PHOTO

Saudi's high inflation will remain elevated until the middle of next year and, combined with the suspension of the Cost of Living Allowance, will act as a major drag on households’ real incomes, according to UK-based Capital Economics. Based on these factors, the research firm has also warned of a weak economic recovery.

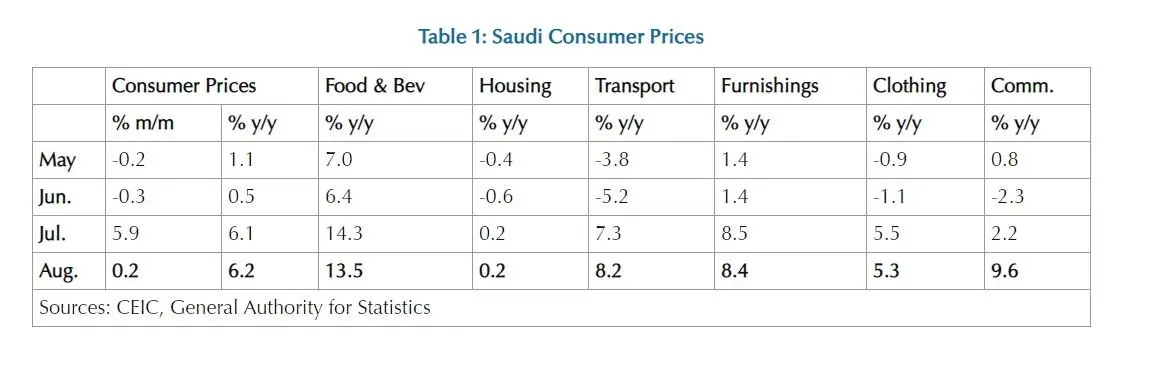

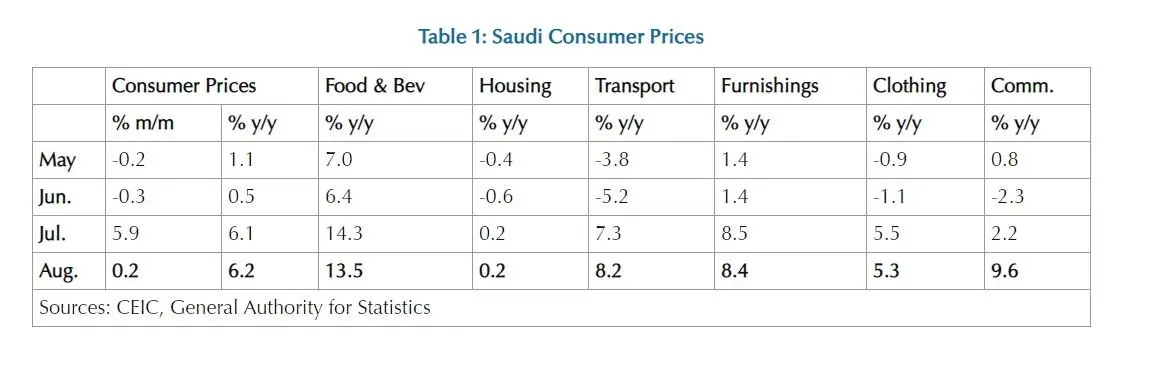

The kingdom's consumer price index jumped 6.2 percent in August compared with the same month last year, the second consecutive rise after a tripling of VAT.

The annual inflation rate in July reached 6.1 percent, jumping from only 0.5 percent in June -- before the VAT increase to 15 percent from 5 percent came into effect on July 1.

The kingdom's headline inflation rate for August is the highest inflation reading since 2011.

In Saudi Arabia, the world's biggest oil exporter, transport was a major contributor to the increase, rising by 8.2 percent. Transport inflation increased as Saudi Aramco raised local fuel prices for a fourth consecutive month.

Jason Tuvey, Senior Emerging Markets Economist at Capital Markets said: “Headline inflation continues to be heavily affected by the effects of the hike in the VAT rate. This caused inflation to rise by more than 5.5 percent points between June and July and these effects will continue to dominate and keep inflation elevated until the middle of next year.”

“This will act as a major drag on households’ real incomes and is being compounded by the government’s decision to suspend the Cost of Living Allowance, a cash transfer programme for public sector workers. The upshot is that we think that Saudi Arabia’s economy will recover only slowly from the effects of the coronavirus crisis,” he added.

Consumer resilience unlikely to last

Consumer spending in the kingdom seems to have bounced back quickly in recent months, but the steep VAT hike and the suspension of the Cost of Living Allowance means that this is unlikely to be sustained, Capital Economics noted.

Citing Google data, the research firm said that households are still taking fewer trips to retail and recreation outlets than before the virus outbreak. However, this could be because of a permanent shift towards online spending and the soaring summer heat may deter households from shopping trips, it said.

“Nonetheless, we doubt that the recent resilience of consumer spending will last. Perhaps most importantly, households are experiencing a severe squeeze on their incomes from recent austerity measures,” Tuvey said.

When VAT was first imposed in 2018, the impact was mitigated by the introduction of a Cost of Living Allowance for public workers. "This time around, however, the allowance has been suspended. Altogether, we estimate that these measures amount to a squeeze of 3.0-3.5 percent of GDP on household incomes," he said.

According to Capital Economics, there are early signs that consumer confidence is suffering. “Weakness in household spending is a key reason why we think that Saudi Arabia’s economic recovery will be slow-going,” Tuvey said.

(Reporting by Seban Scaria; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020