A closer look at Ijarah Sukuk

Kristel Richard from Standard and Poor's explains how the agency rates Ijarah Sukuk.

Ijarah Sukuk are financial obligations, issued by a lessor, and backed primarily by a lease stream from a credit lessee. As Shari'ah (Islamic law) frowns on the payment of interest, Ijarah Sukuk transactions work by passing a lease stream through to the holder of the Ijarah Sukuk, rather than being structured as an interest bearing loan secured by a pledge of assets.

Ijarah Sukuk are one of many forms of Sukuk (notes) compliant with Shari'ah on the provision and use of financial products and services. It should be noted that only an appropriate Islamic body may recognise the compliance of the terms of any Sukuk issuance with Shari'ah and that individual investors should make adequate inquiries as to Shari'ah compliance. Standard & Poor's rating process does not address Shari'ah compliance.

This article describes ratings on Ijarah Sukuk, typical transaction configurations, and factors affecting the rating. These factors include the status and responsibilities of the special purpose entity (SPE) typically found in Ijarah Sukuk, the adequacy of the lease payment stream that will service the rated Ijarah Sukuk, and, where the underlying obligor is a government, its commitment to such transactions as an important and continuing source of financing.

The background to Ijarah Sukuk ratings

Standard & Poor's has rated Ijarah Sukuk transactions backed by various types of underlying credit lessees including sovereign governments, regional governments, corporations and multilateral lending institutions. Standard & Poor's also rates financial institutions that provide Islamic banking and insurance services.

In most cases, Standard & Poor's has assigned Ijarah Sukuk the same ratings as it assigns to the lessees creating the payment stream. This practice reflects the unconditional, irrevocable nature of the lease, any third-party lease guarantees, sale and purchase agreements, and/or financial hedges that are found in the transaction. Ratings lower than those given to the lessee are assigned where there are diminished recovery prospects, greater risks associated with lease payments or other factors supporting such a distinction. Higher ratings are unlikely without additional risk-mitigating features in the case of sovereigns, although for corporates, Ijarah Sukuk may resemble certain characteristics of secured loans and be notched up accordingly.

Table 1 | |||

Islamic Financing Ratings History | |||

Issuer | Date of first rating | Issue amount | Current issue rating* |

Malaysia Global Sukuk Inc. | June 10, 2002 | $600 million | A- |

Kingdom of Bahrain | Sep. 04, 2002 | $80 million | A- |

Kingdom of Bahrain | Nov. 11, 2002 | $50 million | A- |

Solidarity Trust Services Ltd. (Guarantor: Islamic Development Bank) | Aug. 11, 2003 | $400 million | AAA |

Qatar Global Sukuk QSC | Sep. 10, 2003 | $700 million | A+ |

Bahrain Monetary Agency International Sukuk Co. | Feb. 18, 2004 | $250 million | A- |

Stichting Sachsen-Anhalt Trust | July 9, 2004 | ?100 million | AA- |

Loehmann's Holdings Inc. | Sep. 22, 2004 | $110 million | CCC+ |

Sarawak Corporate Sukuk Inc. | Nov. 30, 2004 | $350 million | A- |

Pakistan International Sukuk Co. | Dec. 23, 2004 | $600 million | B+ |

*Senior unsecured debt rating unless otherwise indicated. Senior secured debt rating. |

How do Ijarah Sukuk ratings compare with those of the lessee?

Ijarah Sukuk should receive the same rating as the underlying lessee if the transaction cash flows survive reasonable stress scenarios short of a payment default by the lessee, if the lessee views Ijarah (leasing) financing as pari passu (indistinguishable in terms of priority) with conventional debt based financing, and if recovery prospects are similar to those in a debt-based transaction. Where there is material government appropriation risk, as is the case for government leases in a variety of jurisdictions, or other financial or operating risk, the rating of the Ijarah Sukuk may be below that on the lessee.

Standard & Poor's does not exclude the possibility of rating Ijarah Sukuk above the rating on the lessee. This is most likely to occur when the lessee has a ratable corporate credit profile and the credit characteristics of the Ijarah Sukuk resemble, for credit purposes, those of secured debt, allowing the rating to be notched up above that of the lessee, depending on the strength of the security. To notch up the rating where the lessee is a sovereign entity (or where the lessee seeks a rating above that of the sovereign of domicile), some features of the transaction would have to mitigate the risks posed by a potential sovereign default, including the risk of the sovereign restricting access by the issuer to foreign exchange needed for payments to the holders of the Ijarah Sukuk. In such an instance, an offshore mechanism for collecting cash flows generated by the assets is likely to be necessary for the Ijarah Sukuk to achieve a rating higher than that on the sovereign of domicile.

How are most rated Islamic financings configured?

Standard & Poor's has rated two 'broad types' of Islamic financing:

- Ijarah Sukuk where the whole transaction, including the ownership structure as well as the notes, is Shari'ah-compliant

- and the 'ownership' Shari'ah-compliant structure, where the bonds are issued by an unaffiliated SPE with the proceeds used to acquire the assets from the lessee/seller, combined with a put/tender feature. In this configuration, the securities themselves may not necessarily be Shari'ah-compliant.

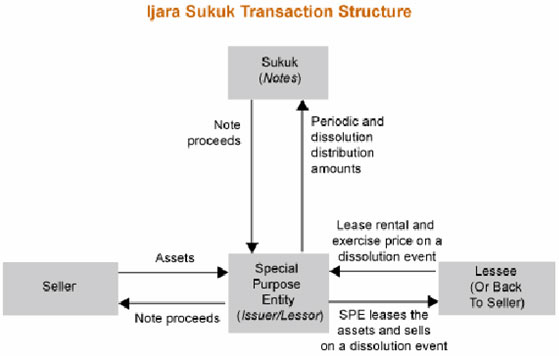

Most Ijarah Sukuk that Standard & Poor's has rated are set up in the following manner

(i) The seller sells certain assets (such as an office building, land, or an airport) to a special purpose entity (the SPE) that may be affiliated or unaffiliated with the seller (depending on the degree of compliance with Shari'ah) for a determined price (the purchase price).

(ii) The SPE raises financing to purchase the assets by issuing Ijarah Sukuk to investors in an amount equal to the purchase price. The Ijarah Sukuk represent an equity interest in the SPE's assets, which may be indirect or direct depending on the type of SPE.

(iii) The SPE then leases the assets to the lessee - an affiliate of the seller, or directly back to the seller itself - in exchange for periodic lease payments. These lease payments should match the obligations of the SPE under the Ijarah Sukuk.

(iv) At maturity, or on a dissolution event, the SPE sells the assets back to the seller at a predetermined value. That value should be equal to any amounts still owed under the terms of the Ijarah Sukuk.

Other transaction configurations are possible. For example, the SPE may sub-lease back to the lessee the assets that have been first leased to the SPE by the same lessee. Typically, the headlease has a longer maturity than the sub-lease. Such configurations do not include the sale of assets and may be preferred when the sale of an asset is difficult, either legally or for political reasons (for example, a sovereign may not wish to sell the country's main airport).

Additionally, depending on the extent of Shari'ah compliance, prior to maturity the lessee may have the right to call for the assets upon certain amounts due under the Ijarah Sukuk as well as other expenses, and the SPE might have the right to tender the assets back to the lessee. The lease may also be supported by affiliate guarantees. Currency or other hedges may also play a part in transaction dynamics.

Do Standard & Poor's ratings address Shari'ah compliance?

Standard & Poor's bases its credit rating opinion on the compliance of an Ijarah Sukuk transaction with applicable commercial law, and the rating therefore does not reflect the compliance of the transaction with Shari'ah. English law, New York state law, and the commercial codes of the countries where the assets are located have, in part, governed transactions rated by Standard & Poor's.

Various scholars charged with interpreting the Koran and other fundamental Islamic writings offer opinions on the conformity of transactions with the principles of Shari'ah. Were a transaction to be governed solely by Shari'ah, such a transaction might be difficult to rate because of the lack of predictability of outcomes in a Shari'ah court, with the possibility of Shari'ah principles overriding otherwise valid commercial contractual obligations. Indeed, certain Shari'ah-compliant transactions have specifically disavowed Shari'ah jurisdiction as a matter of form, although they may satisfy Shari'ah requirements as a matter of substance.

What are the rating implications if Islamic authorities do not recognise a transaction as Shari'ah-compliant?

If a sovereign or an Islamic legal authority declares (at the time of issuance or during the life of the Sukuk) that Ijarah Sukuk do not comply with Shari'ah, there may not necessarily be any credit implications, although such a result could influence market liquidity. Most Ijarah Sukuk transactions involve contractual agreements, subject to commercial law; the enforceability of the transaction in a commercial court should not be affected by any adverse determination by a Shari'ah court. Most, if not all, conventional debt structures from Islamic nations do not comply with Shari'ah, yet this has not curtailed their bond issuance.

However, to the extent Ijarah Sukuk are governed by Shari'ah and are subject to the jurisdiction of the Shari'ah courts (not the case with any Ijarah Sukuk currently rated by Standard & Poor's), then a declaration by such court that the Ijarah Sukuk do not comply with Islamic law could render the Ijarah Sukuk void and unenforceable.

Criteria Guidelines

Standard & Poor's criteria for rating Ijarah Sukuk take into consideration four main elements:

Do the lease and repurchase payments from the lessee to the SPE have the same credit quality as the lessee's conventional debt?

Standard & Poor's analyses the lease and repurchase obligations to determine whether they are timely, irrevocable, and unconditional. If a government is the lessee, Standard & Poor's also gauges appropriation risk (the risk that the legislature will allocate funds to meet the lease obligation). An important factor in determining if the Ijarah Sukuk may be rated the same as the lessee's conventional debt is whether the lease and other relevant obligations rank pari passu with the lessee's conventional debt. Should the lease obligation be subject to budgetary appropriation or other risks that, by comparison, weigh less heavily in issuances of conventional debt, Standard & Poor's might notch the Ijarah Sukuk down from the credit rating of the lessee. Other factors that suggest lower credit quality include:

- Situations under which the lessee may not have to redeem outstanding principal by repurchasing the assets at maturity or in a dissolution event; and

- Any other conditions that allow exceptions for timely payment or for lower recovery prospects.

The essentiality of the asset to the lessee is also considered when assessing the lessee's repurchase commitment.

(ii) Is the SPE a single-purpose pass-through vehicle between the lessee and the holders of Ijarah Sukuk?

Creditworthiness might be impaired relative to the lessee's rating if the issuer is not an SPE, for example, if it has purposes other than engaging in the bare necessities for implementing the transaction.

Loans to the issuer from parties other than the holders of the Ijarah Sukuk are of particular concern, especially if the third parties could interfere with the lease payment stream destined for the Ijarah Sukuk. Furthermore, if the issuer maintains a sinking fund, the credit exposures of the SPE will be considered.

Ownership and management of the issuer is also evaluated. Finally, if the lessee owns the issuer and there are potential conflicts of interest, these would be taken into account in the analysis (see structured finance criteria book 'Legal Criteria for U.S. Structured Finance Transactions,' chapter 3, published on RatingsDirect in April 2004).

(iii) Do the transaction's cash flows provide for the full and timely payment of the obligations to holders of Ijarah Sukuk?

Standard & Poor's compares the terms and conditions of the asset lease and those of the Ijarah Sukuk, analysing how potential shortfalls are covered in the transaction. For example, shortfalls that might arise from foreign currency exposure can be covered by the lease (as supplemental rent), by a lease guarantee from another creditworthy entity, or by a hedge. Usually, government lessees agree to cover, on a timely basis, any additional expenses related to taxes, levies, duties, fees, and charges, whenever they arise. Another important credit consideration is whether the sold assets are free of any lien, pledge, mortgage, security interest, deed of trust, charge, or other encumbrance.

Risks to the leased assets from loss or damage can be mitigated by insurance, though the terms and exceptions, as well as risk of insurer's default, must be examined carefully.

(iv) If the lessee is a government, is its commitment to its Ijarah Sukuk similar to its commitment to other types of debt financing?

'Willingness-to-pay' considerations are of particular importance for sovereign lessees. Historically, financially distressed sovereign lessees have occasionally discriminated among their pari passu financial obligations. Standard & Poor's examines the extent to which the government includes Ijarah Sukuk in government accounts as debt obligations, indistinguishable in terms of priority from conventional debt. 'Willingness' considerations are supported by Ijarah Sukuk financing being designed to target investors interested in Shari'ah-compliant instruments, rather than to create a new stratum of obligation.

Banker Middle East 2005