There are three major questions dominating investment and risk management discussions at the moment, all of which could significantly impact Gulf economies. They are:

- Inflation: will it retreat to pre-pandemic levels?

- Risk of recession: will the biggest monetary tightening since 1981 tip the global economy into a downturn?

- China: How will the Middle Kingdom’s real estate woes impact commodities?

Inflation

Thus far, the 2020s have been characterized by a global surge in inflation and the Gulf region hasn’t been immune, with consumer prices peaking at 6% in Saudi Arabia in 2021 while rising as high as 7% in Dubai in 2022. In Europe and the U.S., inflation rates peaked at even higher levels.

While inflation rates have been falling, core inflation measures remain above pre-pandemic levels. In the U.S., core inflation is running close to 4%, twice its pre-pandemic norm. In the eurozone and Japan, it’s running at between 3% and 4%. This has significant implications for the Gulf region, given its currencies are pegged to the U.S. dollar and therefore influenced by the Federal Reserve’s (Fed) monetary policy.

If inflation rates don’t recede to pre-pandemic levels soon, it could mean U.S. rates stay higher for longer. Indeed, Fed officials have been pushing back against expectations for near-term rate cuts. As recently as early February, a rate cut in March was a majority view among fixed-income traders. However, following strong employment data and hotter-than-expected inflation numbers, very few traders still believe that the Fed will cut that quickly. The European Central Bank and Bank of England have also been pushing back against similar expectations.

Risk of Recession

Meanwhile, the consequences of the biggest global tightening of monetary policy since the early 1980s are becoming apparent. Several economies including Brazil, Chile, Colombia, Germany, Japan and the U.K. are already in or are nearing a recession.

While the U.S. economy grew in Q4, cracks are appearing. Over the course of December and January, non-farm payrolls, which measures employment gains at mostly mid-to-large firms continued to show strong U.S. jobs growth. However, the household survey, which does a better job of capturing employment at small and medium-sized enterprises, showed 1.2 million jobs disappeared.

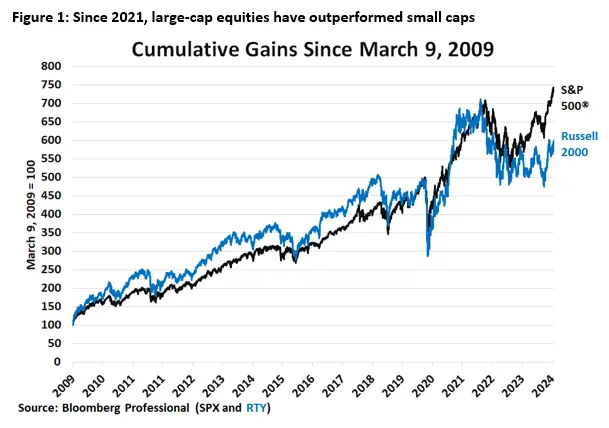

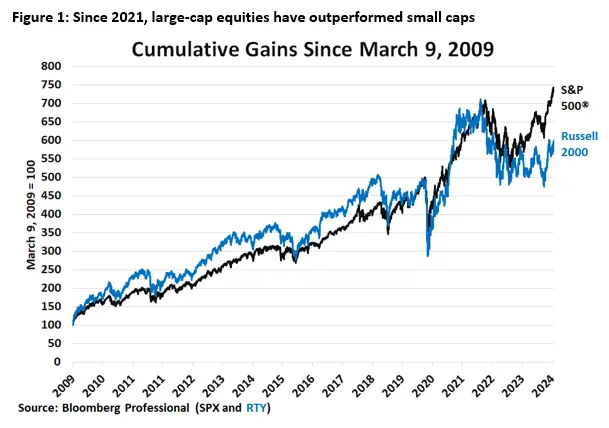

The idea that large businesses are prospering while small and medium-sized businesses struggle is reflected in the stock market. From 2009 to 2021, the small caps in the Russell 2000 kept pace with the large caps in the S&P 500. However, during the past two years the Russell has fallen 20% while the S&P has hit new highs.

Many large companies have significant cash reserves, which now earn 5% returns in T-Bills, and many of them issued bonds at low yields during the pandemic. Meanwhile, smaller firms typically have modest cash reserves and have seen rates on their bank loans jump by 500 basis points (bps), leading to lower earnings, defaults and layoffs.

Fed rate hikes have also produced the most inverted yield curve since the early 1980s. Inverted yield curves can be a precursor of recessions, which often follow with a lag of roughly two years. If the U.S. follows Japan and the U.K. into a recession, it could put downward pressure on oil prices and growth in the Gulf region.

China and Commodity Markets

From 2000 to 2019, China was the main driver of global economic growth. Since 2020, however, Chinese growth has faltered. China’s public and private sector debt levels rose from 140% to 306% of GDP between 2008 and 2023. Its real estate market is contracting. Consumer spending and industrial output are growing only modestly while its import and export volumes have fallen by over 15%.

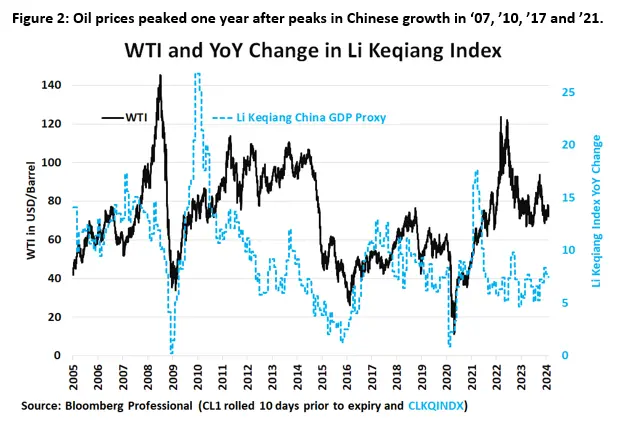

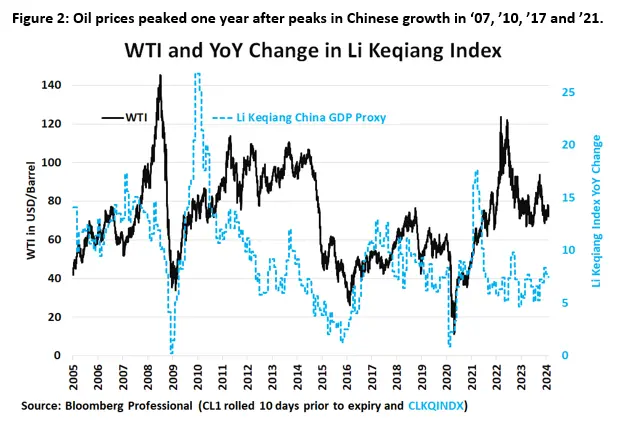

China is the world’s largest commodity importer. It’s also the biggest export destination for Saudi Arabia and the 3rd biggest for the U.A.E. Since 2005, the prices of crude oil, industrial metals and agricultural goods have tended to follow the pace of China’s growth with a lag of about one year. China’s slow growth explains almost single-handedly why crude oil prices are lower today than they were two years ago despite the ongoing war between Russia and Ukraine, 3.6 million barrels per day of OPEC+ production cuts, and conflict in the Levant. China’s impact on oil prices is particularly significant to Gulf economies given that crude and refined products account for over two-thirds of Saudi exports and over one-third of U.A.E. exports.

Disclaimer: All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.