PHOTO

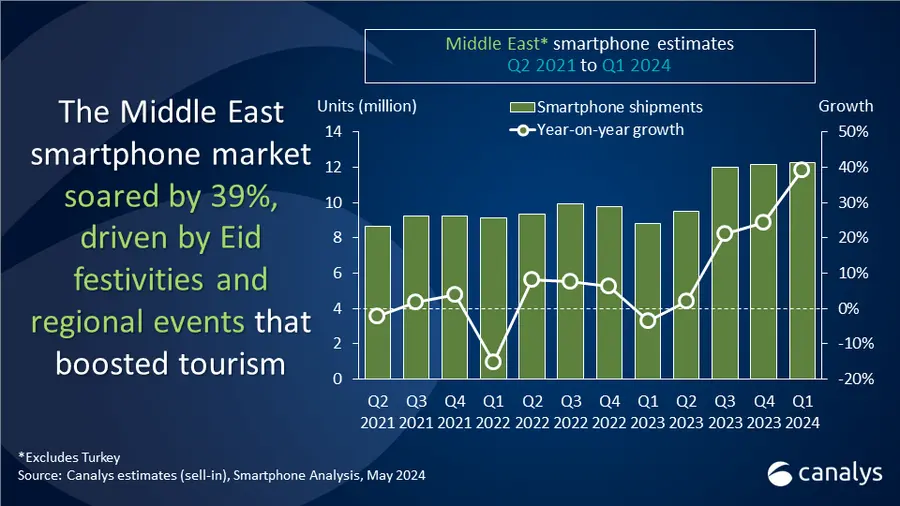

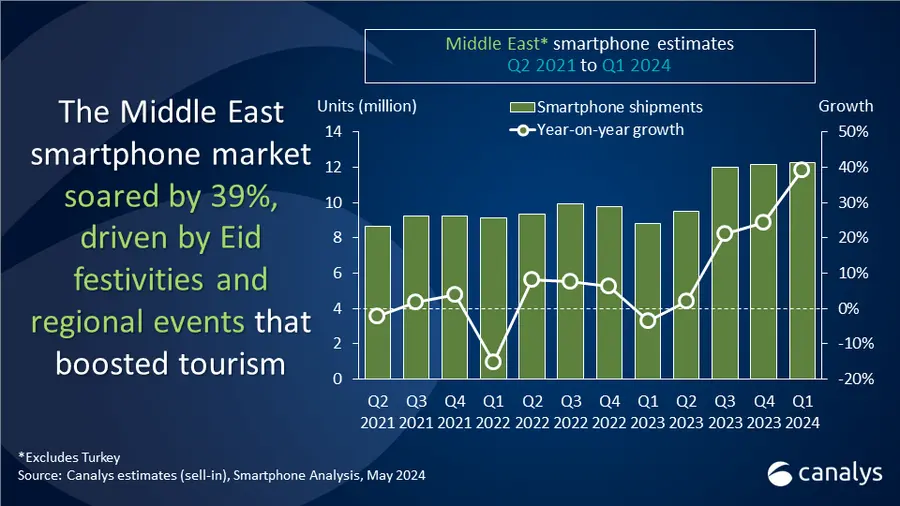

Canalys research reveals that smartphone shipments in the Middle East (excluding Turkey) reached 12.2 million units in Q1 2024, marking a 39% year-on-year increase. This surge was driven by reduced inflation and strong non-oil growth, thanks to ongoing investments in economic diversification by oil-exporting nations. Additionally, economic and social reforms have stimulated private sector investment and an expanding expatriate population, especially in the GCC economies.

Eid celebrations spurring demand in the region in Q1 2024

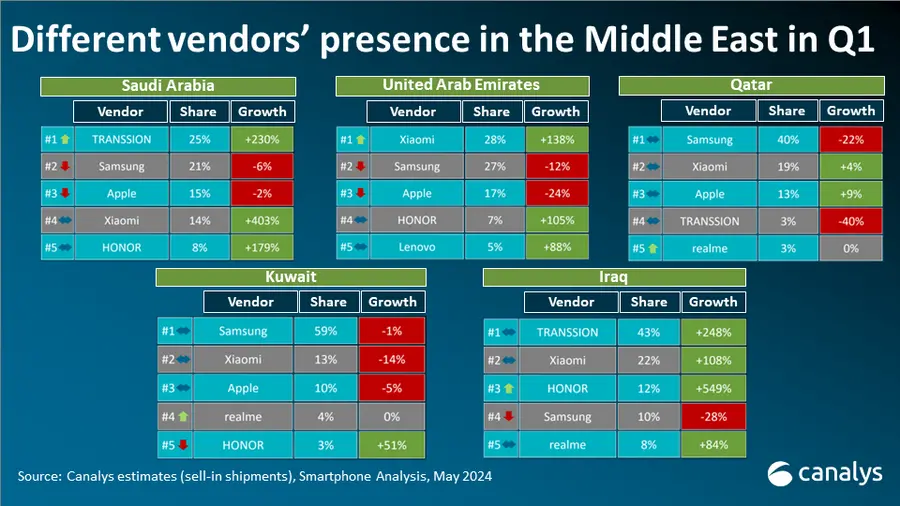

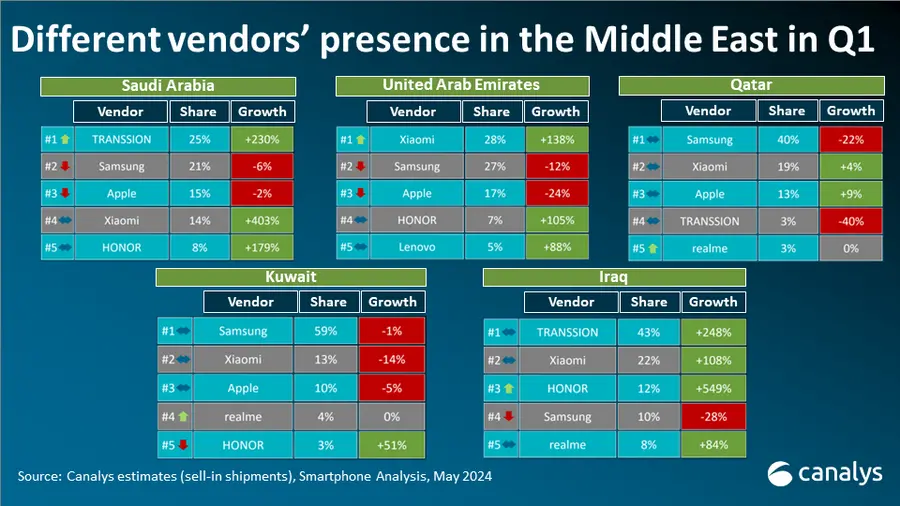

In Q1 2024, Saudi Arabia witnessed a robust 54% year-on-year increase in smartphone shipments, driven by a 10% increase in tourist arrivals and an uptick in tourist spending. The UAE, the region's second-largest market, grew 19% thanks to events like the “World's Coolest Winter”, Ramadan and Eid celebrations toward the end of the quarter, which attracted tourists and increased retail footfall. Iraq underwent a remarkable 112% growth, driven by strong demand for sub-US$200 devices and Chinese vendors offering better color, material and finish (CMF) devices at affordable prices. In contrast, Israel faced a significant 20% decline due to geopolitical tensions. Qatar witnessed a 3% decline due to weakening consumer demand, while Kuwait experienced a modest 4% gain thanks to mid-term school holidays and the relaxed issuance of family permits for expats, which had been discontinued in early 2022.

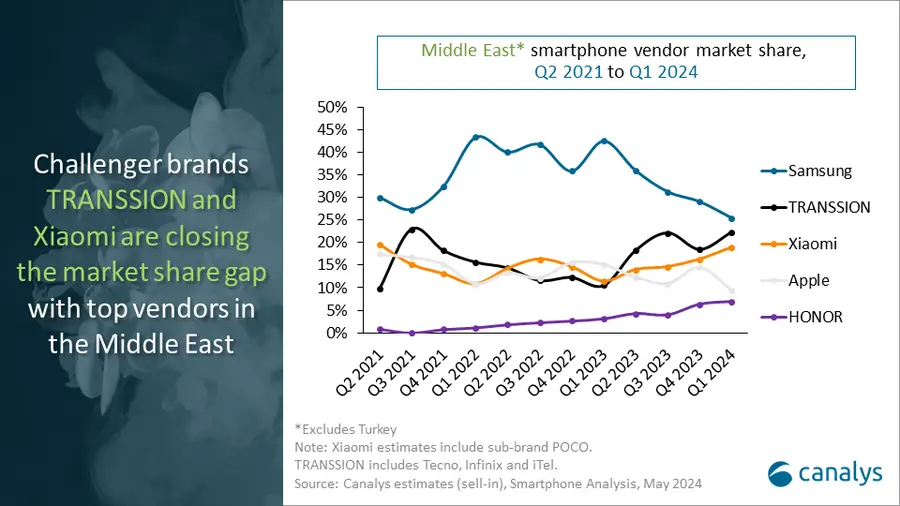

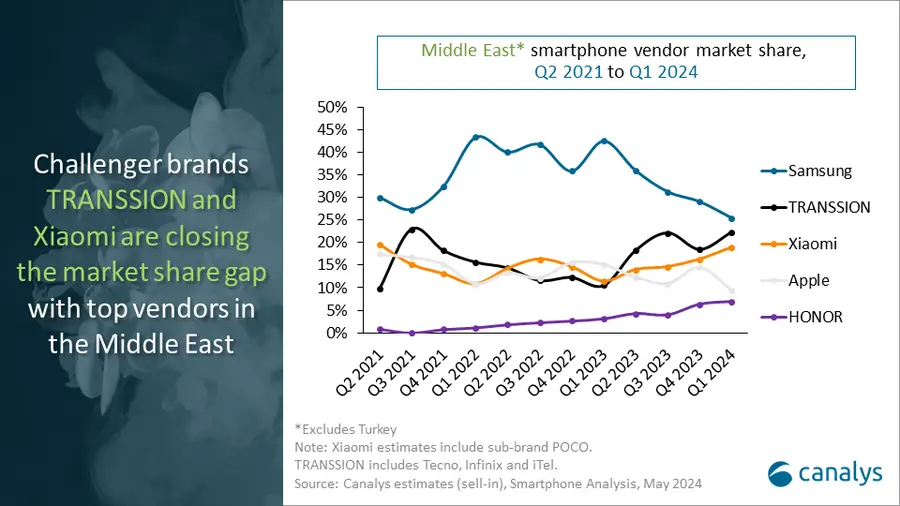

Chinese OEMs are posing stiff competition to incumbents

“Amid declining double-digits due to rising competition in the Middle East, Samsung and Apple prioritized strengthening their premium portfolios in Q1,” said Manish Pravinkumar, Senior Analyst at Canalys. “Samsung’s Q1 volumes declined 17% due to lowered contribution from low-end and mid-range A-series models. But its ASP(Average Selling Price) rose by 19% owing to strong retail campaigns highlighting Galaxy AI features of the S24 series, particularly the S24 Ultra, which accounted for 66% of the series' volume. Similarly, Apple saw a 14% regional decline, but its "Pro" series models contributed more significantly to its portfolio.”

“On the other hand, Chinese OEMs continued to expand in the region. Xiaomi secured the third spot in the Middle East owing to the Redmi Note 13 series and its expansion into independent and organized retail, particularly in competitive markets like the UAE,” commented Pravinkumar. “TRANSSION is experiencing substantial growth, leveraging Infinix's strategic distributor selection in Saudi Arabia and Iraq. Tecno is solidifying its presence in the region through aggressive resource acquisition and intensified marketing efforts. HONOR secured the fifth spot by attracting consumers across all price ranges through aggressive retail initiatives and new service centers in Saudi Arabia. Meanwhile, Motorola is establishing its niche via strategic partnerships with major retailers like Al Ghanim/Xcite in Kuwait and prominent online platforms such as Amazon.”

“Canalys expects high-single-digit growth in 2024 propelled by various regional governmental commitments to diversify economies and market adaptability,” commented Pravinkumar. “Despite soaring component costs and tighter margins, smartphone vendors are ramping up their offerings to appeal to tech-savvy Gen Z and a growing immigrant population seeking the latest technology at accessible prices. However, vendors must focus on long-term sustainability by strengthening retail channel confidence, aligning with government visions, adapting to consumer trends and promoting sustainable practices. Additionally, the market resilience should extend beyond tourism, positioning the region as a global economic hub, attracting foreign investments and talent, fueling growth across real estate, finance, and retail sectors.”

| Middle Eastern* smartphone shipments and annual growth | |||||

| Vendor | Q1 2024 | Q1 2024 | Q1 2023 | Q1 2023 | Annual |

| Samsung | 3.1 | 25% | 3.8 | 43% | -17% |

| TRANSSION | 2.7 | 22% | 0.9 | 11% | 194% |

| Xiaomi | 2.3 | 19% | 1.0 | 11% | 132% |

| Apple | 1.2 | 9% | 1.3 | 15% | -14% |

| HONOR | 0.8 | 7% | 0.3 | 3% | 209% |

| Others | 2.1 | 17% | 1.5 | 17% | 39% |

| Total | 12.2 | 100% | 8.8 | 100% | 39% |

| *Excludes Turkey. | |||||

Senior Canalys analysts will attend COMPUTEX Taipei 2024 and are looking forward to meeting the press, clients and new contacts in person. Schedule your meeting.

-Ends-

For more information, please contact:

Manish Pravinkumar: manish_pravinkumar@canalys.com

About Smartphone Analysis

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, and detailed analysis of storage, processors, memory, cameras and many other parameters. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.