PHOTO

The asset management industry in GCC states is set for steady growth over the next decade, supported by the region's diversification away from oil and encouragement of foreign investment.

GCC asset management will grow with economic diversification and by new regulations designed to attract foreign investors, Moody's Investors Service said in a report published on Tuesday.

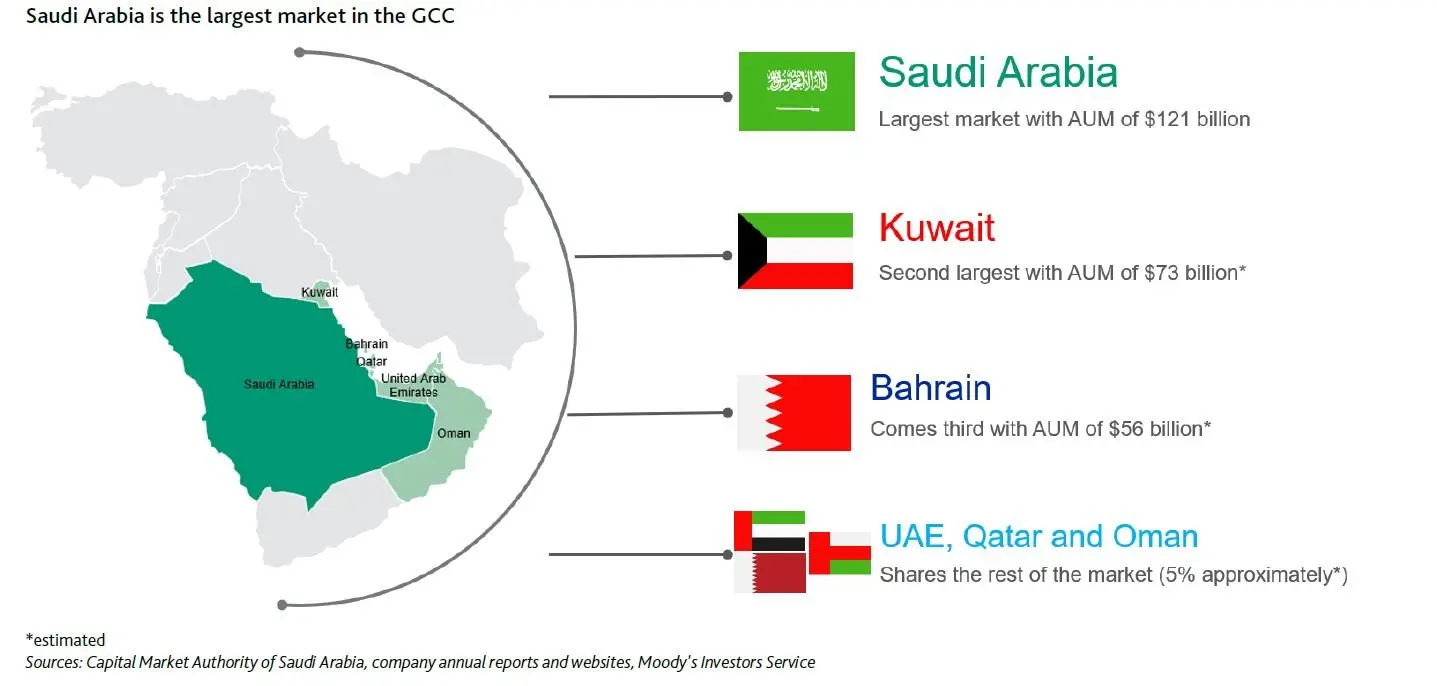

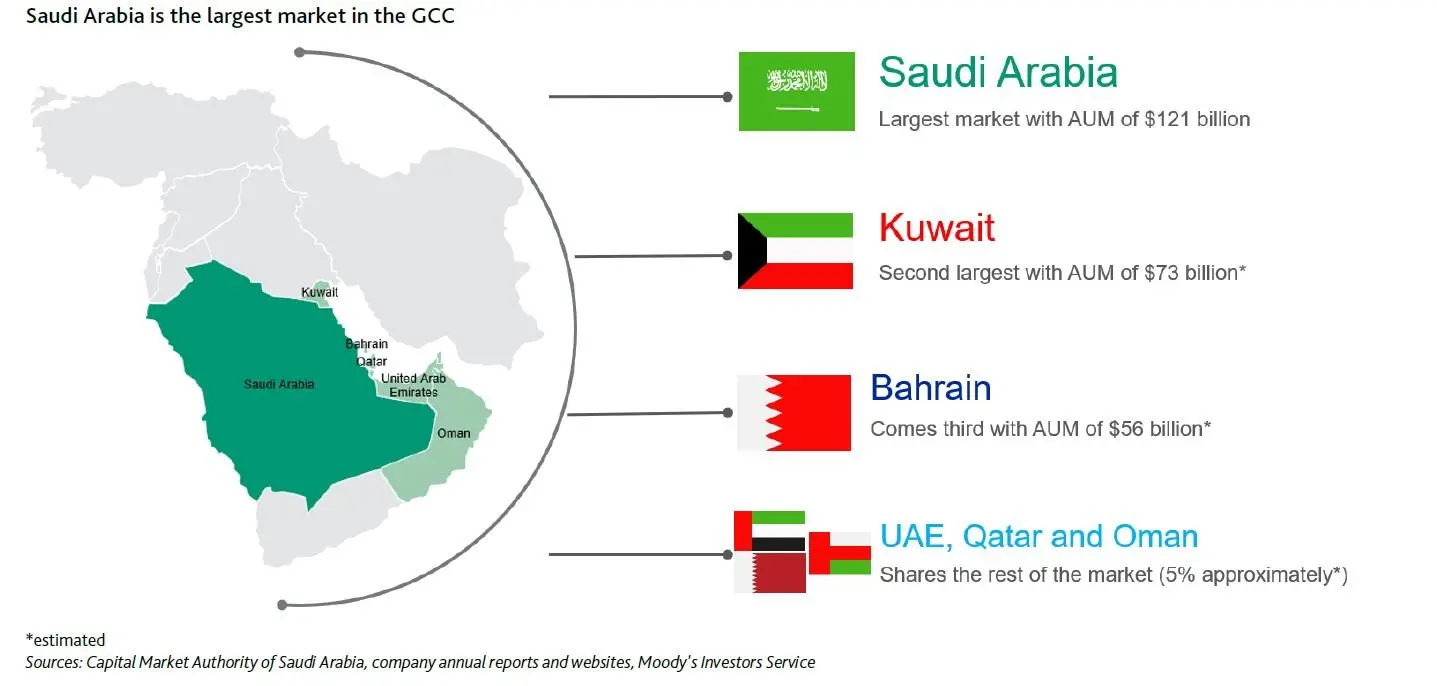

GCC investment managers had $260 billion of Assets Under Management (AUM) as of December last year. The largest market is Saudi Arabia, accounting for slightly less than half of regional AUM, followed by Kuwait, with an estimated $73 billion and Bahrain with $56 billion.

Between them, Saudi Arabia, Kuwait and Bahrain account for 95 percent of all assets managed in the region, with the remainder divided between the UAE, Qatar and Oman.

"Initiatives to diversify, such as Saudi Arabia's Vision 2030 programme, should stimulate private investment, attract more international investors, and ultimately spur more growth in the asset management industry," said Vanessa Robert, VP-Senior Credit Officer at Moody's.

The kingdom's inclusion in the MSCI Emerging Markets Index and the Financial Times Stock Exchange (FTSE) Russell emerging market index, a reduction in minimum capital requirements for qualified investors, and a relaxation of foreign ownership limits will also support capital flows into the kingdom, it said.

Click image to enlarge

However, Saudi Arabia's exposure to geopolitical event risk and relatively limited albeit improving transparency could weigh negatively on this trend, Moody's noted.

Fund managers will face challenges as increased asset inflows test their capacity constraints, and as a more sophisticated client base demands a broader range of products and lower fees, the report said.

"Still, asset managers will also face challenges as increased asset inflows test their capacity constraints, and as a more sophisticated client base demands a broader range of products and lower fees," Robert said.

GCC asset managers primarily focus on traditional asset classes, with real estate the main alternative class. The sector is concentrated in local markets, creating capacity constraints and limiting growth.

According to the report, historically, assets in the region have been managed through bespoke mandates on behalf of sovereign wealth funds (SWFs) and other government-related institutions, as well as high net worth individuals and family offices.

Although the regulatory environment is improving, several jurisdictions will need to adopt more rigorous supervision to compete with Western markets. Larger GCC firms that have diversified their offering to include alternative investments and multi-asset products have a competitive advantage, the report noted.

(Reporting by Seban Scaria, editing by Daniel Luiz)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019