PHOTO

TASSNIEF Opinion

| Ladun Investment Company | |

| Domicile | Saudi Arabia |

| Long-Term Rating | BBB+ |

| Outlook | Stable |

| Short-Term Rating | T-4 |

| Rating Watch | No |

| Action Type | Maintained |

| Initial Rating | February 2023 |

| Rating Type | Solicited |

| Methodology Deviations | None |

Tassnief has maintained long-term entity rating of “BBB+” (Triple B Plus) and short-term entity rating of “T-4” to Ladun Investment Company. The outlook on the rating is “Stable”. Tassnief considers the rated issuer or issuance hold adequate creditworthiness, thus low credit risk. Risk profile may exhibit moderately high variation with changes in economic/ sector conditions.

About the company: Ladun Investment Company (Ladun), established in 1968 and based in Riyadh, operates as a public joint stock entity with four subsidiaries in diverse sectors. Ladun specializes in property development, construction, and off-plan residential sales, alongside generating revenue from construction materials, maintenance, rentals, and HR services. Ladun shares publicly traded on Nomu exchange, and a transition to TASI market planned in the near future.

-

- Rating Rationale

Assigned ratings reflect large scale of operations, extensive track record, integrated operations across entire real estate value chain and sound governance framework. Business risk assessment incorporates diversification across multiple business segments, broad geographic coverage, and sizeable order backlog. Assessment of financial risk profile incorporates sizeable equity base, low margins and room for improvement in terms of coverage indicators and mismatch on balance sheet.

Governance framework remains effective, featuring a seven-member board with three independent directors, supported by three board-level committees, alongside a seasoned management team and a structured decision-making process. It also benefits from diligent project management, effective performance tracking, and stringent internal controls, underpinned by ISO certifications, detailed policies, and an internal audit function that reports directly to the audit committee. An effective strategic planning and business transformation process is in place. IT setup uses Oracle ERP to integrate key functions like finance and project management, with data security ensured by regular backups to cloud and internal servers.

1.3 Rating Triggers

- Improvement in coverage indicators and reduction in mismatch on balance sheet.

- Improvement in net margins and cash flow generation is warranted.

- Deterioration in earnings profile or key risk metrics will lead to a downward pressure in ratings.

RELATED CRITERIA AND METHODOLOGY

Rating Methodology for Corporate (v.2. 2024) can be found on the website:

www.tassnief.com

DISCLAIMER

- Simah Rating Agency (“TASSNIEF”) has conducted this exercise in accordance with its approved Rating Methodologies and Policies to develop a credit rating opinion on the rated entity. The credit ratings and observations presented herein are solely opinions and do not constitute statements of fact or recommendations to purchase, hold, or sell any securities, nor do they serve as advice for any other investment decisions.

- Our assessment is based on certain assumptions and limitations, and we verify the information provided by the rated entity to the extent possible. Ratings are subject to change based on new information, assumptions, and judgements made at the time of the rating. No assurance is given regarding future performance or rating stability.

- The credit ratings are provided solely for informational purposes and do not constitute investment advice or recommendations. Investors and stakeholders are encouraged to conduct their own thorough due diligence and consider all relevant factors before making any investment or financial decisions. The ratings should not be construed as an endorsement to buy, sell, or hold any securities or financial instruments.

- TASSNIEF is not legally obliged for any losses or damages resulting by errors received in TASSNIEF’s information, since the rating was based on what the rated client has provided or what is available from third parties. Rating information includes financial and qualitative data provided by the client, as well as minutes and on-site review.

- The analyses and forecasts in this rating report are inherently forward-looking and cannot be verified. As a result, despite any verification of current facts, ratings and forecasts can be affected by future events or conditions that were not anticipated at the time a rating or forecast was issued or affirmed.

- This rating has not been amended following disclosure to the rated entity or its related party(ies). All analyses related to the rating report are merely opinions of TASSNIEF on the rating date.

- This credit rating herein was determined was determined using the above-mentioned methodology which is available on our website at www.tassnief.com. This methodology, including any significant adjustments or deviations from standard procedures, was applied to arrive at the rating.

- The rating scale, meaning of each rating category, default or recovery definitions, and relevant risk warnings – including a sensitivity analysis of key assumptions – are also available on our website.

- TASSNIEF confirms that all rating activities related to this credit rating were not outsourced to any third party.

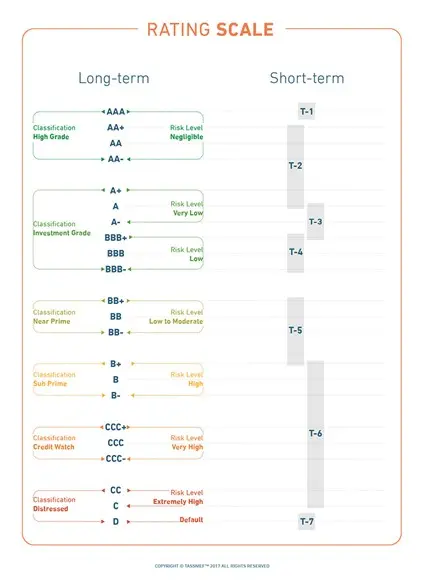

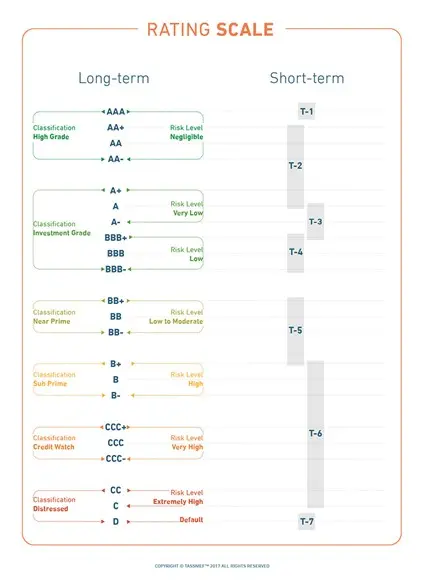

TASSNIEF’s Long-term & Short-term Rating Scale

| Long-Term Rating Scale | Definitions |

| AAA | Extremely Robust; Tassnief considers the rated issuer or issuance hold the highest creditworthiness, thus negligible credit risk |

| AA+ | Very Robust; Tassnief considers the rated issuer or issuance hold very high creditworthiness, thus minimal credit risk. Risk profile may vary slightly with changes in economic / sector conditions |

| A+ | Robust; Tassnief considers the rated issuer or issuance hold high creditworthiness, thus very low credit risk. Risk profile may vary with changes in economic / sector conditions |

| BBB+ | Moderate; Tassnief considers the rated issuer or issuance hold adequate creditworthiness, thus low credit risk. Risk profile may exhibit moderately high variation with changes in economic / sector conditions |

| BB+ | Tassnief considers the rated issuer or issuance hold low to moderate credit risk. Risk profile may exhibit wide variation with changes in economic / sector conditions. |

| B+ | Tassnief considers the rated issuer or issuance hold very low creditworthiness, thus high credit risk |

| CCC+ | Tassnief considers the rated issuer or issuance hold extremely low creditworthiness, thus very high credit risk |

| CC | Highly speculative credit profile, and the default is imminent |

| D | Tassnief considers the rated issuer or issuance have defaulted or may default soon. |