PHOTO

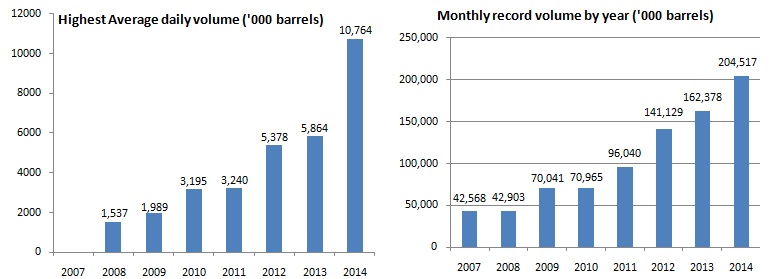

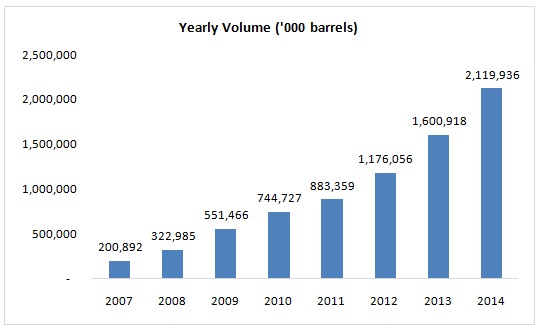

2,119,936,000 barrels of Oman crude oil traded on DME in 2014 compared to 1,600,918,000 barrels in 2013

Dubai, January 12, 2015 - The Dubai Mercantile Exchange (DME), the premier international energy futures and commodities exchange in the Middle East, registered an impressive performance in 2014, posting- a 33 per cent growth in trading volumes to average 8,431 lots per day. Over 160 different traders from more than 90 entities traded on the DME in 2014 - the broadest level of participation ever recorded.

During the year, DME set records in every aspect of the DME Oman contract with record daily and monthly volumes, record physical delivery, record EFP (Exchange Futures for Physical) activity, and record open interest in addition to record marker windows. In December, DME average daily volume (ADV) was 6,975 lots (7.0mn bl), which was 9% up year-on-year. Physical delivery for February loading was 11.6mn bl while EFP/EFR (Exchange for Risk) volumes were 7.8mn bl.

"Our performance in 2014 reflects the success we have had in providing a mature and fully transparent price discovery mechanism for industry participants," said Christopher Fix, Chief Executive of DME. "Our consistent growth in volumes can also be attributed to the confidence of global players in the DME value proposition which has been boosted by measures that we have taken to enhance our trading platform. The global oil markets have never been more volatile and so the need for quality benchmarks and hedging mechanisms have become even more imperative. Our impressive performance and our ever increasing roster of members from Asia is a definite sign that the DME Oman is the undisputed crude oil benchmark in Asia."

A key focus last year was to make trading on the DME easier for customers and so the Exchange allowed Letters of Credit (LCs) to be issued from Singapore and Tokyo with participating banks SocGen, RBS, Rabobank and Mizuho. The exchange also introduced Trade at Marker (TAM) functionality and revised the duration required for LCs.

The DME also made major strides in increasing the number of market participants in 2014 in order to expand its presence globally. The exchange welcomed four new trading members -Marubeni, Idemitsu, Mitsui, Itochu - in addition to attracting four new clearing members, namely GH Financials, Advantage Futures, Phillip Capital and Straits Financial.

The DME also initiated several strategic agreements in 2014 to support the development of energy trading benchmarks within Asia which would act as a natural complement to the DME Oman crude oil contract. The exchange signed agreements with the Shanghai International Energy Exchange Corporation (INE) to strengthen cooperation in promoting the development of crude oil futures. An agreement was also signed with Korea Exchange (KRX), the leading North Asian equities and derivatives operator, in addition to an agreement with Tokyo Commodity Exchange, Inc. (TOCOM) and with Bank of China.

2014 Performance Highlights:

- Record Volume Traded: 14,873 on 25th November 2014. Previous high was 14,282 on 26th February 2014

- Record Window Volume: 6,511 on 26th February 2014. Previous high was 5,951 on 12th February 2014

- Overall DME Record ADV: 10,764 in February 2014. Second high was 9,334 in April 2014

- Record Physical Delivery: 18,355 in March for May 2014 delivery. Second high was 17,238 in April for June 2014 delivery

About DME

DME is the premier international energy futures and commodities exchange in the Middle East. It aims to provide oil producers, traders and consumers engaged in the East of Suez markets with transparent pricing of crude oil.

Launched in 2007, DME has rapidly grown into a globally relevant exchange. Its flagship Oman Crude Oil Futures Contract (DME Oman) contract is now firmly established as the most credible crude oil benchmark relevant to the rapidly growing East of Suez market. Reflecting the economics of the Asian region like no other contract, and the largest physically delivered crude oil futures contract in the world, DME Oman is the world's third crude oil benchmark and the sole benchmark for Oman and Dubai exported crude oil.

DME is a fully electronic exchange, with regulatory permissions allowing access from more than 20 jurisdictions, including the major financial centers of Asia, Europe and the United States. The Exchange is located within the Dubai International Financial Center (DIFC), a financial free zone designed to promote financial services within the UAE. The DME is regulated by the Dubai Financial Services Authority and all trades executed on the DME are cleared through and guaranteed by CME Clearing.

DME is a joint venture between Dubai Holding, Oman Investment Fund and CME Group. Global financial institutions and energy trading firms including Goldman Sachs, JPMorgan, Morgan Stanley, Shell, Vitol and Concord Energy also hold equity stakes in the DME. www.dubaimerc.com

Media Contacts:

DME

Mayssam Hamadeh

Head of Marketing

+971 506523754 (mobile)

mayssam.hamadeh@dubaimerc.com

TRACCS (PR agency)

Walid Majzoub

+9714 3672530

walid.majzoub@traccs.net

TRACCS 24/7 Media Hotline: +97150 9448389

© Press Release 2015