PHOTO

LONDON/BRUSSELS - EU governments have agreed to lift the annual spending of the bloc's powerful European Investment Bank (EIB) lending arm to 100 billion euros ($115 billion) this year and treble its funding for the EU's defence industry.

Sources briefed on the plans said the decision was approved at an EIB board meeting in Luxembourg ahead of a formal sign-off expected by EU finance ministers later on Friday. They spoke on condition of anonymity because the information was not yet public.

The new 100 billion euro annual spending ceiling is more than 10 billion euros above the amount the EIB lent last year and 5 billion higher than 95 billion euros the bank's President Nadia Calvino set as a target at the start of the year.

It will also allow it to more than treble its funding for defence-related projects. The amount will go up 3.5 billion euros from 1 billion euros last year and be well above the 2 billion euros it had flagged would be spent back in January, the sources said.

The EIB is prohibited from investing directly in weapons or ammunition but it can lend for so-called "dual use" purposes, such as GPS systems or buildings and infrastructure for army bases.

It has signed off on funding for one such base in Lithuania near the border with Belarus where German troops are due to be permanently deployed on foreign soil for the first time since the Nazi military in World War II.

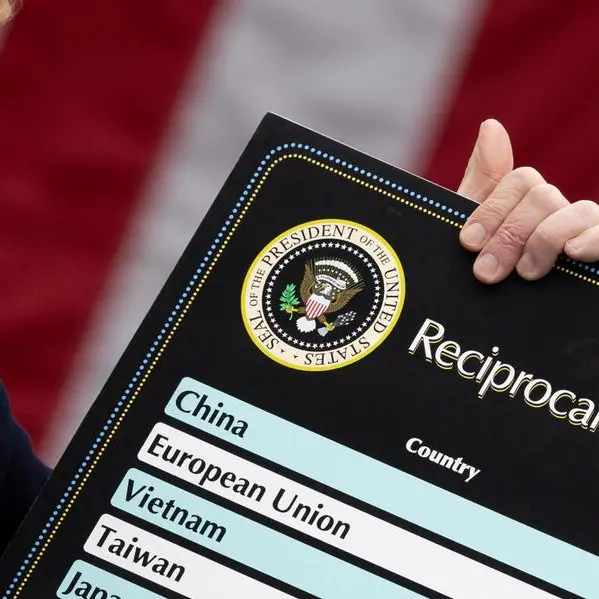

European nations are scrambling to ramp up their defence spending amid pressure from U.S. President Donald Trump who has signalled plans to reduce the decades-long U.S. security backstop for the continent.

It also comes just days before a NATO summit in The Hague where the alliance's members are under pressure to raise their defence commitments.

The increased EIB lending is set to funnel money into other areas as well, the sources said, including technology innovation and renewable energy.

It follows a mid-year review of its operational plan and comes after it got approval last year to raise its so-called gearing ratio, which sets out a nominal maximum for the amount of loans on its balance sheet as a percentage of its subscribed capital.

EU officials said the bank, already the biggest multilateral lender in the world, is also likely to announce plans to pump 70 billion euros into the development of European technology firms over the next three years.

The programme, called Tech EU, aims to help Europe better compete with China and the United States in the race for cutting-edge tech like supercomputing, robotics and artificial intelligence as well as renewable energy.

The 70 billion euros funding is to be split into 20 billion euros for equity and quasi-equity, 40 billion euros for loans and 10 billion for guarantees in 2025-2027, the officials said.

They hope the money to mobilise a further 250 billion euros of private investor funding and complement broader European Commission efforts to support startups and higher risk ventures.

($1 = 0.8727 euros)

(Reporting by Marc Jones; Editing by Jamie Freed and Shri Navaratnam)