PHOTO

In the world of alternative investments, amidst geopolitical fractures, private equity and fixed income assets can serve to diversify portfolios, according to Swiss private bank Lombard Odier.

The fragmentation of global trade and supply chains, together with an increased appetite for fiscal largesse, could contribute to higher inflation volatility in the years ahead, which could result in higher neutral interest rates, the bank said, adding that alternative investments can play an increasingly important portfolio diversification role.

In its investment strategy bulletin, the bank said it had made several changes to its strategic asset allocation, favouring a simpler overall portfolio architecture, with a focus on core holdings, more fixed income in certain portfolio profiles and a tilt towards quality across asset classes.

"While private equity accounts for two-thirds of all private assets, the varying drivers and resulting dynamics of private debt, infrastructure, and real estate offer further opportunities. Professional investors, from university endowments to pension funds, show significant allocations to private assets," Lombard Odier said in its report.

Family offices expect 52% of their portfolios to be invested in alternative assets in 2024, with a focus on investments in private credit, infrastructure and private equity, the bank said, citing a survey by KKR.

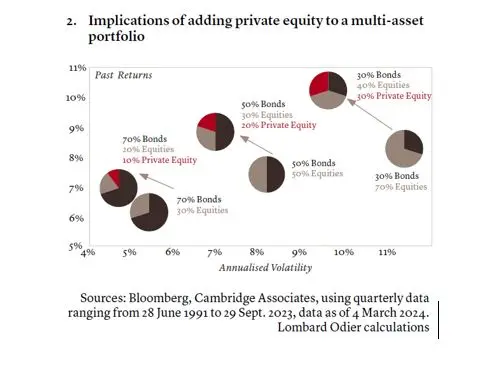

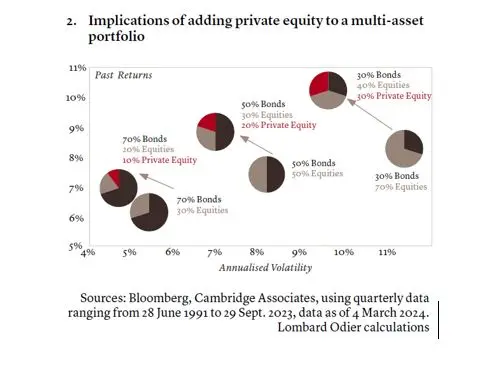

According to Lombard Odier, its modelling shows that the inclusion of private equity would have improved the performance profile of diversified portfolios over time compared to those without private equity. "However, that comes at the cost of lower liquidity of the overall portfolio," the bank noted.

"Much of the value of newly formed ‘unicorns’, or start-ups valued at over $1 billion at the early stages of their innovations, can only be captured before they are listed," it said, in its investment strategy bulletin.

Though the pandemic years saw private assets attract a total of $4 trillion across all sub-asset classes in Q1 2023, the M&A market marked its slowest first quarter of any year in a decade.

"This slowdown in deal activity curbed valuations, particularly for venture and growth capital funds, creating opportunities for those with capital to deploy and those with a focus on distressed assets," the bank said in its bulletin.

Private equity funds that launched in difficult markets have historically performed well, the private bank said citing data from Cambridge Associates.

"Relative valuation of private equity deals versus public equities has returned to long-term averages and is one the reasons why we believe private equity can sustain its edge. This is reflected in our own forward-looking 10-year return expectations," Lombard Odier said.

(Writing by Bindu Rai; editing by Seban Scaria ) bindu.rai@lseg.com