Kuwait price and weighted indices decline (8.7%) and (7.4%) respectively in January

Kuwait, 03, February 2016

Kuwait Financial Centre "Markaz" recently released its Monthly Market Research report. In this report, Markaz examines and analyzes the performance of equity markets in the MENA region as well as the global equity markets for the month of January.

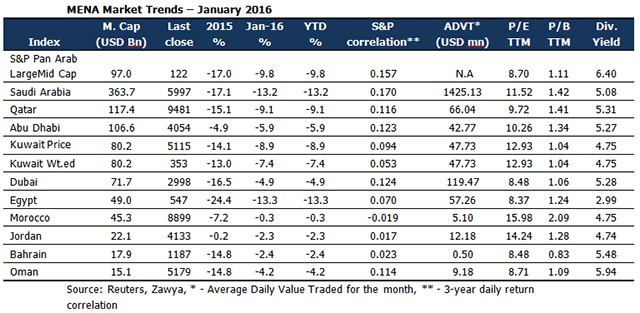

The report pointed out that MENA markets ended in red during the month of January 2016, with Egypt (13.3%) and Saudi Arabia (13.2%) declining the most, followed by Qatar (9.8%) and Kuwait price (8.7%) and weighted (7.4%) indices. Brent crude fell to USD 27.88 per barrel during the month, a fall of over 25%, before recovering and closing the month at USD 34.74 per barrel (6.8%). S&P GCC declined by 10.7% in January, to close at 85 points.

The fortunes of MENA markets followed the oil price, with most indices recording a marginal recovery in the last two weeks of the month. Saudi's TASI index slipped 21% in January, before rebounding by close to 10% by the end, to close Jan at 5,997 points. Egypt stock market continued to be plagued by the foreign currency crisis, and the country is under increasing pressure to devalue the pound. Egypt's foreign currency reserves have declined from USD 36bn in 2011 to USD 16.4bn, and the country has been keeping the pound artificially strong by rationing dollars through the weekly dollar auctions to banks.

MENA markets liquidity had a mixed month, with volumes increasing by 10% and value traded decreasing by 4.5%. Kuwait, Dubai and Jordan witnessed increases in both volume and value traded, while Morocco, Oman and Bahrain markets recorded large declines in both. Kuwait's volume and value traded improved by 50% and 40%, respectively, despite fluctuations of oil price and persistent selling pressures.

Most Blue Chips ended the month of January in red, barring Ooredoo (Qatar, 5.7%), Emirates NBD (UAE, 3.9%) and Emirates Telecom (UAE, 0.3%). Ooredoo's Oman division secured three new streams of financing from domestic and international banks worth USD 177mn, and expects the funds to help it to continue improving its services and reach in the country. The company also lowered data rates in Myanmar in a bid to increase its presence. Emirates NBD, reported a net profit of USD 1.9bn for the full year 2015, up 39% compared to 2014, due to income growth, modest rise in costs and lower impairment charge. Kingdom Holding (Saudi Arabia, 28%) had a bad start to the year after the company declared an 86% slump in Q4 profit due to lower income and higher provisioning. Net profit fell from USD 71mn in Q4 2014 to USD 10mn in Q4 2015.

Saudi Basic Industries Corp (SABIC) reported a 29.4% drop in Q4 net profit, due to lower prices for its products, particularly in its metals division, and decline in crude prices. Saudi Arabia's National Commercial Bank (NCB) reported a 16.6% rise in fourth-quarter net profit despite fall in deposits, as higher income from fees and lending helped boost profits.

Falling oil continues to hold center stage

Saudi Arabia's government is contemplating selling shares of the state oil giant Saudi Aramco to raise money in an era of cheap oil. Saudi Aramco is the world's largest oil firm with crude reserves close to 265bn barrels, over 15 percent of all global oil deposits. Analysts have estimated that it could become the first listed company valued at USD 1tn or more, if it goes public. Kuwait has called for better management of spending and for budget cuts to cope with declining revenues due to lower oil prices. The country's Finance Minister has said that he expects the price of oil for the 2016/17 budget to be set at around USD 25 per barrel.

The government of Oman plans to cut subsidy spending by almost two-thirds to help tackle a budget deficit caused by low oil prices, and its cabinet approved fuel subsidy reforms, as well as spending cuts and tax rises to bring the deficit under control. Bahrain cabinet set new price for super fuel at 160 Bahraini fils (USD 0.424) per litre from 100 fils, while the price for regular fuel would be raised to 125 fils per litre from 90 fils.

Weak sentiment continued in 2016, plummeting oil to fresh lows, as Brent crude hit USD 27 per barrel on 20 Jan, its lowest level since November 2003. Uncertainties around China's economy, OPEC's continued strategy to defend its market share, coupled with lifting of Iran's sanctions weighed heavily, as the latter released excess bottled up supply into the market. Prices rebounded after 20 Jan, as heavy blizzards in the US and a possible deal between OPEC and other producers to cut production by as much as 500,000bpd buoyed investor sentiments. January closed with positive news from Saudi Arabia, the premium OPEC producer, hinted at possible cooperation with other oil producers to support the oil market.

-Ends-

About Kuwait Financial Centre "Markaz"

Kuwait Financial Centre K.P.S.C "Markaz", established in 1974, is one of the leading asset management and investment banking institutions in the Arabian Gulf Region with total assets under management (AUM) of KD 1.05 billion as of September 30th, 2015 (USD 3.47 billion). Markaz was listed on the Kuwait Stock Exchange (KSE) in 1997.

For further information, please contact:

Osama Al Musallam

Senior Communications Officer

Media & Communications Department

Kuwait Financial Centre K.P.S.C "Markaz"

Tel: +965 2224 8000 ext 1819

Dir: +965 2224 8075

Fax: +965 2241 4499

Email: omusallam@markaz.com

www.markaz.com

© Press Release 2016