PHOTO

Macro sentiments in many parts of the world have been weak, keeping prices lower with prices trading near a 2-month low.

Time spreads of Dubai crude oil swaps have continued to trend lower, reflecting the weaker demand fundamentals in several parts of the world.

With recessionary indicators, sentiment has been weak. Spreads in the Brent complex have also weakened with the level of backwardation dropping, pointing to near term sufficient supply of oil in European markets.

With the December 05 EU deadline to ban imports of Russian oil and G7 imposition of price caps, refiners in Europe appear to have stocked ample supplies of oil in advance adding pressure on the physical oil cargo differentials.

Oil demand to surge

The OPEC trimmed forecasts for 2022 global oil demand growth for the 5th time since April and also reduced the expectations for next year on account of the global economic scenario and the looming downturn.

Oil demand for 2022 is now forecasted to increase by 2.55 million bpd, 0.1 million bpd lower than last month forecasts.

2023 estimates have also been cut by 0.1 million bpd to a current forecasted growth of 2.24 million bpd. The OPEC+ is expected to meet on Dec 04 to decide on the plan of action with respect to production.

Chinese and Indian refiners are hesitant to book Russian oil cargoes and prefer to wait and watch the G7 price cap effect, according to reports.

Should the refiners avoid the cargoes, it would ensure steady demand for Middle Eastern barrels, which have had to face competition from the Russian volumes and have had to price accordingly.

Click here to view graphic in a higher resolution.

China's domestic demand is likely to continue to trend lower as the spike in Covid-19 cases in recent days has brought back some curbs which had just recently been relaxed.

With higher export quotas available to refiners, it is likely to continue push the diesel exports stronger from the country. Refining throughputs are likely to be supported to keep distillate production going.

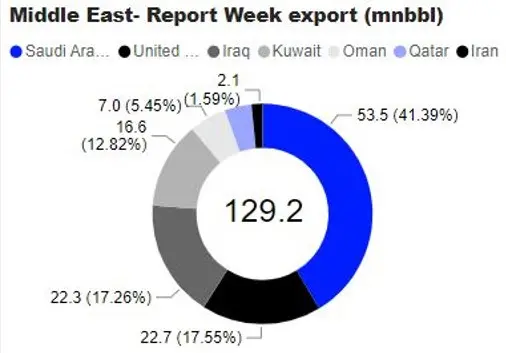

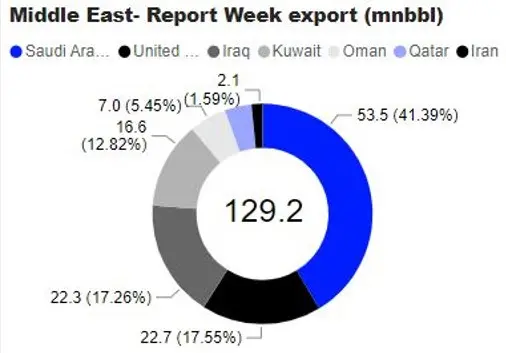

Weekly crude oil exports (week ending Nov 20) from the Middle East and North Africa were higher at 129.2 million bbl and 16.7 million bbl respectively. A tanker carrying gasoil, the 'Pacific Zircon' was hit by a drone attack off the coast on Oman last week, raising the threat of attacks on infrastructure once again.

With global spare capacity of oil limited to the region, any attack on infrastructure could constrain supply further.

(Reporting by Sudharsan Sarathy; editing by Seban Scaria)