PHOTO

As the UN points out, the number of people aged 80 years or over is projected to triple from 143 million in 2019 to 426 million in 2050. Clearly, population ageing is a global phenomenon whose pace at present is significantly faster than it was in the past.

Population ageing is a significant concern for nations worldwide since it pushes up old age support ratios (the ratio of elderly people to those in the workforce), creating pressure on future workforces and healthcare systems. Moreover, as mentioned above, 80% of older people will be living in low- and middle-income countries by 2050.

OIC countries are affected

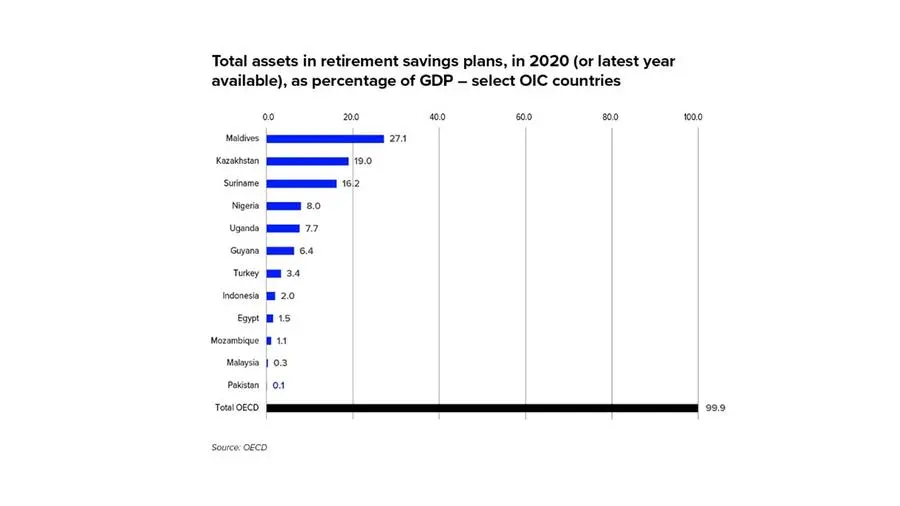

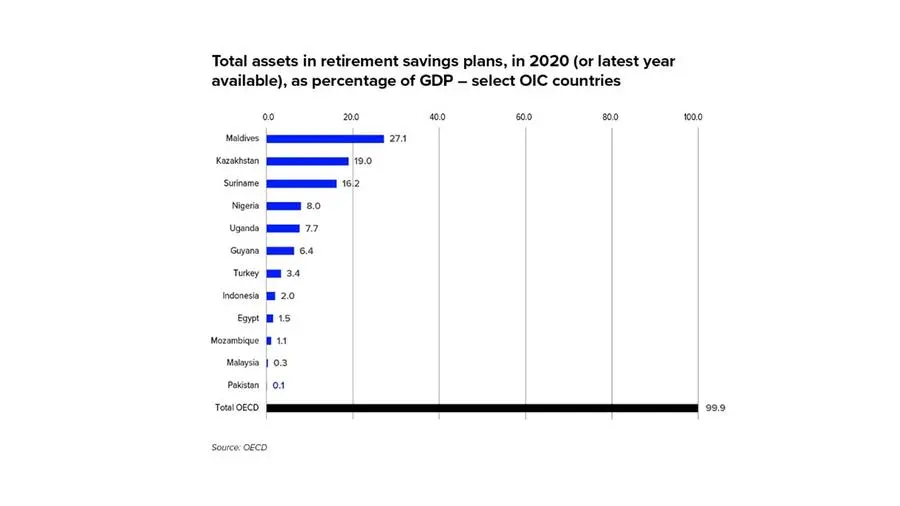

Despite increases in pension assets between 2010 to 2020 for some major Islamic finance jurisdictions, including Malaysia, Pakistan, Turkey and Nigeria, the OECD’s 2020 pensions statistics database suggests that OIC pension assets are still dramatically low in comparison with developed economies.

Major Islamic finance jurisdictions have less than 10% of total assets in retirement savings plans, with most below the 5% level: Nigeria (8%), Turkey (3.4%), Indonesia (2%), Egypt (1.5%), Malaysia (0.3%), and Pakistan (0.1%). Contrast this with the average figure for the OECD’s 37 countries (99.9%), and it is evident that OIC pension fund assets still have a long way to go.

Compared to developed markets, Muslims in OIC countries are not saving enough for retirement, as indicated by saving habits in major Islamic finance jurisdictions like Malaysia. Also, existing major pension funds in Indonesia, Kuwait, Malaysia and Saudi Arabia have total assets value of $542.47 billion, almost five times the overall Islamic fund figures in 2018, but this is still much lower than the total assets value of US pensions, which alone are 34 times larger ($18.8 trillion).

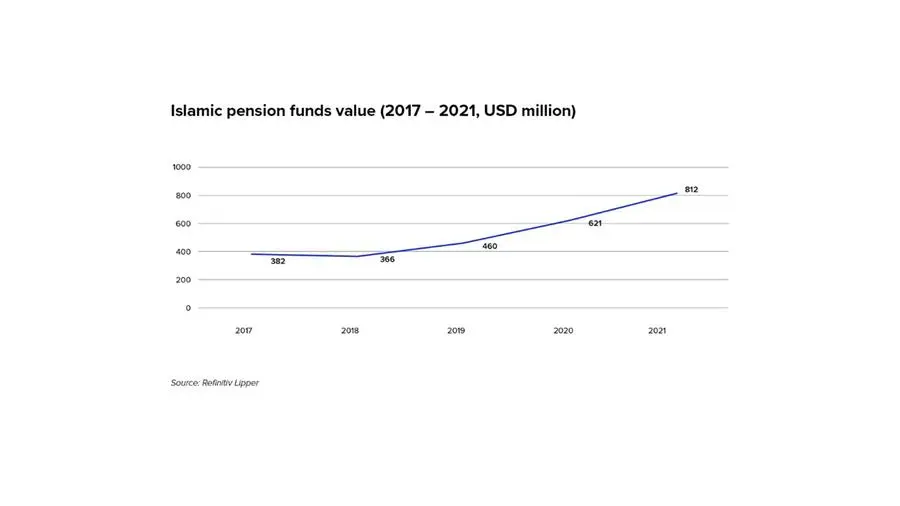

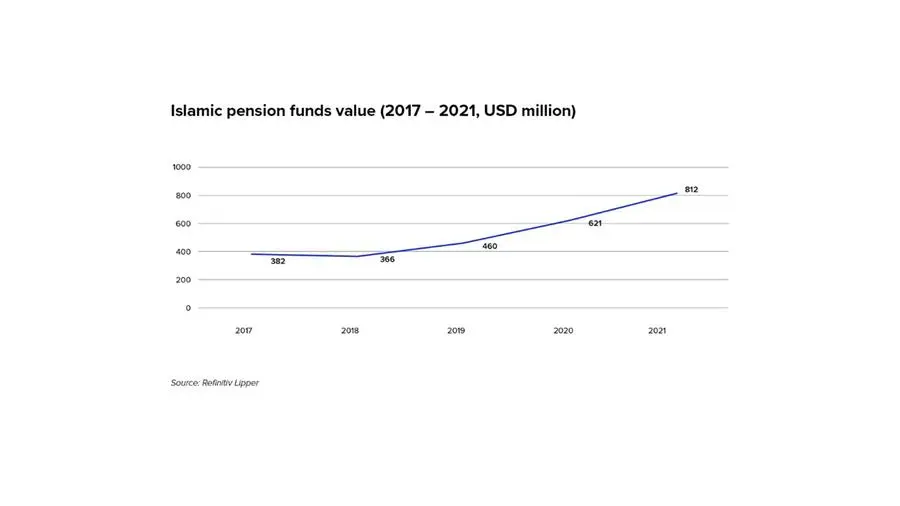

Shariah-compliant pensions and longevity sukuk

The value of Islamic pension funds is rising: in 2017, their assets were worth $382 million globally and by the end of 2021 this number had risen to $812 million, according to Refinitiv Lipper data. However, it is important to put this number in perspective: the largest single pension market in the world, the US, has $18.8 trillion in assets value. In terms of domicile, three countries dominated: Malaysia, Pakistan and the UK accounted for 98% of Islamic pension funds in 2021.

Complementing Shariah-compliant pensions are solutions such as longevity sukuk. Though a longevity sukuk has yet to be launched in the market, it could be a matter of time given the dramatic rise in population ageing that is set to unfold in OIC countries as well as globally.

A longevity sukuk, as the name implies, aims to combat longevity risk arising from increasing lifespans by providing returns via sukuk that can then be used to fund Shariah-compliant annuities (regular payments in retirement).

Although market solutions such as Shariah-compliant pensions and longevity sukuk can help increase access to assets in retirement, they can only go so far without consistent and tangible regulatory support.

Regulators across the OIC need to do more to amplify these solutions by providing regulatory support. Two examples of regulatory support in this space are Malaysia’s private retirement schemes that help encourage Malaysians to save more for their retirement on top of their mandatory pensions (EPF), and a Shariah-compliant option for the state-run pension fund (Simpanan Shariah).

For more insights and key findings, read the report.

(Reporting by Tayyab Ahmed; editing by Seban Scaria)