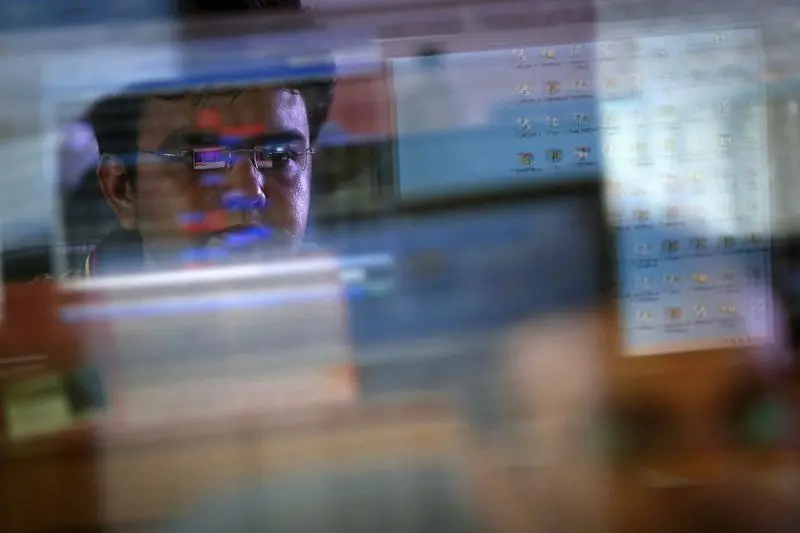

PHOTO

Indian shares swung between gains and losses on Thursday, after the U.S. Federal Reserve reiterated its fight against inflation with a quarter-point rate hike and the treasury secretary ruled out insuring all banking deposits.

The Nifty 50 index was up 0.07% at 17,163.60, while the S&P BSE Sensex rose 0.05% to 58,237.40, as of 10:24 a.m. IST. Both the benchmarks had fallen 0.6% earlier in the session.

Ten of the 13 major sectoral indexes advanced with high weightage financials rising 0.2%. On the flip side, information technology (IT) stocks lost nearly 1%. HCL Technologies, Wipro, Infosys were among top Nifty 50 losers.

IT firms, which earn a significant share of their revenue from the United States and Europe, could see a growth slowdown due to potential delays in discretionary tech spending in the West, said Harsha Upadhyaya, president and chief investment officer for equity at Kotak Mahindra Asset Management Company

"Economic uncertainty and a disproportionate exposure to the banking, financial services and insurance (BFSI) sector are the key risks for the IT sector".

Wall Street equities initially rose after the Fed raised rates by 25 basis points, as expected. The indexes then reversed course to end sharply lower after U.S. Treasury Secretary Janet Yellen said the government is not considering "blanket insurance" for all banking deposits, dashing hopes of a quick guarantee to stem the banking crisis.

"While steep Fed rate hikes are unlikely from hereon, a prolonged high interest rate regime will lead to volatility across global markets", Kotak's Upadhyaya said.

Among the individual stocks, Hero MotoCorp added over 1% and was among the top Nifty 50 gainers after the company announced a price hike in select two-wheeler models from April 1.

Nazara Technologies

rose

over 3.5% after its unit acquired a stake in U.S. sports media publisher Pro Football Network for $1.82 million.

Hindustan Aeronautics lost nearly 6% after the government proposed to

sell an up to 3.5% stake

in the company.

($1 = 82.4030 Indian rupees) (Reporting by Bharath Rajeswaran in Bengaluru; Editing by Savio D'Souza and Eileen Soreng)