PHOTO

-

1,000,000,000 ordinary shares, representing 20% of ALEC Holdings’ share capital, to be sold to the public through the Offering (as defined below).

-

Offering made to Individual Subscribers (First Tranche), Professional Investors (Second Tranche) and Eligible ALEC and ICD Employees (Third Tranche).

-

Subscription for all tranches will open on 23 September 2025 and close on 30 September 2025.

-

The Selling Shareholder, ICD, retains the right to amend the size of the Offering at any time prior to the end of the subscription period at its sole discretion, subject to applicable laws and the approval of SCA (as defined below).

Dubai, United Arab Emirates – ALEC Holdings PJSC (under conversion in Dubai, UAE) today announces its intention to list 20% of its share capital on the Dubai Financial Market (“DFM”) through an Initial Public Offering (“IPO” or the “Offering”), with the Investment Corporation of Dubai (the “Selling Shareholder” or “ICD”) retaining the right to amend the size of the Offering at any time prior to the end of the subscription period at its sole discretion, subject to applicable laws and the approval of the Securities and Commodities Authority (“SCA”).

ALEC Holdings (and together with its subsidiaries, “ALEC” or the “Company”) is a market-leading diversified engineering and construction group with operations focused on large-scale, complex and iconic buildings and energy projects in the United Arab Emirates (“UAE”) and the Kingdom of Saudi Arabia (“KSA”).

Summary of the Offering

-

ICD, the principal investment arm of the Government of Dubai, is currently the sole shareholder of ALEC and is offering 1,000,000,000 (one billion) ordinary shares (“Shares”) through the Offering.

-

The Offering subscription period is expected to run from 23 September 2025 to 30 September 2025 (both days included).

-

The Offering will be made available to (i) Individual Subscribers (as defined below), as part of the First Tranche, (ii) Professional Investors outside the United States (as defined below), as part of the Second Tranche, and (iii) ALEC Eligible Employees and ICD Eligible Employees (together “Eligible Employees”), as part of the Third Tranche.

-

Admission of Shares for trading on the DFM (“Admission”) is anticipated on or around 15 October 2025.

-

The Internal Shariah Supervision Committee of Emirates NBD Bank PJSC has issued pronouncements confirming that, in its view, the Offering is compliant with Shariah principles.

Summary of ALEC’s Investment Highlights

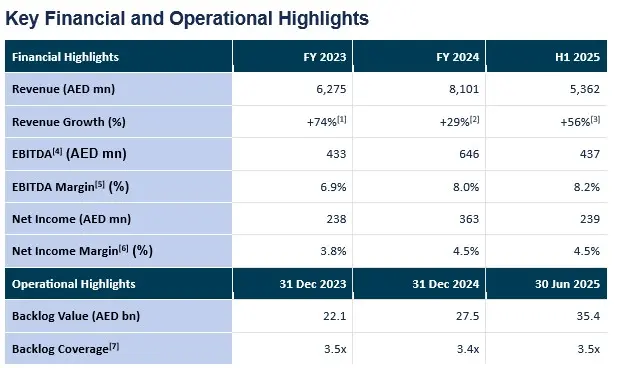

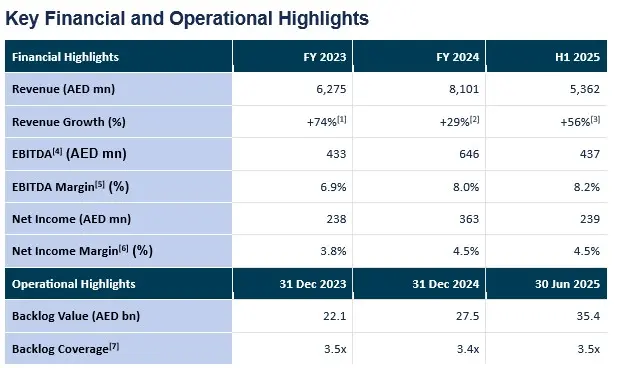

Longstanding track record of financial and commercial success. Sustained operational excellence and strong financial management discipline have allowed ALEC to deliver uninterrupted profitability for the past 18 years, successfully navigating macroeconomic and geopolitical disruptions without compromising financial stability. As of June 2025, ALEC ranks among the UAE’s leading construction players by value of work under execution, reinforcing its scale, credibility, and long-term relevance in the region.

Operational excellence and risk management drive a sustainable edge. ALEC’s operational excellence, disciplined risk management, integrated capabilities, innovative methodologies, progressive use of technology, and people-first culture have driven its long-term success and given it a competitive advantage to deliver complex projects.

Unparalleled capabilities to deliver large-scale, complex and iconic projects. With a reputation as the contractor of choice for large, iconic and technically complex projects, ALEC delivers transformative developments across the UAE and KSA. Examples include One Za’abeel, a mixed-use development with the world’s longest cantilever, SeaWorld Abu Dhabi, the world’s largest indoor marine theme park, and Dubai Hills Mall, for which ALEC was awarded “Retail Project of the Year 2022”.

Strongly positioned to capture significant growth in the UAE and KSA. ALEC is set to benefit from the significant expansion of construction and infrastructure activity in both the UAE and KSA, especially in segments where ALEC has strong expertise including hospitality, airports and data centres. According to the industry consultant MEED, total project spend in the UAE is expected to increase 76% to AED 304 billion by 2033 compared to AED 173 billion in 2024. In KSA, total project spend is forecast to more than double to AED 410 billion by 2033 compared to AED 193 billion in 2024.

Large and secured backlog set to drive visible growth. ALEC maintains a strong pipeline of large-scale projects, reflected in its AED 35.4 billion backlog as at 30 June 2025, with 79% of the current backlog secured in the last two years, highlighting ALEC’s momentum and success in the marketplace. This robust backlog provides multi-year visibility on earnings and cash flow generation.

Robust financial profile and significant acceleration in revenue and profits. ALEC has consistently delivered profitable and cash-generative growth, underpinned by disciplined execution, efficient capital deployment, a robust risk management framework, and a balanced project portfolio. This growth has accelerated in recent years, reflecting ALEC’s success in securing new projects and the strong demand from clients for highly-skilled contractors. ALEC is intending to distribute cash dividends through a clear dividend policy, reflecting its confidence in its cash flow strength and long-term earnings potential, while preserving flexibility for growth investments.

Experienced and performance-focused management team supported by an accomplished Board of Directors and shareholder. ALEC is led by a high-calibre management team with deep sector experience and a long track record of successful project delivery, supported by a strategic and independent Board of Directors and a strong institutional shareholder, ICD, the principal investment arm of the Government of Dubai.

Summary of the Dividend Policy

-

ALEC intends to distribute a cash dividend of AED 200 million, payable in April 2026, and a cash dividend of AED 500 million for the financial year ending 31 December 2026, payable in October 2026 and April 2027.

-

Thereafter, the Company expects to distribute cash dividends on a semi-annual basis (in April and October of each year), with a minimum payout ratio of 50% of the net profit generated for the relevant financial period, subject to the approval of the Board of Directors and the availability of distributable reserves.

-

ALEC continues to evaluate accretive investment opportunities for growth. In the absence of suitable opportunities that meet the target investment criteria and returns, the Company will consider distributing higher dividends than the minimum annual dividend.

Overview of ALEC

ALEC is a market-leading diversified engineering and construction group with operations focused on large-scale, complex, and iconic building and energy projects in the UAE and KSA. Founded in 1999, ALEC grew into a leading regional construction player and, in 2017, became a subsidiary of ICD, aligning it with the strategic vision of the Government of Dubai. In addition to its core construction business, ALEC offers a complete and integrated suite of services spanning fitout, mechanical, electrical, and plumbing, modular construction, data centre solutions, energy solutions, technology, facades, renewables, and equipment rental. This integrated platform enables ALEC to exercise greater control over cost, quality, and supply chain dynamics, while providing clients with a single point of engagement.

ALEC has delivered iconic and complex projects across the UAE and KSA, with consistent and elevated delivery standards across public and private sector clients. Its history of delivering complex, high-value builds for various sectors underscores its strong execution capabilities and solid reputation. With deep expertise across a diverse range of sectors, such as airports, energy, data centres, hospitality, retail, ultra-luxury high-rise towers, and themed entertainment, ALEC has positioned itself as a partner of choice for clients with technically complex, large-scale projects.

Building long-term relationships with blue-chip clients is a key focus for ALEC. Between 2021 and the first half of 2025, around 60% of awarded projects were secured through bilateral negotiations. This approach reflects ALEC’s differentiated offering and ability to deliver tailored solutions.

As of 30 June 2025, ALEC employed approximately 47,500 people, fostering a dynamic and thriving work environment that places people at the heart of its operations.

Overview of ALEC’s Businesses

Core Businesses

- ALEC Construction - A leading, specialised regional engineering and construction company, renowned for delivering large-scale, complex, and iconic projects across the UAE and KSA.

- Target Engineering - One of the leading energy contractors in the region with over 50 years of experience offering comprehensive in-house services in both onshore and offshore areas.

Related Businesses

- ALEC Fitout - Specialises in high-end fitout, theming and refurbishment for luxury hotels, retail, museums, offices, and themed entertainment venues in the UAE and KSA.

- ALEMCO - Leading innovative mechanical, electrical and plumbing (MEP) contractor offering integrated electromechanical and building services solutions.

- ALEC Data Center Solutions - Provides engineering, procurement and construction services for large-scale traditional, AI, and prefabricated data centres.

- ALEC Technologies - Offers pioneering cutting-edge Electronic Low Voltage (ELV) solutions and employs a comprehensive approach providing solutions that are fully integrated and end-user-oriented.

- ALEC Lite - Executes fast-track, turnkey small-scale construction, and refurbishment projects across MEP, civil, and architectural services.

- ALEC Facades - A pioneer in building envelopes and complex facades, aligning with the latest global technologies for superior engineering and execution.

- LINQ – Leading GCC modular housing manufacturer, delivering off-site prefabricated solutions.

- ALEC Energy - Provides comprehensive solar photovoltaics (PV) energy solutions across the renewable energy sector.

- AJI Rentals - A comprehensive provider of equipment rental and custom service solutions, catering to a wide range of project needs.