PHOTO

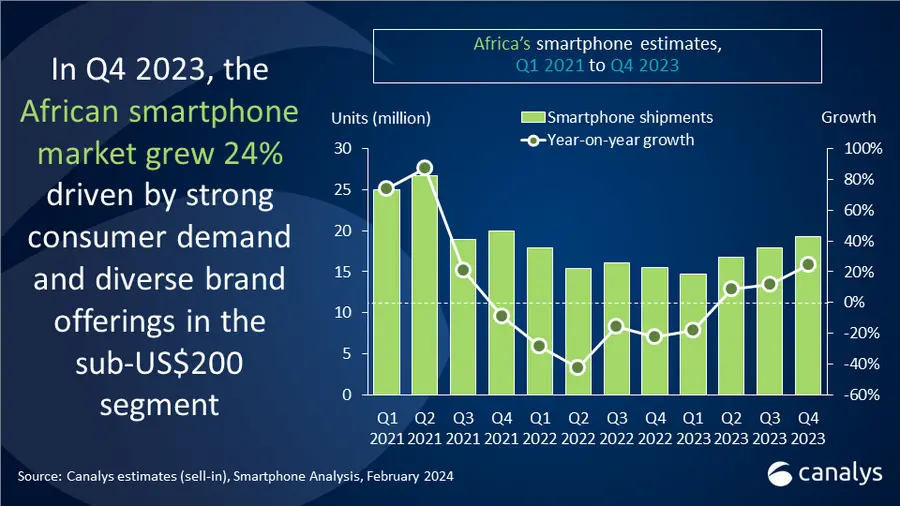

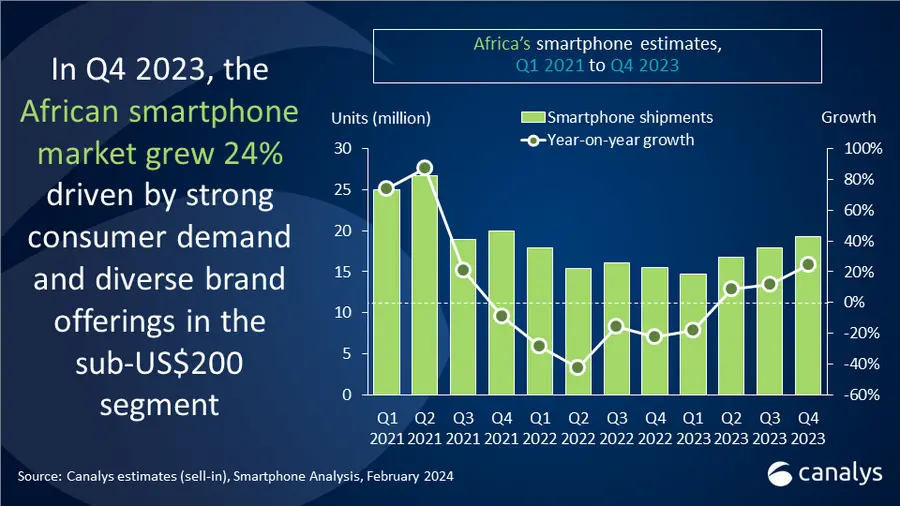

Canalys' latest research reveals a significant resurgence in Africa’s smartphone market, with shipments reaching 19.2 million units in Q4 2023 with 24% year-on-year growth. The surge in Q4 was fueled by rising demand for digital services, burgeoning social media engagement, and the proliferation of ‘Buy Now, Pay Later’ options acting as catalysts. Despite economic challenges (South Africa, grappled with energy crises, Nigeria navigated government reforms in the oil sector, and Egypt faced foreign exchange scarcities), the region’s top three markets experienced robust growth. Assisted by the introduction of more affordable smartphone options, South Africa, Nigeria, and Egypt grew 15%, 63%, and 63% respectively. For the full year, the region reached 68.7 million units, up 6% from 2022. This was mainly due to better consumer confidence in the second half of 2023.

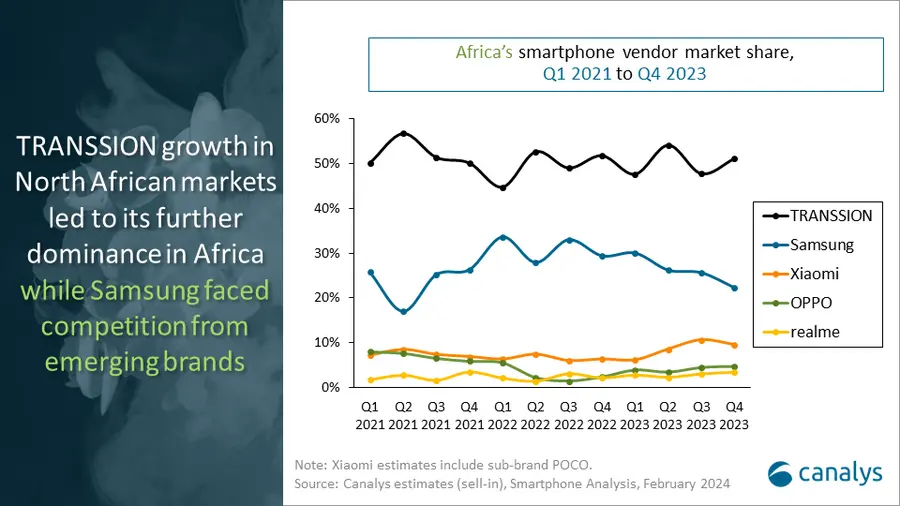

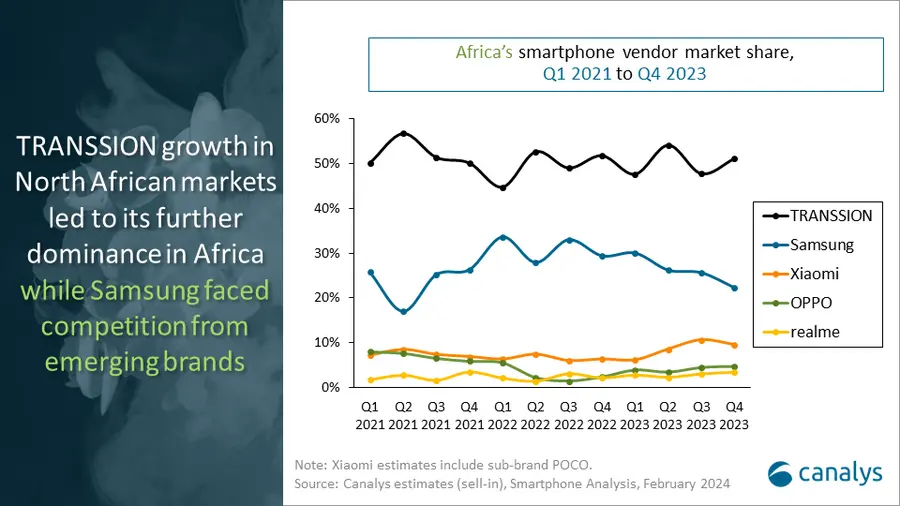

“The shift from feature phones to affordable smartphones in African markets reflects a strong consumer push for modernization and improved connectivity, resulting in rising vendor-level activities in the entry-level segment,” said Canalys Senior Consultant in Dubai, Manish Pravinkumar. “In Q4 2023, shipments of smartphones in the ultra-low-end (sub-US$100) segment experienced a noteworthy 43% year-on-year growth. This surge was predominantly driven by the TRANSSION brands, which introduced new low-end models in H2 2023. Despite declines in certain markets, South Africa remains crucial for Samsung, contributing 30% of its volume from Africa with its A-series models A14 and A04 as key drivers. Xiaomi has aggressively expanded its product range, including the new Redmi 13 lineup, to cater to consumers seeking better aesthetics. Xiaomi's success is attributed to its marketing strategy, which involves significant investments in social media marketing, influencer collaborations, and online promotions, establishing it as an appealing brand for the tech-savvy youth.”

“African consumers want higher specs in entry-level devices, especially in RAM and storage due to increased digitalization and social media use. New brands are using diverse products and partnerships to establish themselves in specific markets, while established players are chasing untapped market opportunities,” added Pravinkumar. “OPPO experienced a strong surge of 156% in growth, mainly fueled by expanding markets in Arab-speaking nations such as Egypt and Morocco. Despite not clinching a top five spot, Huawei's remarkable 371% growth, particularly driven by South Africa, highlights its success in offering a wide array of smartphones supported by HMS across various price ranges to effectively cater to diverse consumer preferences. Although some Sub-Saharan African markets have reached maturity for TRANSSION brands, the company is seizing growth opportunities in North African markets like Morocco, Egypt and Algeria, where Q4 2023 witnessed an average growth of around 94%.”

“Demand for smartphones in African countries will continue to surge amid technological paradigm shifts. With disposable incomes constrained across multiple countries; vendors, governments, and telcos will aggressively tackle smartphone affordability and high internet costs through innovative solutions,” added Pravinkumar. “In sub-Saharan markets, governments and operators are striving to provide affordable 4G smartphones, as seen with Airtel Rwanda, to boost internet access. Countries such as Kenya and Zambia are even setting up smartphone manufacturing plants to drive affordability. However, the region will continue to witness macro challenges from government policy changes on taxes and imports. Channel partners are also worried about rising import costs and currency fluctuations potentially affecting profit margins in the forthcoming year. Canalys remains cautiously optimistic for 2024 and expects single-digit growth in the African smartphone market owing to rising initiatives in product marketing and various financing options.”

| Africa smartphone shipments and annual growth | |||||

| Vendor | Q4 2023 | Q4 2023 | Q4 2022 | Q4 2022 | Annual |

| TRANSSION | 9.8 | 51% | 8.0 | 52% | 23% |

| Samsung | 4.3 | 22% | 4.5 | 29% | -5% |

| Xiaomi | 1.8 | 10% | 1.0 | 6% | 88% |

| OPPO | 0.9 | 5% | 0.4 | 2% | 156% |

| realme | 0.7 | 4% | 0.3 | 2% | 105% |

| Others | 1.7 | 9% | 1.2 | 8% | 35% |

| Total | 19.2 | 100% | 15.5 | 100% | 24% |

| Note: Xiaomi estimates include sub-brand POCO and Redmi. TRANSSION includes Tecno, Infinix and iTel. | |||||

| Africa smartphone shipments and annual growth | |||||

| Vendor | 2023 | 2023 | 2022 | 2022 | Annual |

| TRANSSION | 34.5 | 50% | 32.0 | 49% | 8% |

| Samsung | 17.7 | 26% | 20.2 | 31% | -12% |

| Xiaomi | 6.1 | 9% | 4.2 | 6% | 45% |

| OPPO | 2.8 | 4% | 1.9 | 3% | 50% |

| realme | 2.0 | 3% | 1.4 | 2% | 44% |

| Others | 5.4 | 8% | 5.1 | 8% | 6% |

| Total | 68.7 | 100% | 64.8 | 100% | 6% |

| Note: Xiaomi estimates include sub-brand POCO and Redmi. TRANSSION includes Tecno, Infinix and iTel. | |||||

For more information, please contact:

Manish Pravinkumar: manish_pravinkumar@canalys.com

About Smartphone Analysis

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.