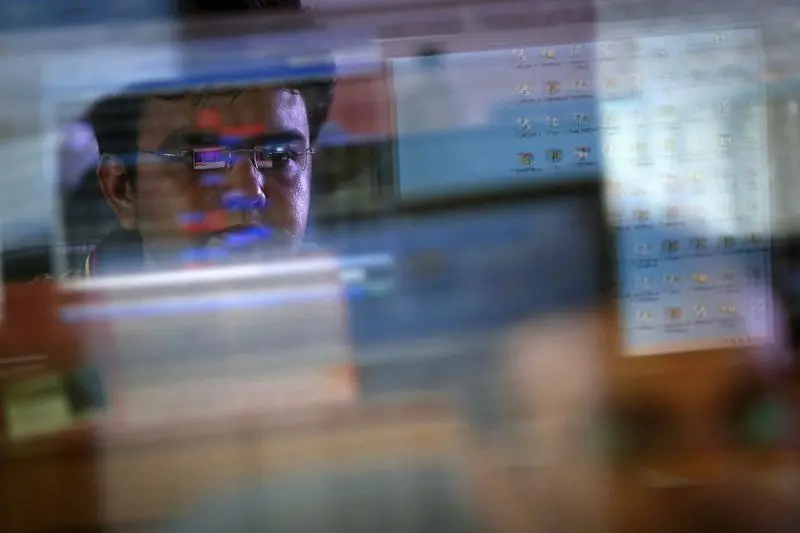

PHOTO

Indian shares fell marginally on Tuesday, weighed by weaker information technology stocks after U.S. data added to worries of a delay in interest rate cuts and a drop in financial services after a recent rally.

The blue-chip NSE Nifty 50 index slipped 0.13% at 22,433.75 as of 10:26 a.m. IST, while the BSE Sensex shed 0.15% to 73,905.76.

The benchmarks had hit record highs on Monday, led by metal stocks on strong industrial data from top consumer China.

"Domestic equities will likely consolidate between now and next week, as earnings will be the next key trigger to drive markets," said Sunny Agrawal, head of fundamental equity research at SBICaps Securities.

Financial services, the highest-weighted sub-index on the Nifty, shed 0.31% following three sessions of gains on the back of the Reserve Bank of India easing provision norms on investments into alternative investment funds.

U.S. rate-sensitive IT stocks fell 0.5%, after manufacturing data signalled strength in the U.S. economy that could allow the Federal Reserve to delay rate cuts. Markets are pricing in a 62.1% chance of a 25 basis points rate cut in June.

"Weakness in demand environment is already weighing on IT stocks. If rate cuts are delayed, that could lead to a further delay in earnings recovery," Agrawal said.

Meanwhile, the more domestically-focussed small- and mid-caps were up about 0.5% each.

Mid-cap index stock Aditya Birla Fashion and Retail gained 15% after the apparel retailer said it was planning to demerge Madura Fashion & Lifestyle, which contributes more than 70% of its total revenue, into a separate listed entity.

Among Nifty 50 stocks, two-wheeler maker Bajaj Auto gained 2% after reporting a 25% annual jump in total vehicle sales in March.

Adani Ports gained 2.25% after Citi reiterated "buy" on the stock and raised its target price to a Street-high 1,758 rupees from 1,564 rupees. (Reporting by Bharath Rajeswaran and Kashish Tandon in Bengaluru; Editing by Rashmi Aich, Sonia Cheema and Varun H K)