PHOTO

(The author is a Reuters Breakingviews columnist. The opinions expressed are her own.)

LONDON - Procrastination has landed central bankers in a tricky situation. Federal Reserve Chair Jerome Powell and many of his global peers insisted last year that surging inflation was temporary and took their time to respond. Now they face a new problem: Rising oil prices may thwart their hope that they can hike interest rates enough to curb price pressures without smothering growth.

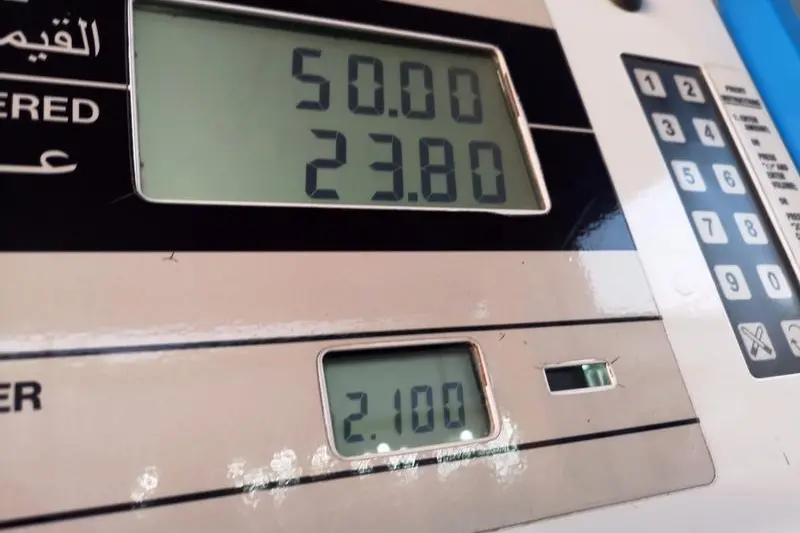

Brent crude futures on Thursday rose above $91 a barrel to their highest since 2014. Their rally was partly driven by concern that geopolitical tensions might disrupt energy markets: Russia has massed troops near Ukraine's border, though it says it does not plan to invade. There’s also an increasing threat of a scarce global supply of black gold, not least because oil companies became very disciplined about capital spending over the past two years in an effort to stay in line with weaker demand. Chevron, which slashed spending on new projects in 2021, said on Friday it expected to return more cash to shareholders this year.

Central bankers have little more insight than investors about when geopolitical tensions will ease or supply will increase. They must, however, deal with the implications for inflation. Usually, rate-setters ignore temporary surges in energy costs and focus on what will happen in the medium term. But looking past rising oil prices is hard when consumer prices are already galloping. Inflation is at a four-decade high of 7% in the United States, three-decade peaks of 5.4% and 4.8% in Britain and Canada respectively, and a record high of 5% in the euro zone.

Price pressures may abate this year. But central bankers were going to overshoot inflation targets in 2022, even before the spike in energy prices. Sustained oil price gains will present them with a difficult choice. They can either raise interest rates by more than they – and investors – had previously anticipated, which will slam the brakes on growth in the process; or they can tolerate higher inflation and jeopardise their credibility. The choice is unenviable.

CONTEXT NEWS

- Brent crude futures on Jan. 27 hit $91.04 a barrel, the highest since 2014. They were up 75 cents, or 0.8%, at $90.09 a barrel on Jan. 28.

- Both Brent and U.S. West Texas Intermediate (WTI) crude futures are on track for what would be the longest run of weekly gains since October due to supply scarcity and concerns that geopolitical tensions might disrupt energy markets. Russia, the world’s third largest producer of oil and similar products in 2020, has massed troops near Ukraine's border but says it does not plan to invade.

(The author is a Reuters Breakingviews columnist. The opinions expressed are her own.)

(Editing by Lauren Silva Laughlin and Sharon Lam) ((For previous columns by the author, Reuters customers can click on PATTANAIK/ SIGN UP FOR BREAKINGVIEWS EMAIL ALERTS https://bit.ly/BVsubscribe | swaha.pattanaik@thomsonreuters.com; Reuters Messaging: swaha.pattanaik.thomsonreuters.com@reuters.net))