PHOTO

Goldman Sachs has launched a secondaries advisory franchise in the Europe, Middle East and Africa (EMEA) region, according to an internal memo seen by Reuters on Monday, as transaction volumes in the secondary market for private equity funds continue to grow.

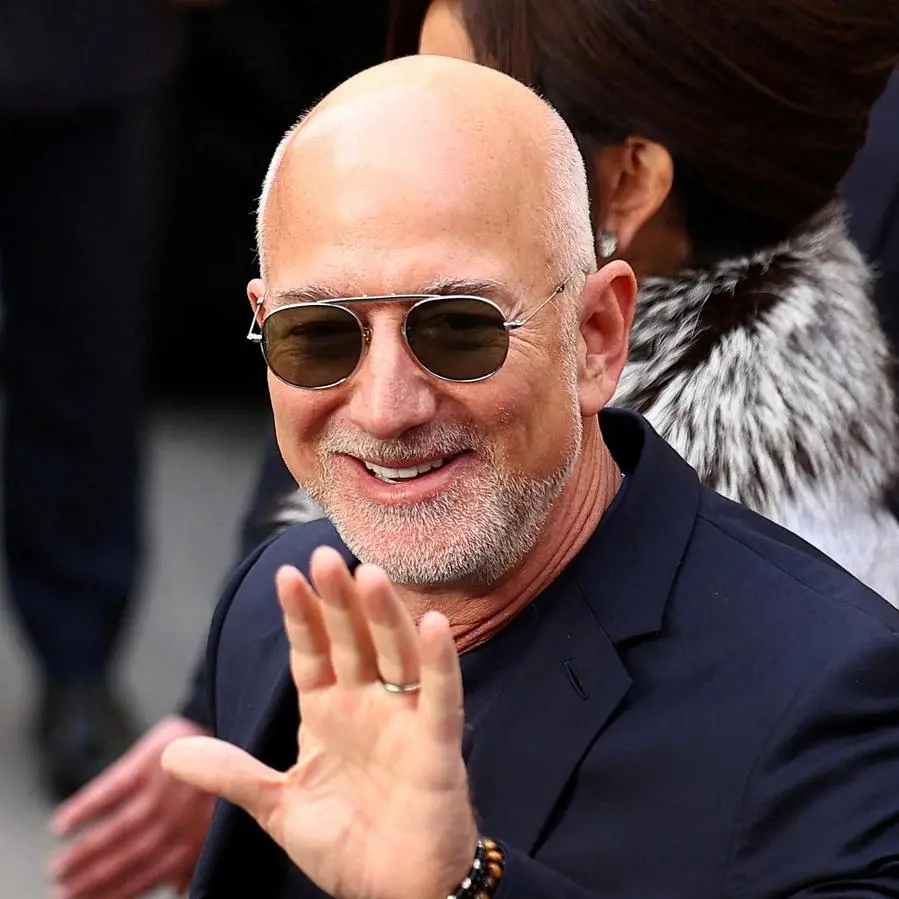

The bank has named Andrei Brougham, who was previously part of Rothschild & Co, as a managing director in its mergers and acquisitions business to lead these efforts in EMEA.

A secondaries advisory franchise advises clients on buying, selling, and structuring interests in existing private equity and alternative funds.

In public markets, the volume of buying and selling each year generally matches the value of the underlying stocks.

For private markets, secondary transactions are a fraction of overall assets under management, since it is tougher to trade in and out of inherently illiquid investments.

In 2025, however, about 1.4% of AUM across buyout, venture capital, private credit, real estate and infrastructure funds was expected to trade on the secondary market, up from a 2014-2024 average of 0.9%, according to Breakingviews calculations using Preqin and Evercore data.

An S&P report last year said Preqin Pro data through mid-June indicated that secondaries funds raised about $38.8 billion. That put private equity secondaries fundraising on track to exceed $60.78 billion from 2024.

Brougham, alongside Benedict van Hovell tot Westerflier, who recently joined Goldman Sachs as an executive director, will focus on private equity and infrastructure secondaries, with a particular emphasis on continuation vehicles, the bank said.

(Reporting by DhanushVignesh Babu in Bengaluru and Anousha Sakoui in London; Editing by Vijay Kishore and Shilpi Majumdar)