PHOTO

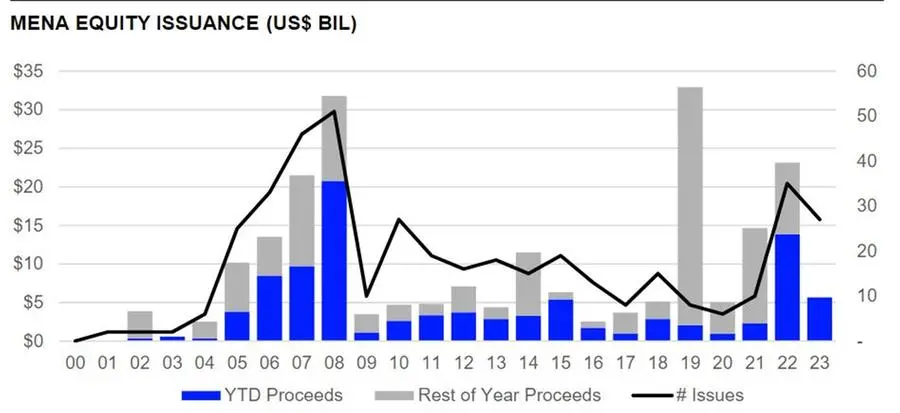

MENA equity capital markets (ECM) raised $5.7 billion in equity and equity-related issuances during the first half of 2023, declining 59% compared with the $13.5 billion raised in H1 2022.

The number of issuances too fell 23%, according to the latest Refinitiv Deals Intelligence data. However, the total amount raised during the first six months of 2023 was the third highest first half total since Refinitiv's records began.

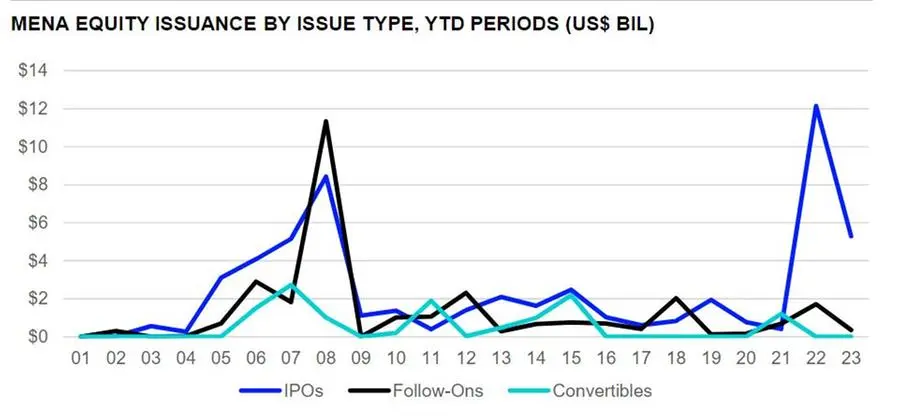

IPOs accounted for 94% of activity, while follow-on issuance accounted for 6%, the data showed.

A total of 23 IPOs were recorded in H1, one more than the number of IPOs in the year earlier period. Combined, they raised proceeds worth $5.3 billion, down 5.3% from a year ago.

Abu Dhabi National Oil Company (ADNOC) raised $2.5 billion in the IPO of its gas business in March.

In May, another ADNOC subsidiary, ADNOC L&S, raised $769 million in the public sale of 19% of its business.

UAE's Presight AI Holding's IPO followed, netting $496 million, while Saudi Arabia's Jamjoom Pharmaceutical Factory Co. raised $336 million.

The energy & power sector was most active, with issuers raising $2.8 billion accounting for 49% of the total equity capital raised in the region. The industrials and high technology sectors followed, accounting for 14% and 12%, respectively.

EFG Hermes took first place in the MENA ECM underwriting league table during the first half of 2023 with a 9.5% market share. However, the total proceeds of $538.1 million were 56% lower on year.

Dubai Islamic Bank PJSC was in the second spot with 8.8% market share with total proceeds of $496.1 million.

(Reporting by Brinda Darasha; editing by Seban Scaria)