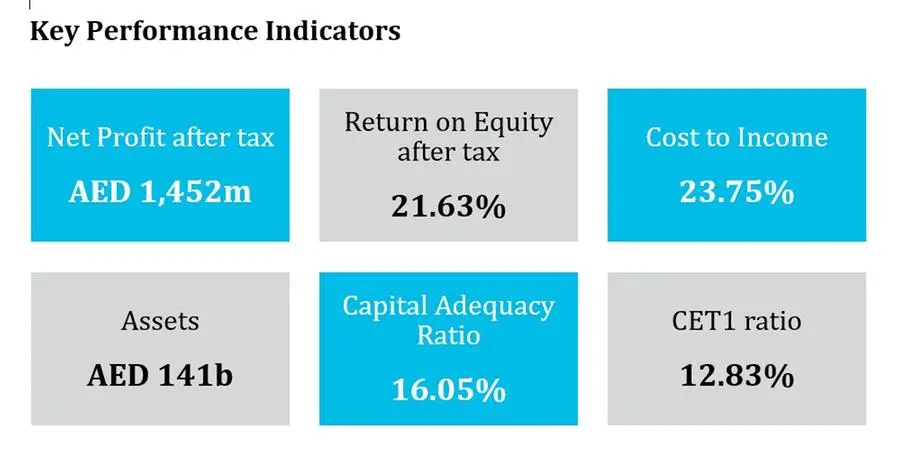

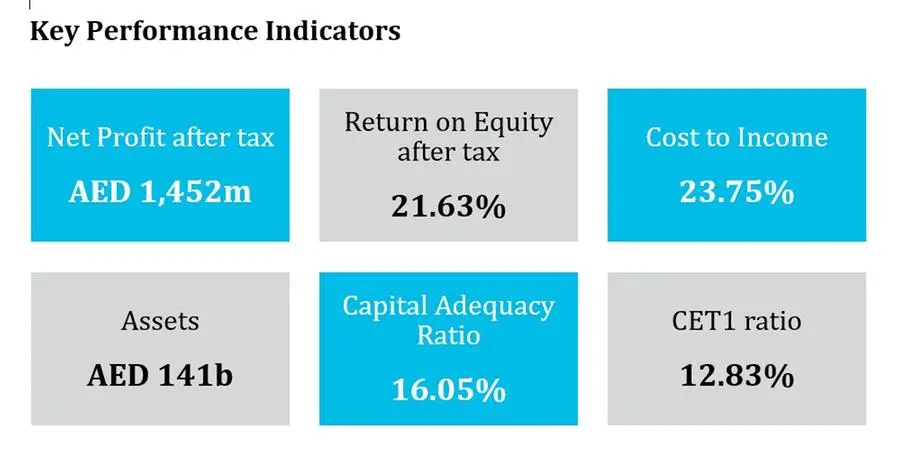

- Excellent performance uplift in H1 2024 compared to H1 2023 Net profit after tax of AED 1,452 million up 30.2% on a pre-tax basis (18.5% on a post-tax basis) versus the prior comparative period

- Prudent provisioning for expected credit losses Net impairment loss was AED 471 million. Coverage ratio at 89.61%, up 789 bps compared to H1 2023

- Cost to income ratio Market leading cost to income ratio at 23.75%

- Strong loan growth whilst maintaining healthy liquidity, funding and capital ratios Gross loans were AED 95.2 billion, an increase of 7.1% compared to 31 December 2023

Dubai, 24th July 2024: Commercial Bank of Dubai (CBD) today reported its financial results for the first six months of 2024.

CBD delivered an excellent net profit after tax result of AED 1,452 million for the first half of 2024, up 30.2% on a pre-tax basis (on a post-tax basis, the result is up 18.5%) compared to the corresponding period in 2023. Strong growth in loans during the first half of 2024 resulted in a solid net interest outcome, which was supported by non-funded income and lower cost of risk that more than offset higher expenses and the corporate tax charge. High global market interest rates continued to contribute to the solid net interest income outcome. UAE business activity, population growth and business confidence remained positive and are forecast to continue to remain supportive in the periods ahead. Public sector strategic intent, investment and broad-based economic growth is expected to offset any future headwinds from interest rate cuts.

Commenting on the Bank’s performance, Dr. Bernd van Linder, Chief Executive Officer, said, “CBD has delivered a commendable result attributable to strong loan growth with higher revenues at outstanding returns and improved overall asset quality. Our net profit after tax for H1 2024 was a record AED 1,452 million, above the prior comparative period by 30.2% on a pre-tax basis, attributable to customer business activity and strong overall revenues. The Bank remains steadfastly focused on the execution of the Bank’s strategy and is well positioned to continue to deliver on our strategic objectives and high-quality performance for the remainder of 2024 and beyond.

In Q2 2024, CBD selected du and HPE Greenlake to accelerate the Bank’s hybrid cloud journey improving our customers’ experience and those of our employees. The financial sector landscape is changing dramatically through technological innovation. With this in mind, CBD continues to digitally transform and innovate, ensuring we evolve to support the needs of our customers and employees, while optimizing our operational efficiency and maintaining our market leading banking platforms.

CBD continues to take long strides in its commitment to achieving Carbon Neutrality in the Bank’s operations' greenhouse gas emissions by 2030. The Bank is committed to supporting the UAE Net Zero by 2050 strategic initiative to transition towards a climate-neutral economy and aims to become a key player in enabling the flow of sustainable finance. In June 2024, the USD 500 million Green Bond issuance by CBD was recognized with the prestigious EMEA Finance Achievement Awards 2023 as the “Best Financial Institution Green Bond in EMEA”, which demonstrates the enduring resolve of the Bank in this crucial area.”

H1 2024 results:

- Net profit after tax was AED 1,452 million, 30.2% above the prior comparative period on a pre-tax basis (18.5% on a post-tax basis)

- Operating income was AED 2,710 million, up 10.1% driven by net interest income, fees and commissions

- Operating expenses were AED 644 million, up by 11.0%

- Operating profit was AED 2,066 million, up by 9.8%

- Net impairment loss was AED 471 million, down by 28.2%

- Corporate tax expense of AED 143 million

As at 30 June 2024:

- Capital ratios remained strong with the capital adequacy ratio (CAR) at 16.05%, Tier 1 ratio at 14.92% and Common Equity Tier 1 (CET1) ratio at 12.83%, well in excess of regulatory requirements

- Gross loans were AED 95.2 billion, an increase of 7.1% compared to 31 December 2023

- Advances to stable resources ratio (ASRR) stood at 83.63%, lower by 362 bps compared to 31 December 2023

Income Statement

Operating income for H1 2024 was AED 2,710 million, up 10.1%, attributable to an increase in Net Interest Income (NII) by 7.8% on strong loan growth during the first half of 2024 with high market interest rates, and robust Other Operating Income (OOI) up 16.0%.

Operating expenses were AED 644 million, with the increase primarily driven by inflation, investments in digitisation, technology, business growth, governance and regulatory compliance. The cost-to-income ratio remains market leading at 23.75%.

(AED Million)

| Income statement | H1 24 | H1 23 | Var | Q2 24 | Q1 24 | QoQ Var |

| Net interest income | 1,906 | 1,768 | 7.8% | 947 | 959 | (1.3%) |

| Other operating income | 804 | 693 | 16.0% | 391 | 413 | (5.3%) |

| Total income | 2,710 | 2,461 | 10.1% | 1,338 | 1,372 | (2.5%) |

| Operating expenses | 644 | 580 | 11.0% | 329 | 315 | 4.4% |

| Operating profit | 2,066 | 1,882 | 9.8% | 1,009 | 1,057 | (4.5%) |

| Expected credit losses | 471 | 656 | (28.2%) | 184 | 287 | (35.9%) |

| Net profit before tax | 1,595 | 1,225 | 30.2% | 825 | 770 | 7.1% |

| Corporate tax expense | 143 | - | 100.0% | 74 | 69 | 7.2% |

| Net profit after tax | 1,452 | 1,225 | 18.5% | 751 | 701 | 7.1% |

Balance Sheet

Total assets were AED 141.3 billion as at 30 June 2024, an increase of 9.5% compared to AED 129.0 billion as at 31 December 2023.

Net loans and advances were AED 89.6 billion, registering an increase of 7.6% compared to AED 83.3 billion as at 31 December 2023.

Customers’ deposits were AED 99.8 billion as at 30 June 2024, representing an increase of 13.1% compared to AED 88.3 billion as at 31 December 2023. Low-cost CASA constituted 47.8% of the total customer deposit base, while the loan-to-deposit ratio stood at 89.8%.

(AED Million)

| Balance sheet | Jun 24 | Jun 23 | YoY Var | Jun 24 | Mar 24 | QoQ Var |

| Gross loans and advances | 95,197 | 86,401 | 10.2% | 95,197 | 92,762 | 2.6% |

| Allowances for impairment | 5,589 | 5,427 | 3.0% | 5,589 | 5,971 | (6.4%) |

| Net loans and advances | 89,608 | 80,974 | 10.7% | 89,608 | 86,791 | 3.2% |

| Total assets | 141,256 | 122,921 | 14.9% | 141,256 | 130,976 | 7.8% |

| Customers' deposits | 99,831 | 85,720 | 16.5% | 99,831 | 90,342 | 10.5% |

| Total Equity | 15,843 | 14,319 | 10.6% | 15,843 | 15,138 | 4.7% |

Asset Quality

The non-performing loan (NPL) ratio decreased markedly to 5.56%, down from 6.46% at the end of 2023. The net impairment charge totaled AED 471 million for the first half of 2024. The coverage ratio increased by 635 bps to 89.61% (December 2023: 83.26%) and was 127.62% inclusive of collateral for stage 3 loans. As at 30 June 2024, total allowances for impairment (covering loans and advances and unfunded exposures) amounted to AED 5,801 million.

Liquidity and Capital position

The Bank’s liquidity position remained robust with the advances to stable resources ratio at 83.63% as at 30 June 2024 (December 2023: 87.25%), compared to the UAE Central Bank maximum of 100%.

CBD’s capital ratios were strong with the capital adequacy ratio (CAR) at 16.05%, Tier 1 ratio at 14.92% and Common Equity Tier 1 (CET1) ratio at 12.83%. All capital ratios were well above the minimum regulatory thresholds mandated by the UAE Central Bank.

(%)

| Key ratios % | H1 24 | H1 23 | YoY Var | Q2 24 | Q1 24 | QoQ Var |

| Return on equity | 21.63% | 20.84% | 79 | 22.93% | 21.08% | 185 |

| Return on assets | 2.15% | 2.05% | 10 | 2.21% | 2.16% | 5 |

| Cost to income ratio | 23.75% | 23.55% | 20 | 24.56% | 22.96% | 160 |

| Non-performing loans (NPL) | 5.56% | 6.63% | (107) | 5.56% | 5.88% | (32) |

| Provision coverage | 89.61% | 81.72% | 789 | 89.61% | 93.39% | (378) |

| Loan-to-deposit ratio | 89.76% | 94.46% | (470) | 89.76% | 96.07% | (631) |

| Advances to stable resources | 83.63% | 86.18% | (255) | 83.63% | 89.24% | (561) |

| Capital adequacy ratio | 16.05% | 16.43% | (38) | 16.05% | 15.67% | 38 |

| Tier 1 ratio | 14.92% | 15.27% | (35) | 14.92% | 14.54% | 38 |

| CET1 ratio | 12.83% | 12.92% | (9) | 12.83% | 12.41% | 42 |

Ratings

| Agency | Rating | Outlook | Date |

| Fitch Ratings | A- | Stable | Mar-24 |

| Moody's | Baa1 | Stable | May-24 |

About CBD

The Bank was incorporated in Dubai, United Arab Emirates in 1969 and is registered as a Public Joint Stock Company (PJSC).

The Bank is listed on the Dubai Financial Market (DFM) and is majority owned by UAE Nationals, including 20% by the Investment Corporation of Dubai (ICD). The Bank employs nearly 1,200 staff and offers a wide range of conventional and Islamic banking products and services to its institutional, corporate and personal banking customers through a network of 13 branches. Moreover, the Bank has invested in an extensive network of 166 ATMs/CDMs.

For further information, kindly contact: CBD Investor Relations @ investor.relations@cbd.ae