As the merger of FGB and NBAD was declared effective at the end of Q1 2017, this release discusses Pro-forma Preliminary Condensed Consolidated Financial Information for the combined bank as at 31 March 2017. Pro-forma Financial Information for prior periods was restated for retrospective comparability of adjustments

Key Financial Highlights

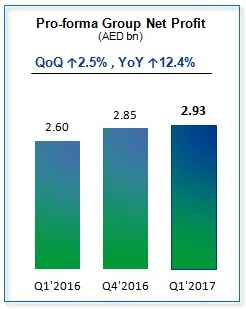

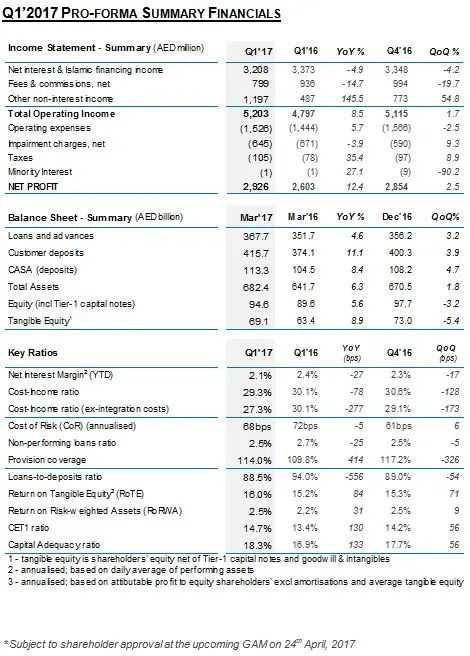

- Pro-forma Q1’2017 Group Net Profit at AED 2.93 billion, up 12.4% compared to AED 2.60 billion in the first quarter of 2016 led by growth in revenues

Pro-forma Group Revenues at AED 5.20 billion, up 8.5% compared to AED 4.80 billion in Q1’2016, on the back of healthy business volumes and investment gains

- Realisation of cost synergies of AED 75 million during the first quarter led to a 1.5% reduction in pro-forma operating expenses (ex-integration costs) and improvement in Cost-to-Income ratio (ex-integration costs) to 27.3%

- Healthy growth in pro-forma Loans and Advances of 4.6% to AED 368 billion; pro-forma Customer Deposits up 11.1% to AED 416 billion resulting in comfortable Loans to Deposits Ratio of 88%

- Excellent asset quality with pro-forma NPL ratio at 2.5% and strong provision coverage of 114%

- Other key ratios on pro-forma basis: Net Interest Margin of 2.1%, CET1 ratio of 14.7%, Return on Tangible Equity1 (RoTE) at 16.0% and Return on Risk Weighed Assets1 at 2.5%

- Integration journey off to a strong start with seamless merger completion as per initial timeline and realisation of cost synergies

- Strong credit profile of combined bank led to ratings affirmation of NBAD of AA- or equivalent by the three major credit rating agencies post-merger completion, and removal of ‘CreditWatch Negative’ by S&P to ‘Stable’ outlook; FGB ratings were withdrawn post-merger

- General Assembly Meeting to be held on 24 April, 2017 to approve name change of combined bank from “National Bank of Abu Dhabi” to “First Abu Dhabi Bank”

Abu Dhabi, 19 April 2017

NBAD and FGB reported a pro-forma Group Net Profit of AED 2.93 billion for the first quarter of 2017, a 12.4% increase from AED 2.60 billion for the same period last year.

These results were achieved on the back of a healthy operating performance driven by higher business volumes and investment gains, coupled with disciplined risk management and the realisation of cost synergies in relation to the merger between the two banks.

Commenting on this performance, Abdulhamid Saeed, Group CEO of the combined bank, said: “With the merger of FGB and NBAD now effective, we are starting First Abu Dhabi Bank’s* journey on a solid footing thanks to robust fundamentals at the end of Q1’2017, positioning us well to successfully execute our integration plan. We have already achieved a number of key milestones since the completion of the merger, which is a strong testament to the exceptional merits of bringing two highly complementary businesses together, as we already began to draw on our combined strengths and realise synergies for the benefit of all our stakeholders.”

* Subject to shareholder approval at the upcoming GAM on 24th April, 2017

He continued: “The combined bank delivered a good set of results in the first quarter of 2017, in spite of challenging operating conditions. Pro-forma Group net profit increased by 12.4% from last year, driven by healthy activity across our various businesses and notable improvements in efficiency and asset quality. Our liquidity profile has strengthened and our capital position is robust with CET1 ratio of 14.7% which places us in a positive standing to comply with the Basel III regulatory framework. The affirmation of our AA-, Aa3 and AA- credit ratings by Fitch, Moody’s and Standard & Poor’s, respectively, is also a key milestone for the new bank, recognising its strong credit profile and unique ability to navigate the evolving economic, banking and regulatory landscape.”

Business Integration Update

Corporate and Investment Banking (CIB)

Q1’2017 witnessed major preparation work for CIB ahead of merger completion, driven by a core philosophy revolving around building specialisation, synergy and service.

- The CIB architecture has been finalised and is centered around putting customers at the core of the model built on coverage for corporates and for financial institutions by geographies with proper business segmentation and dedicated relationship managers.

- Products specialisation is split into four areas, namely: Global Transaction Banking, Global Corporate Finance, Global Markets as well as a window for Islamic Banking.

- Customers are serviced across geographies, locally and internationally, as well as across a comprehensive range of product offerings.

- Teams across CIB cooperated together on several landmark transactions during the quarter.

Personal Banking (PB)

During the first quarter of 2017, the Personal Banking Group teams at both banks continued with intensive preparations for legal merger completion, addressing all necessary changes across all customer touch points to ensure clarity, security and the seamless continuation of services - the key guiding principle being minimum disruptions to customers.

- Significant progress has been achieved on customer segmentation, including value propositions, product harmonisation and end-state product offerings.

- To maximise business potential and market reach, PB is structured along the major customer segments, spanning from Mass Market to Private Banking and Business Banking segments.

- Assessment of sales and distribution channels, with initial view on end-state coverage and capacities has been performed.

- Execution is in progress with initial synergies being already delivered according to the plan. Further due diligence is scheduled, especially for digital channels, to be conducted later in the next two quarters.

- Customers, from 1 April, have been availing free transactions across more than 500 ATMs throughout the UAE as well as unified branch services in one branch each, in Dubai and Abu Dhabi.

Outlook

Abdulhamid Saeed, concluded: “While 2017 is poised to be a transitional year for the economy and for the banking industry, we are looking ahead with confidence and a clear focus on driving individual and institutional prosperity by putting our customers first, as we continue to deliver an extensive range of fully personalised solutions, products and services to meet their needs. Over the next few months in our integration journey, we will be focusing on establishing a strong platform across our various businesses to ensure that we have the right infrastructure to deliver a harmonised banking offering across our various channels. As the largest bank in the UAE and one of the world’s largest and strongest financial institutions, we are firmly on track to move forward and pursue growth opportunities across UAE, MENA region and beyond. At our upcoming General Assembly Meeting on 24th of April, we will be proposing to change the name of our institution to “First Abu Dhabi Bank” – a name that embodies the UAE’s vision for growth and prosperity, whilst reconfirming our commitment to driving top shareholder value as a financial services leader.”

-Ends-

About NBAD

The UAE’s largest bank and one of the world’s largest financial institutions, NBAD offers an extensive range of tailor-made products and services to offer a customised experience to clients. Through its strategic offerings, NBAD looks to meet the banking needs of customers across the world via its market-leading Corporate and Investment Banking and Personal Banking franchises.

Headquartered in Abu Dhabi in Business Park, Khalifa Park, the bank’s international network spans 19 countries across the world, providing the global relationships, expertise and financial strength to support local, regional and international businesses seeking to do business at home and abroad.

In line with its commitment to put customers first and help them grow stronger, the Bank continually invests in people and technology to create the most customer-friendly banking experience possible, and support the growth ambitions of shareholders, residents, entrepreneurs and the economy.

NBAD has a strong, diversified balance sheet, leading efficiency and a solid corporate governance structure in place that is set to drive forward growth for the business and for the region.

For More Information

Please visit www.bankfortheUAE.com or www.nbad.com

Download the NBAD IR app: http://bit.ly/2pw2WGG

Contacts

For analyst and investor enquiries: IR@nbad.com

For media enquiries:

Jennifer Cain

+ 971 55 4741105, JCain@webershandwick.com

Hiba Haddad

+971 56 1679577, HHaddad@webershandwick.com

Other Business & Operational Highlights

© Press Release 2017