PHOTO

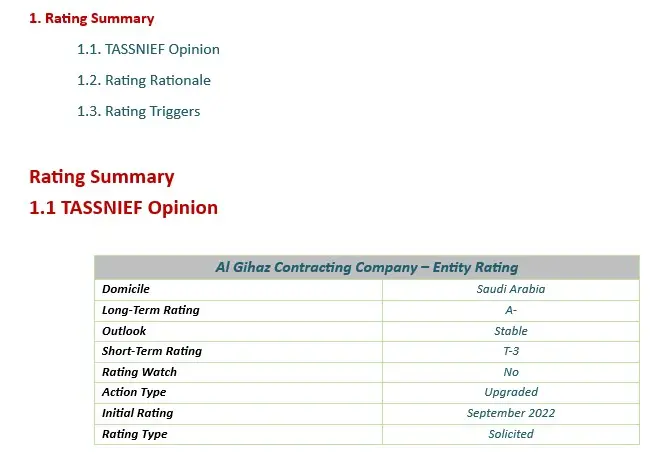

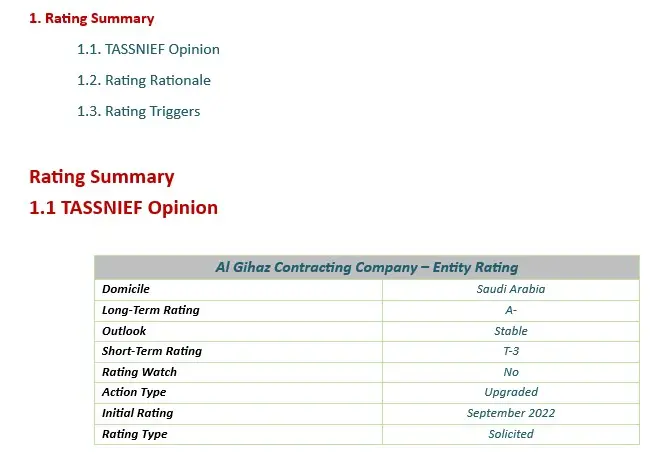

Tassnief has upgraded long-term entity rating of Al Gihaz Contracting Company from “BBB+” (Triple B Plus) to “A-” (Single A Minus) and short-term entity rating to “T-3”. The outlook on the rating is “Stable”.

About the company

Al Gihaz Contracting Company, referred to as "Al Gihaz Contracting" or "the Company" is a Single Person Limited Liability Company registered in the Kingdom of Saudi Arabia under the commercial registration number 1010090181 dated December 24, 1991. Al Gihaz Contracting is involved in the sale of energy devices, water pumping equipment, electrical tools, spare parts, and circuits. The scope of activities also includes construction and maintenance of non-residential buildings, electrical power stations, transformers, network extensions, telecommunication towers, and energy related services as well as investment activities.

1.2 TASSNIEF Rating Rationale:

The assigned ratings take into account Al Gihaz Contracting’s extensive experience in engineering, procurement, & construction (EPC) contracting with expertise in energy & power sector, established customer base, strong revenue growth, growing profits & fund flow from operations (FFO) generated, and strong order backlog. However, the ratings also factor in high concentration risk arising from significant dependence on a single client, increased working capital requirements largely funded through short-term borrowings, and elevated leverage indicators. Governance framework is satisfactory.

Al Gihaz Holding demonstrates a clear structure of Board oversight across all group companies. In accordance with the best practices, the Board of Directors is composed of five members, comprising one non-executive director, three independent directors, and one executive director. The Board’s oversight is further supported by the Audit Committee, which includes two independent directors. Tassnief is of view that in line with the best governance practices and its charter, the committee shall be chaired by an independent director. Al Gihaz Holding has established a comprehensive, documented authority matrix encompassing critical areas. Governance assessment also draws comfort from experienced management team, structured decision-making process, and well-documented policies and procedures.

The business risk profile of Al Gihaz Contracting is underpinned by its extensive operational experience spanning over four decades, coupled with a proven track record of successfully delivering large-scale construction projects. The Company possesses specialized expertise in power generation, renewable energy, electrical contracting, power product manufacturing, and smart grid and meter solutions. The Company maintains a strong market position amongst the leading engineering, procurement, and construction (EPC) providers in Saudi Arabia. It has recorded accelerated growth in recent years, with revenue increasing by a 3-year CAGR of 85%.

Al Gihaz Contracting is well positioned to capture substantial growth opportunities aligned with Saudi Arabia’s Vision 2030. SEC has announced a SAR 258b capex program for 2025–2029 focused on T&D expansion and grid modernization. While moderated from the earlier SAR 500b plan for 2024–2030, the program remains sizeable and provides a robust pipeline for Al Gihaz Contracting, particularly in substations and T&D where it holds established expertise.

The business profile is constrained by high client concentration, reflecting the nature of operations, which are largely tied to large-scale, long-duration projects. While this level of concentration exposes the Company to revenue volatility linked to the timing and continuity of projects from its major clients, some comfort is derived from its long-standing business relationships and demonstrated track record in securing repeat contracts. The strong pipeline of projects from SEC and other strategic clients provides revenue visibility. Nonetheless, continued dependence on a narrow client base remains a structural risk, highlighting the importance of diversification to enhance business resilience. The revenue visibility for 2025 and 2026 is supported by a strong order backlog which has expanded compared to the prior year, with further sizeable awards anticipated over the remainder of 2025.

The profitability profile is supported by sustained growth in revenue and profit generation. In 2024, net income increased in line with higher revenue; however, margins contracted as procurement and subcontracting costs increased faster than topline growth. The execution efficiencies, restructuring measures, and a more favorable business mix supported margin recovery in 6M2025. Sustaining revenue growth while delivering on targeted margin improvements will remain important from the ratings perspective.

The assessment of liquidity incorporates an improving working capital cycle, driven by reduction in receivables collection cycle, improved billing, and growth in cash flow generation. Tassnief expects utilization of short-term borrowings to remain elevated over the rating horizon, reflecting the Company’s sizeable capital requirements for project execution and growth initiatives. As such, efficient receivables collection and timely billing will be essential to maintaining liquidity indicators, while sustained delays could pressure cash flows and constrain financial flexibility.

The equity base has strengthened due to retention of profits, with no dividend payouts and a stated plan to continue full profit retention over the medium term. Leverage indicators have increased as growth has been largely funded through project-specific financing. Nevertheless, some moderation in gearing and adjusted leverage was observed in 6M2025 due to reduced utilization of short-term borrowings, highlighting the Company’s capacity to deleverage as project cash flows normalize. Despite this improvement, leverage levels remain elevated relative to historical trends, underscoring continued reliance on external funding to support growth. The Company’s debt-servicing capacity is considered adequate, supported by improved coverage metrics, which reflect growing FFO generated and lower outstanding borrowings. Maintaining prudent leverage indicators with adequate debt servicing capacity for the assigned ratings while pursuing aggressive growth plans remains important.

1.3 Rating Triggers

- Timely and profitable completion of ongoing projects.

- Achieving revenue growth and profit margins targets.

- Strengthening liquidity profile and improving working capital cycle.

- Consistently generating positive cash flow from operations.

- Maintaining leverage indicators within prudent levels.

- Effectively managing concentration risk.