PHOTO

Government-backed funds dominated the dealmaking circles in the Middle East region last year, although the overall market fell amid a challenging macroeconomic environment, a new report showed.

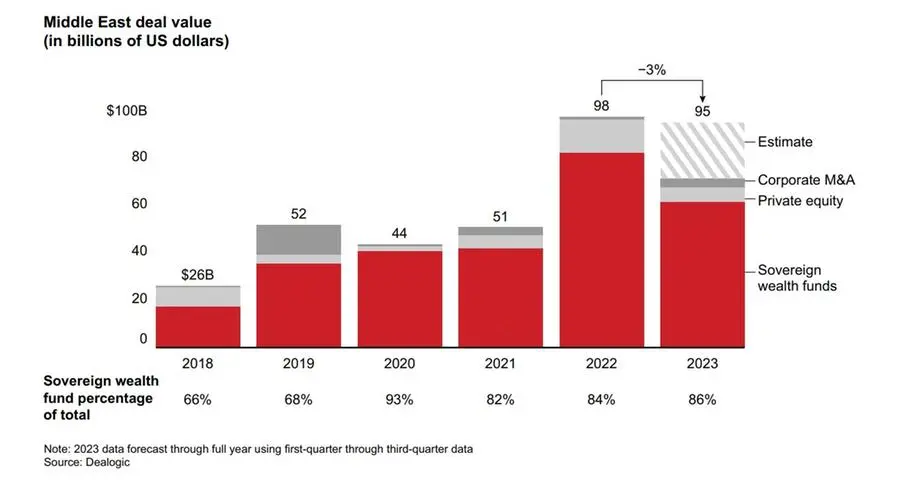

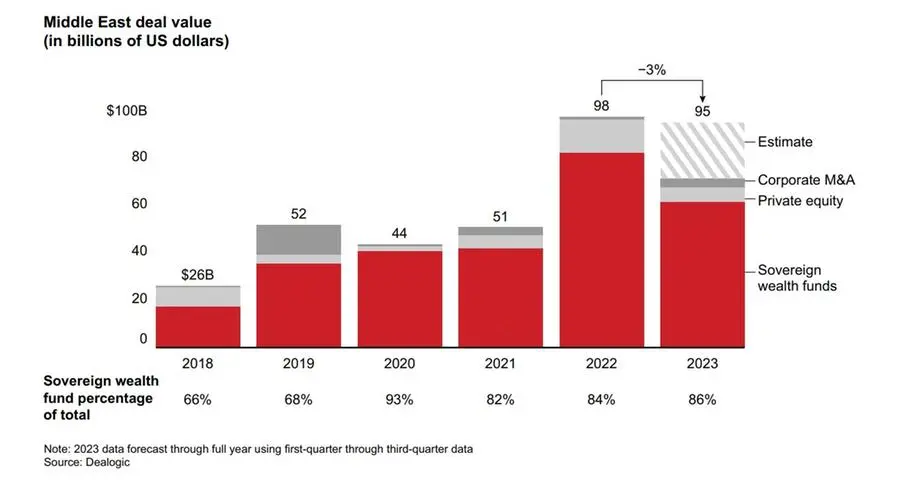

Sovereign wealth funds (SWFs) poured an estimated $81.7 billion into mergers and acquisitions (M&As) in 2023, representing 86% of the total value of deals during the year, Bain & Company said in its new report.

The region saw around $95 billion worth of M&As, according to estimates, registering a 3% decline from the prior year’s $98 billion. The slowdown mirrors the trend worldwide, with global M&As dropping 15% to a ten-year low of $3.3 trillion.

The decline is due to high interest rates, tight scrutiny from the government and macroeconomic challenges.

infographic from Bain & Co: Dealmaking in Middle East, 2023

Dealmaking data in the Middle East suggest that government funds play a “pivotal influence” in the region’s investment space.

“The Middle East is undergoing a significant shift towards accelerating the energy transition, with a growing emphasis on clean energy investments and ambitious net-zero tar gets,” said Elif Koc, a partner at Bain & Company Middle East.

“Through strategic investments, sovereign wealth funds are leading the charge in reshaping the economic future of the Middle East, diversifying beyond oil and laying the groundwork for sustainable growth and prosperity.”

More interest in Asia

The consultancy firm also noted the “burgeoning” trend of investments by SWFs in Asian companies, particularly aimed at revitalising the manufacturing sector and promoting innovation within the Middle East.

The value of SWF deals with Asia surged by 60% during the first nine months of 2023, signalling a strategic shift towards increased investment in the region.

Across the global market, Bain and Co noted, dealmakers grappled with high interest rates, regulatory scrutiny and mixed economic signals.

Tech deal values, which fell by around 45%, emerged as the biggest drag on strategic M&As.

The report noted that at least $361 billion in announced deals were challenged by regulators around the globe over the past two years. Around $255 billion of those deals ultimately closed, but nearly all required remedies, Bain noted.

(Writing by Cleofe Maceda; editing by Seban Scaria)