Dubai's private sector rounds off strongest quarter since Q1 2015

Dubai, April 10th, 2017:

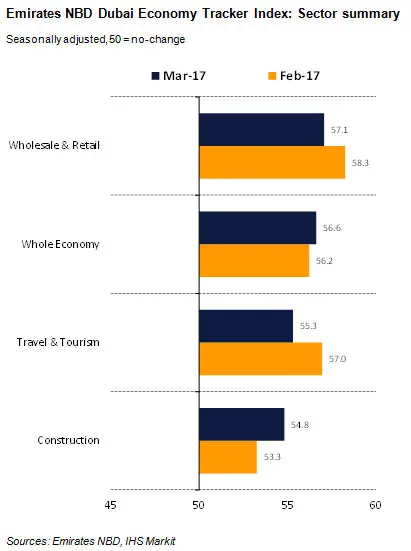

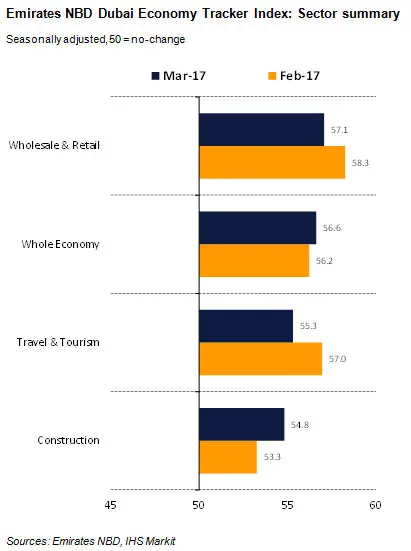

March data signalled a sharp improvement in business conditions across Dubai’s private sector economy, with output, new orders, and employment and stocks of purchases all expanding at a faster pace than in the preceding month. This was highlighted by a rise in the seasonally adjusted Emirates NBD Dubai Economy Tracker Index – a composite indicator designed to give an accurate overview of operating conditions in the non-oil private sector economy – to 56.6 in March, up from 56.2 in February. Moreover, the latest reading was indicative of the second-sharpest upturn in business conditions for over two years. As a result, the average for the first quarter (56.7) was the sharpest since Q1 2015.

The best performing sub-sector monitored by the survey was wholesale & retail (index at 57.1), followed by travel & tourism (55.3) and construction (54.8).

A reading of below 50.0 indicates that the non-oil private sector economy is generally declining; above 50.0, that it is generally expanding. A reading of 50.0 signals no change.

The survey covers the Dubai non-oil private sector economy, with additional sector data published for travel & tourism, wholesale & retail and construction.

Commenting on the Emirates NBD Dubai Economy Tracker, Tim Fox, Head of Research & Chief Economist at Emirates NBD, said:

“The March data is consistent with sharp improvements in business conditions across Dubai’s non-oil private sector economy, with output, new orders and employment all expanding at a faster pace than the previous month.”

Key Findings

- March data highlights that Dubai’s private sector gained momentum

- Sharpest rise in new orders in 25 months

- Renewed increase in employment

Business activity and employment

A robust and accelerated expansion of business activity was at the heart of the latest upturn in operating conditions. Furthermore, the overall pace of output growth in March accelerated from February’s three month low. Anecdotal evidence cited improved underlying demand conditions, alongside successful promotional strategies and more ongoing projects.

Latest data indicated a renewed increase in overall employment. However, the pace of jobs growth was relatively subdued.

Incoming new work and business activity expectations

New business increased for the thirteenth month in succession. Furthermore, the rate of expansion climbed to the sharpest in over two years. Survey respondents linked the increase to generally favourable economic conditions, more construction projects, and successful promotional activities.

Business confidence regarding growth prospects over the coming 12 months remained strongly optimistic in March, but the degree of optimism eased to its weakest in seven months, despite increasing output. At the sub-sector level, business confidence improved across construction firms, but moderated elsewhere.

Input costs and average prices charged

Input price inflation remained modest across the private sector in March. All the three monitored sub-sectors noted a rise in input costs, led by wholesale & retail. However, output charges fell again, with the rate of decline little-changed from the prior month and marginal overall. There were divergent trends recorded across the key sub-sectors; travel & tourism companies raised their average selling prices, while construction and wholesale & retail firms reduced output charges. Discounts were generally offered in order to attract customers amid reports of intense competition.

-Ends-

The next Dubai Economy Tracker Report will be published on 9th May 2017 at 08:15 (DUBAI)

For further information, please contact:

Ibrahim Sowaidan

Head - Group Corporate Affairs

Emirates NBD

Telephone: +971 4 609 4113 / +971 50 6538937

Email: ibrahims@emiratesnbd.com

Shaleen Sukthankar

ASDA’A Burson-Marsteller; Dubai, UAE

Tel: +971 50 9547834

Email: shaleen.sukthankar@bm.com

Joanna Vickers

Corporate Communications

IHS Markit

Tel: +44-207-260-2234

Email: joanna.vickers@ihsmarkit.com

The Emirates NBD Dubai Economy Tracker™, produced by Markit, is based on data compiled from monthly replies to questionnaires sent to senior executives in approximately 600 private sector companies, which have been carefully selected to accurately represent the true structure of the Dubai economy, including manufacturing, services, construction and retail.

The panel is stratified by Standard Industrial Classification (SIC) group, based on industry contribution to GDP. Survey responses reflect the change, if any, in the current month compared to the previous month based on data collected mid-month.

For each of the indicators the ‘Economy Tracker report’ shows the ‘diffusion’ index. This index is the sum of the positive responses plus a half of those responding ‘the same’. Diffusion indexes have the properties of leading indicators and are convenient summary measures showing the prevailing direction of change. An index reading above 50 indicates an overall increase in that variable, below 50 an overall decrease.

The Dubai Economy Tracker Index is a composite index based on five of the individual indexes with the following weights: New Orders - 0.3, Output - 0.25, Employment - 0.2, Suppliers’ Delivery Times - 0.15, Stock of Items Purchased - 0.1, with the Delivery Times index inverted so that it moves in a comparable direction. The Dubai Economy Tracker Index is comparable to the UAE Purchasing Managers’ Index.

Markit do not revise underlying survey data after first publication, but seasonal adjustment factors may be revised from time to time as appropriate which will affect the seasonally adjusted data series.

About Emirates NBD

Emirates NBD is a leading banking Group in the region. As at 31st December 2016, total assets were AED 448 Billion, (equivalent to approx. USD 122 Billion). The Group has a significant retail banking franchise in the UAE and is a key participant in the global digital banking industry, with over 90 per cent of all financial transactions and requests conducted outside of its branches. The bank currently has 219 branches and 1012 ATMs and CDMs in the UAE and overseas and a large social media following, being the only bank in the Middle East ranked among the top 20 in the ‘Power 100 Social Media Rankings’, compiled by The Financial Brand. It is a major player in the UAE corporate and retail banking arena and has strong Islamic Banking, Global Markets & Treasury, Investment Banking, Private Banking, Asset Management and Brokerage operations.

The Group has operations in the UAE, Egypt, the Kingdom of Saudi Arabia, Singapore, the United Kingdom and representative offices in India, China and Indonesia.

The Group is an active participant and supporter of the UAE’s main development and community initiatives, in close alignment with the UAE government’s strategies, including financial literacy and advocacy for inclusion of People with Disabilities under its #TogetherLimitless platform.

For more information, please visit: www.emiratesnbd.com

About IHS Markit (www.ihsmarkit.com )

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and expertise to forge solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 key business and government customers, including 85 percent of the Fortune Global 500 and the world’s leading financial institutions. Headquartered in London, IHS Markit is committed to sustainable, profitable growth.

IHS Markit is a registered trademark of IHS Markit Ltd. All other company and product names may be trademarks of their respective owners © 2017 IHS Markit Ltd. All rights reserved.

The intellectual property rights to the Emirates NBD Economy Tracker provided herein are owned by IHS Markit. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without IHS Markit’s prior consent. IHS Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall IHS Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. IHS Markit is a registered trade mark of IHS Markit Limited.

© Press Release 2017