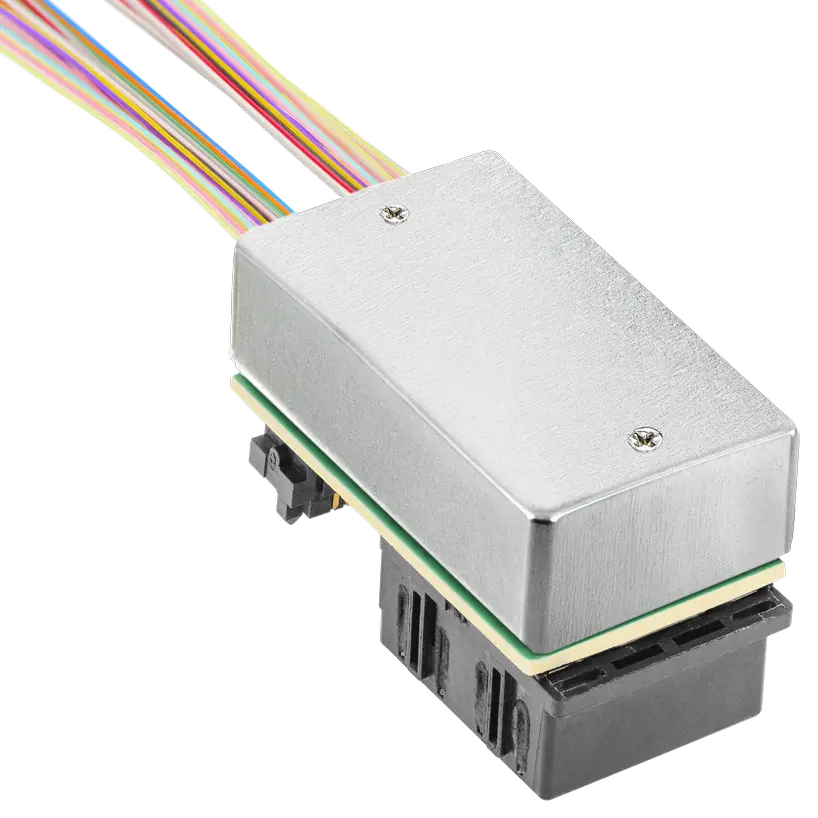

PHOTO

Dubai, April 28, 2016: The Metric stream hosted its 4th Annual GRC Summit 2016 under the vision "Leading with GRC" from April 25 -27, 2016 at the Marriot Marquis Hotel, Washington DC. The GRC Community comprising of partners, analysts, industry experts and executives participated in the event.

Dr. R. Seetharaman, Group CEO of Doha Bank participated in the session "Making GRC Simple: A C- Level Discussion" on 26th April 2016.

Speaking at the session, Dr. Seetharaman highlighted the key trends impacting the GRC framework. He said "The Key trends which are impacting the banking environment include macroeconomic developments, financial market developments, technology developments, cyber security incidents and Changes in legislation and regulation. The above developments have a bearing on the GRC (Governance, Risk and Compliance) framework. The Global Governance had got redefined after the crisis and has an impact on Corporate Governance. The failures of Lehman & Madoff has indicated how corporate governance failure can contribute to systemic risks. Risk management, Remuneration and Incentive Systems, Board Skill's and independence and Shareholder engagement are the key areas which had been revisited after the Global financial crisis. The Board should review and provide guidance about the alignment of corporate strategy with risk appetite and the internal risk management structure. Steps must be taken to ensure that remuneration is established through an explicit governance process. Transparency needs to be improved beyond disclosure. The functions of Chief Executive Officer and Chair of the Board of Directors are separated. Shareholders should be proactive. There has been a general shift of attention toward financial crime, the vanishing tolerance for tax avoidance, and the perceived increased threat of terrorism from individuals and countries. There is an increasing demand for both domestic and global compliance within regulatory standards."

Dr. Seetharaman gave insight on GRC framework. He said "GRC (Governance, Risk and Compliance) framework is an organization's integrated approach to governance, risk and compliance; typically encompasses activities such as governance, enterprise risk management (ERM), internal controls, regulatory compliance and internal audit. GRC improves the alignment of risk activities to the strategic objectives of the business. Companies are now being forced to align in order to close gaps and eliminate overlaps, while focusing on the risks that matter and create value. GRC framework should be realigned to address challenges arising from changing market dynamics. There is an increased focus on GRC to ensure that how these three functions integrate and work closely to increase their effectiveness."

Dr. Seetharaman highlighted the benefits of GRC framework. He said, "Capital markets, especially since the recent financial markets crises, are paying closer attention to governance systems and how organizations manage risks and demonstrate compliance. Rating agencies have expanded their assessments to include more qualitative factors around governance, risk

and compliance; with the belief that better governance and management of risk can lead to more certainty around the achievement of business objectives which in turn can increase business value. Software vendors are mapping software development to purpose built frameworks such as COSO and Basel frameworks. In the current business environment, where access to real-time information can be critical in nature and the burden of regulatory compliance continues to trend upward at an accelerated pace, technology must be viewed as a key enabler for addressing the rising demands of stakeholders."

Dr. Seetharaman gave insight on implementation of GRC framework. He said "Adopting sustainable development in the GRC framework is both a challenge and an opportunity. We are in a volatile environment and the growth dynamics are constantly changing. Economic changes, market volatility, technology, digital security are some areas where GRC could find itself challenging to adopt if it doesn't understand the dynamics in each segment and the linkages between them. It is also an opportunity as GRC framework becomes more dynamic and wider in Scope. GRC should promote sustainable development."

About Doha Bank

Doha Bank is the largest private commercial bank in the State of Qatar. It was incorporated in 1978 and commenced its banking business (including its International Banking services) in Doha, Qatar on March 15, 1979.

As one of Qatar's leading financial services company, Doha Bank is committed to making banking work for customers and clients like it never has before. Through innovative technologies and the ingenuity of its people, Doha Bank provides individuals and commercial, corporate and institutional clients across Qatar and even internationally, new and better ways to manage their financial lives. The company enables customers to do their banking and investing whenever, wherever and however they choose through an extensive network, and multiple access channels.

The Dubai branch of Doha Bank was opened in 2008.

For further information, please contact:

Ms. Tasneem Raza

Watermelon PR

Dubai, UAE

Tel: +971-4-2833655

Email: tasneem@watermelonme.com

© Press Release 2016