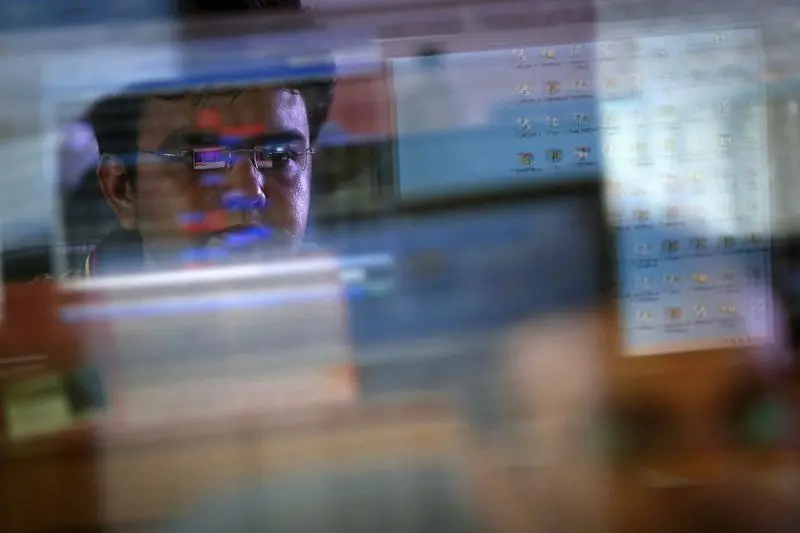

PHOTO

MUMBAI - Indian government bond yields ended largely unchanged on Wednesday, a day before the Reserve Bank of India's crucial monetary policy decision, which is expected to give direction and clarity on the central bank's stance on handling inflation.

The 10-year benchmark 7.26% 2033 bond yield ended at 6.9808%, after closing at 6.9780% in the previous session. The benchmark note traded in a narrow eight paisa band through the day.

A Reuters poll of 64 economists showed the central bank is expected to not only leave the key interest rate unchanged at 6.50% for June, but also maintain a prolonged pause for the rest of 2023.

"We believe and expect RBI to reiterate its policy stance and maintain withdrawal of accommodation as a predominant policy step in order move closer to its durable inflation target of 4%," said Siddharth Kothari, an economist with Sunidhi Securities & Finance.

The RBI surprised markets with a pause in its rate hike cycle in its April policy after raising rates by 250 basis points (bps) in the previous financial year to control the soaring inflation.

Apart from the policy stance, traders will also keep a close eye on the central bank's commentary on liquidity management, after back-to-back reverse repos over the last four days.

The RBI may have to opt to absorb liquidity for overnight basis using variable rate reverse repo (VRRR) auctions, as bankers remain reluctant to park funds for a longer period of time, bankers and analysts said.

"The RBI's intention is to keep the overnight rate around the repo rate consistently. If they want the overnight rate to align to the repo, the easiest and cleanest way to do is to give an overnight VRRR," said A Prasanna, head of research at ICICI Securities Primary Dealership.

Market participants will also await the U.S. Federal Reserve's monetary policy outcome due next week, with the odds of a pause currently at around 78%.

(Reporting by Bhakti Tambe and Dharamraj Dhutia; editing by Eileen Soreng)