PHOTO

LONDON, Sept 6 (Reuters) - Following are five big themes likely to dominate thinking of investors and traders in the coming week and the Reuters stories related to them.

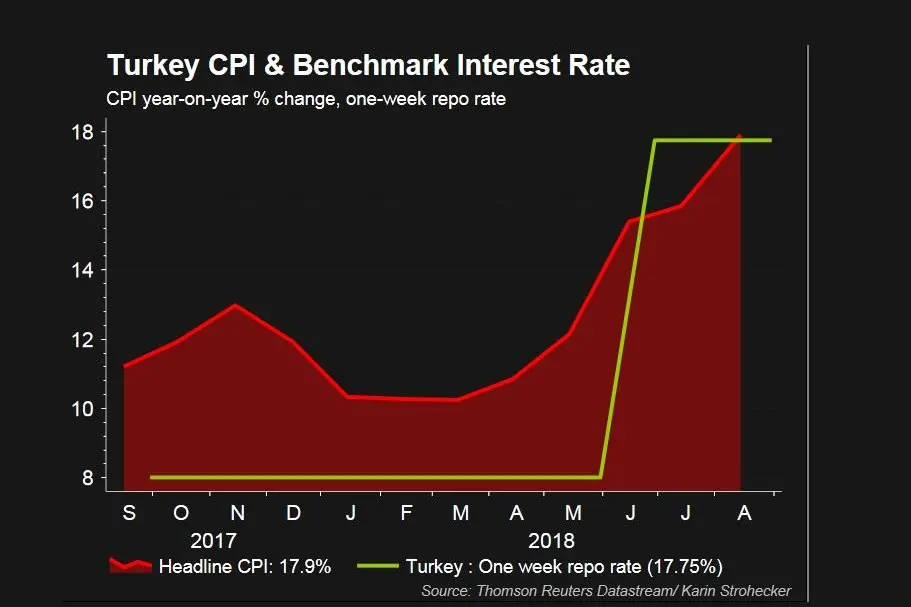

1/ WHO WANTS TO BE AN EM CENTRAL BANKER It's a tough job, but someone's got to do it. Markets' eyes are on a host of central banks to see if they can calm down currency markets, above all in Turkey. The central bank is expected to finally hike interest rates on Sept. 13 but with a full-blown currency crisis on and near-18 percent inflation, the move may come too late to avert a hard landing.

In Argentina, at least, draconian rate rises to 60 percent -- alongside heavy currency interventions -- have not prevented the peso from tumbling 50 percent this year. It's hard to see what else the central bank there can do when it meets on Tuesday.

Russia's position seems enviable in comparison - healthy currency reserves and a balance of payments surplus. But the possibility of growth-crimping Western sanctions being extended has put foreign investors to flight and driven the rouble to 2-1/2-year lows. Prime Minister Dmitry Medvedev is clearly trying to head off a rate rise at next Friday's central bank meeting but inflation-fighting governor Elvira Nabiullina has already signalled policy tightening. In any case, Russia's three-year long rate-cutting cycle looks to be at an end.

Graphic: Turkey CPI & Interest Rate - reut.rs/2oL9mlU