PHOTO

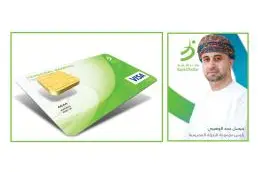

BankDhofar migrates with CBO-OmanNET EMV programme

The new feature brings in enhanced security measures and smoother account-to-account transactions between BankDhofar and other local bank accounts

Muscat, 27 June 2015: To further enrich its customers experience, BankDhofar recently adapted the CBO-OmanNET EMV programme to handle chip card transactions, both as an acquirer and issuer, in respect to ATMs and points of sale (POS). The bank has started issuing new EMV chip-based debit cards, allowing customers to do banking transactions smoothly and with extra security measures to minimise card fraud risk and scams.

In a statement highlighting the new initiative by BankDhofar, Faisal Hamed Al Wahaibi, Chief Retail Banking Officer, said: "In a competitive business world, and especially in the banking industry, customers seek convenient, secure and reliable banking products and services. We at BankDhofar stand out by the distinctive instant services we provide and the cutting-edge technology we apply. Our world-class banking options are the most sought after, and we constantly introduce new technology and additional security measures to better suit our customers' requirements and fulfill their needs."

Ali Taqi, Head of Card Centre, added that "The new EMV chip-based debit cards project has been launched at all BankDhofar branches across the Sultanate and they all have the facility to issue new EMV cards. The new technology is a global standard for credit card and debit card payments. It features payment instruments with embedded microprocessor chips that store and protect cardholder data. Introducing chip-based cards will further enhance the security of ATM cards and ensure global interoperability of BankDhofar cards."

Among the various benefits, in addition to high security features and global interoperability of the debit cards, the new feature allows account-to-account transfer facility where BankDhofar customer can enjoy online fund transfer with limit of OMR 5,000 to other local bank accounts by entering the beneficiary card number in the ATM.

BankDhofar offers a diverse range of services that include, but not limited to, cash withdrawal in OMR (AED & USD in some ATM's), requests for mini statement, balance inquiry, self-fund transfer, third party transfer, card-less cash withdrawal. Additionally, BankDhofar has an extensive network of Cash Deposit Machines (CDM) to further ease transactions such as cash deposit in OMR, bill payment (water, electricity, internet and phone bills), mobile phone top-up, donation to registered charities that maintain an account with the bank, credit card payment, American Express card payment and cheque deposit.

Aspiring to be the best bank in the Sultanate and the wider Gulf area, BankDhofar is committed to provide its customers with the best banking experience. Today BankDhofar is one of the fastest growing banks in the Sultanate, with a strong presence in Corporate Banking, Consumer Banking, Treasury and Project Finance. The Bank has an extensive network of branches across the Sultanate, in addition to ATM and CDM facilities located in all parts of Oman.

For the latest updates, visit BankDhofar social media channels: Facebook (/BankDhofar), Twitter (@BankDhofar), Instagram (/BankDhofar), or visit the official BankDhofar website www.BankDhofar.com to learn more about the wide range of products and services. Contact the 24/7 BankDhofar call centre on (+968) 24791111 for inquiries.

-Ends-

© Press Release 2015