16 May 2012

Look who's making a smart recovery.

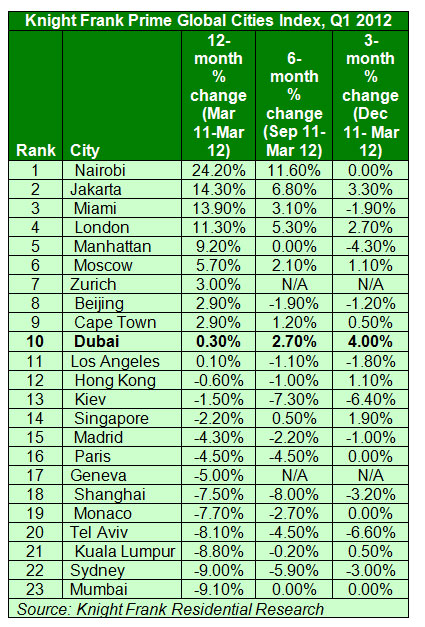

Dubai's luxury residential real estate prices rose 4% in the first three months of 2012, according to UK-based consultancy Knight Frank, a stunning reversal after residential prices fell off a cliff in the emirate after the global financial crisis in 2008.

In fact, Dubai's 4% increase was the best among the 23 cities Knight Frank tracked in its quarterly survey. The city bucked the global trend that appears to be taking a negative turn for the first time since the first quarter of 2009.

The Knight Frank quarterly index showed the value of prime property in major cities collectively declined by 0.4% in the first quarter. Manhattan saw a 4% decline, while Shanghai fell 3.2%, mirroring the slowdown in U.S. and Chinese markets.

"In our view the overall index will remain subdued in 2012 fluctuating between marginal price falls and rises (with London, Moscow, Jakarta, Nairobi and Singapore expected to be the strongest performers) but it seems unlikely we are on the cusp of a new deflationary cycle in luxury global house prices," said Kate Everett-Allen, International residential research analyst at Knight Frank in a report.

Dubai's 4% growth came on the back of a 2.3% rise in the last quarter of 2011, according to Knight Frank, suggesting a sustainable recovery may be taking root.

But there is a long way to go. Dubai real estate prices have fallen considerably over the past few years and analysts were predicting as early as February that more pain was on the way for the emirate's real estate market on the back of new supplies.

"We believe the Dubai residential market may see delivery of 30,000-35,000 units of apartments and villas combined in 2H11-2013, upon an existing supply base of roughly 322,000 units," Rasmala analysts had said in a note in February. "This translates into roughly 10% incremental supply, which we believe would further depress real state asset values."

Dubai had also ranked the ninth worst market last year, in a survey by Frank Knight last year, as prices of high-end units fell 4.7%.

FAVOURABLE ENVIRONMENT

But the clouds of gloom seem to be dissipating, although prices are only 0.3% higher on a yearly basis.

Dubai's economy has been showing signs of improvement over the past year, with tourism, retail and services sector leading the way. With Dubai Inc. working its way through its massive debt pile, investors and businesses are gaining in confidence as well.

For example, HSBC's purchasing managers' index climbed to its highest level in 10 months in April.

"Sharper expansions were recorded in output, total new business, buying activity and employment, pointing to an improved business environment," said HSBC. "Price pressures eased over the month, but remained solid."

However the uptick came on the back of six months of 'doldrums', and may be followed by quieter summer months, said HSBC.

Overall, the indicators are more promising than they have been for years. Dubai Land Department said that residential unit transactions during the first quarter of 2012 totalled AED3.1 billion, a 9% increase compared to the previous quarter.

"It is hoped that the positive economic growth forecast for 2012 will provide a stimulus for an improvement in the overall business environment which could have a knock on impact for the commercial office sector in particular," noted real estate consultant CB Richard Ellis. "However, with new stock entering the market, lease rates are likely to remain broadly unchanged, with current rents below 2005 levels."

Apart from the high-end luxury market, other prime spots are witnessing an increase too. Harbor Real Estate data shows Jumeirah Beach Residence rents shot up 20% in a year.

The continued recovery suggests that prices are now at 2008 levels.

Despite seeing a sharp fall from its peak levels in Q3 2008, the villa market began to see some uptick towards the end of 2011 and this trend has continued into 2012 with sale indices now 3% higher than in January 2008, said Jones Lang La Salle in a report.

"Villa sales are still 25% lower than at their peak in Q3 2008. Apartment sales indices have also begun to stabilise but remain at lower levels, 34% down on the peak in Q3 2008."

The consultancy expects the villa market to outperform the apartment sector with prime residential units seeing much improved performance at the expense of secondary locations.

Dubai's ability to maintain the positive indicators will depend on the authorities' continued management of the economy and the debt issue, but will also be a function of global economic sentiment.

Look who's making a smart recovery.

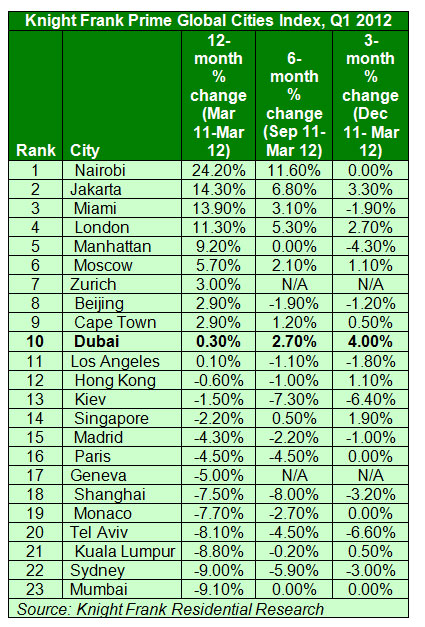

Dubai's luxury residential real estate prices rose 4% in the first three months of 2012, according to UK-based consultancy Knight Frank, a stunning reversal after residential prices fell off a cliff in the emirate after the global financial crisis in 2008.

In fact, Dubai's 4% increase was the best among the 23 cities Knight Frank tracked in its quarterly survey. The city bucked the global trend that appears to be taking a negative turn for the first time since the first quarter of 2009.

The Knight Frank quarterly index showed the value of prime property in major cities collectively declined by 0.4% in the first quarter. Manhattan saw a 4% decline, while Shanghai fell 3.2%, mirroring the slowdown in U.S. and Chinese markets.

"In our view the overall index will remain subdued in 2012 fluctuating between marginal price falls and rises (with London, Moscow, Jakarta, Nairobi and Singapore expected to be the strongest performers) but it seems unlikely we are on the cusp of a new deflationary cycle in luxury global house prices," said Kate Everett-Allen, International residential research analyst at Knight Frank in a report.

Dubai's 4% growth came on the back of a 2.3% rise in the last quarter of 2011, according to Knight Frank, suggesting a sustainable recovery may be taking root.

But there is a long way to go. Dubai real estate prices have fallen considerably over the past few years and analysts were predicting as early as February that more pain was on the way for the emirate's real estate market on the back of new supplies.

"We believe the Dubai residential market may see delivery of 30,000-35,000 units of apartments and villas combined in 2H11-2013, upon an existing supply base of roughly 322,000 units," Rasmala analysts had said in a note in February. "This translates into roughly 10% incremental supply, which we believe would further depress real state asset values."

Dubai had also ranked the ninth worst market last year, in a survey by Frank Knight last year, as prices of high-end units fell 4.7%.

FAVOURABLE ENVIRONMENT

But the clouds of gloom seem to be dissipating, although prices are only 0.3% higher on a yearly basis.

Dubai's economy has been showing signs of improvement over the past year, with tourism, retail and services sector leading the way. With Dubai Inc. working its way through its massive debt pile, investors and businesses are gaining in confidence as well.

For example, HSBC's purchasing managers' index climbed to its highest level in 10 months in April.

"Sharper expansions were recorded in output, total new business, buying activity and employment, pointing to an improved business environment," said HSBC. "Price pressures eased over the month, but remained solid."

However the uptick came on the back of six months of 'doldrums', and may be followed by quieter summer months, said HSBC.

Overall, the indicators are more promising than they have been for years. Dubai Land Department said that residential unit transactions during the first quarter of 2012 totalled AED3.1 billion, a 9% increase compared to the previous quarter.

"It is hoped that the positive economic growth forecast for 2012 will provide a stimulus for an improvement in the overall business environment which could have a knock on impact for the commercial office sector in particular," noted real estate consultant CB Richard Ellis. "However, with new stock entering the market, lease rates are likely to remain broadly unchanged, with current rents below 2005 levels."

Apart from the high-end luxury market, other prime spots are witnessing an increase too. Harbor Real Estate data shows Jumeirah Beach Residence rents shot up 20% in a year.

The continued recovery suggests that prices are now at 2008 levels.

Despite seeing a sharp fall from its peak levels in Q3 2008, the villa market began to see some uptick towards the end of 2011 and this trend has continued into 2012 with sale indices now 3% higher than in January 2008, said Jones Lang La Salle in a report.

"Villa sales are still 25% lower than at their peak in Q3 2008. Apartment sales indices have also begun to stabilise but remain at lower levels, 34% down on the peak in Q3 2008."

The consultancy expects the villa market to outperform the apartment sector with prime residential units seeing much improved performance at the expense of secondary locations.

Dubai's ability to maintain the positive indicators will depend on the authorities' continued management of the economy and the debt issue, but will also be a function of global economic sentiment.

ALSO READ: Projects: Dubai Beats Abu Dhabi

Global Hotspots

Dubai's Property Pain: 15-20% Drop In Prices Again This Year, Says Rasmala

© alifarabia.com 2012