PHOTO

Average sold prices decline at slowest pace since June, despite an accelerated fall in new buyer enquiries

Dubai: This press release contains the latest release of data collected from a survey of the Dubai real estate sector, sponsored by Emirates NBD and produced by Markit.

Real estate agents indicated a subdued end to 2015 for the Dubai property market, with the majority of survey respondents noting declines in new buyer enquiries and transaction numbers over the three months to December. The latest drop in new buyer enquiries was the sharpest since the survey began in April, which real estate agents linked to weaker investor sentiment and muted underlying market conditions.

Looking ahead, around 47% of real estate agents expect a fall in Dubai property values over the course of 2016, while 32% forecast a rise. Survey respondents generally noted that market conditions would favour buyers over the next 12 months, as construction volumes look set to remain strong while the uncertain economic outlook has acted as a brake on investor demand.

December's survey also indicated weaker trends on the lettings side of the market, with new rental enquires falling for the first time since the survey began in April. This in turn contributed to a slight drop in new lettings activity at the end of 2015, alongside the slowest rise in newly agreed rental prices in the short survey history.

Commenting on the Emirates NBD Real Estate Tracker, Khatija Haque, Head of MENA Research at Emirates NBD, said:

"The survey is consistent with recent data on residential sales and lettings prices in Dubai, which show prices continuing to ease. However, the momentum of price decline has moderated in December. The strong USD and low oil prices are likely to remain headwinds for the real estate sector in 2016."

Key Findings

- Real estate agents indicate fastest drop in new buyer enquiries since the survey began in April 2015

- Average sold prices and transaction numbers decrease at slightly slower rates

- Rental market shows signs of cooling at the end of 2015

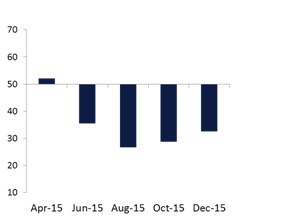

Sold prices, new buyer enquiries and price expectations

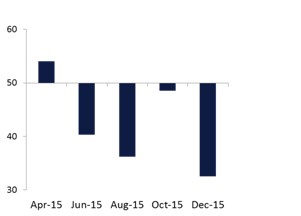

The proportion of Dubai real estate agents reporting a fall in average sold prices (55%) continued to exceed those that indicated a rise (21%) during the three months to December. Although the headline Emirates NBD Dubai Average Sold Prices Index remained below the 50.0 no-change threshold, the latest reading was 32.6, up from 28.8 in October, to signal the slowest pace of decline since June. Survey respondents indicated softer falls in property values for both apartments and villas at the end of 2015. Transaction volumes were also reported to have dropped at a slower pace during December.

However, real estate agents indicated that new buyer enquiries decreased at the steepest pace since the survey began in April. This was despite a softer fall in new sales leads from international buyers. Anecdotal evidence suggested that the uncertain economic outlook had weighed on demand in December.

In contrast to the downbeat expectations reported by real estate agents, latest data indicated that Dubai households are overwhelmingly optimistic about property values over the course of 2016. Around two-thirds of Dubai households (66%) anticipate a rise in their property value during the next 12 months, while only 14% forecast a reduction.

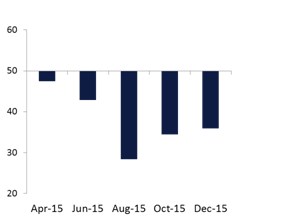

New lettings activity and rental prices

Real estate agents signalled another marginal decline in new letting activity during the three months to December, with stable demand for apartments offset by a marked drop in the number of villa rentals. Survey respondents highlighted a moderate rise in newly agreed rental prices, although the latest increase was the slowest since the survey began in April. There were a number of reports that cooling demand conditions could place downward pressure on newly agreed rents over the next three months. Reflecting this, latest data pointed to a drop in new rental enquiries for the first time since the survey began in April.

At the same time, Dubai households reported the slowest rise in rent renewal prices in the short survey history. People living in apartments were more likely to report a rise in their rental price than those living in villas. However, in contrast to the trends expected by real estate agents for newly agreed lettings, households in Dubai overwhelmingly expect higher rent renewal prices in the next three months. Around 62% anticipate an increase in their rent renewal price, while only 7% expect to negotiate a reduction.

Dubai Real Estate Agents: Average Sold Prices (vs. three months ago)

50 = no-change, not seasonally adjusted

Sources: Emirates NBD, Markit

Dubai Real Estate Agents: New Buyer Enquiries (vs. three months ago)

50 = no-change, not seasonally adjusted

All New Buyer Enquiries International New Buyer Enquiries

Sources: Emirates NBD, Markit

Dubai Real Estate Agents: New Lettings Activity (vs. three months ago)

50 = no-change, not seasonally adjusted

Sources: Emirates NBD, Markit

-Ends-

The next Dubai Real Estate Tracker will be published on 9th March 2016 at 09:15 (DUBAI)

About Dubai Real Estate Tracker™

The Dubai Real Estate Tracker™ is based on survey data collected from two separate but complementary sources: real estate agents and households across the region. The real estate agents' segment is based on survey responses from a carefully selected panel of 70 real estate agents in Dubai, covering trends for apartments and villas across the region. Respondents included in the survey are established agents that deal in both sales and rentals of residential property in Dubai. All results are broken down by housing type (villas and apartments).

The Dubai household survey is based on a representative sample of 600 households based in Dubai. A representative sample of adults is achieved by using quota controls set by age, income, nationality, ownership status and type of property. The questionnaire looks at current and future house price sentiment, alongside changes in current and expected changes to rental prices at the renewal stage (where applicable). All results are broken down by housing type (villas and apartments).

For each of the indicators, the 'Report' shows the 'diffusion' index, which varies between 0 - 100 and is the sum of the positive responses plus a half of those responding 'the same'. Readings of exactly 50.0 signal no change, readings above 50.0 signal an increase or improvement, and readings below 50.0 signal a decline or deterioration.

About Emirates NBD

Emirates NBD is a leading banking Group in the region. As at 30th September 2015, total assets were AED 390.4 Billion, (equivalent to approx. USD 106 Billion). The Group has a leading retail banking franchise in the UAE, with more than 220 branches and over 900 ATMs and CDMs in the UAE and overseas. It is a major player in the UAE corporate and retail banking arena and has strong Islamic banking, Global Markets & Treasury, Investment Banking, Private Banking, Asset Management and Brokerage operations.

The Group has operations in the UAE, Egypt, the Kingdom of Saudi Arabia, Singapore, the United Kingdom and representative offices in India, China and Indonesia.

The Group is an active participant and supporter of the UAE's main development initiatives and of the various educational, environmental, cultural, charity and community welfare establishments.

About Markit

Markit is a leading global diversified provider of financial information services. We provide products that enhance transparency, reduce risk and improve operational efficiency. Our customers include banks, hedge funds, asset managers, central banks, regulators, auditors, fund administrators and insurance companies. Founded in 2003, we employ over 4,000 people in 11 countries. Markit shares are listed on Nasdaq under the symbol MRKT. For more information, please see www.markit.com.

The intellectual property rights to the Emirates NBD Real Estate Tracker provided herein are owned by Markit. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit's prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information ("data") contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Markit is a registered trade mark of Markit Group Limited.

For further information, please contact:

Ibrahim Sowaidan

Head - Group Corporate Affairs

Emirates NBD

Telephone: +971 4 609 4113 / +971 50 6538937

Email: ibrahims@emiratesnbd.com

Tricia Rego

ASDA'A Burson-Marsteller; Dubai, UAE

Tel: 971-4-4507600; Fax: 971-4-4358040

Email: tricia.rego@bm.com

Joanna Vickers

Corporate Communications

Markit

Tel: +44-207-260-2234

Email: joanna.vickers@markit.com

© Press Release 2016